In the third quarter of FY19, foreign institutional investors (FIIs) have been net sellers in the Indian equity market.

Out of the 425 BSE companies that have made public their shareholding data, 256 have reported FIIs to be sellers and only 169 companies have seen FIIs to be net buyers, Narnolia Securities said in a report.

“The net selling by FIIs had been on the backdrop of volatile crude price and depreciating rupee. The strengthening dollar and rising US yields also aided the cause. DIIs (domestic institutional investors), on the other hand, have increased stakes in 263 companies and decreased stakes in 172 companies in Q3 2019,” the report said.

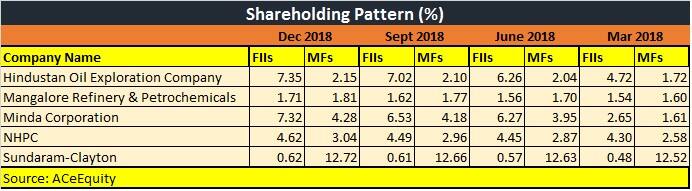

Meanwhile, foreign investors raised their stake consistently in as many as five companies mostly from the small & midcap space, which are — HOEC, Mangalore Refinery & Petrochemicals, Minda Corporation, NHPC and Sundaram-Clayton.

On a QoQ basis, both FIIs and DIIs increased their exposure in the pharma and utility sector, and trimmed stakes in auto components companies and the telecom industry.

Private commercial banks saw huge sell-off by FIIs and DIIs, and on the other hand, many private commercial banks saw increased holdings.

In terms of specific stocks, there are five stocks in which both FIIs and DIIs reduced their stake on a year-on-year (YoY) basis and quarter-on-quarter (QoQ) basis, which are Ashok Leyland, Bharat Forge, CRISIL, PC Jewellers, and Rain Industries, as per Narnolia's report .

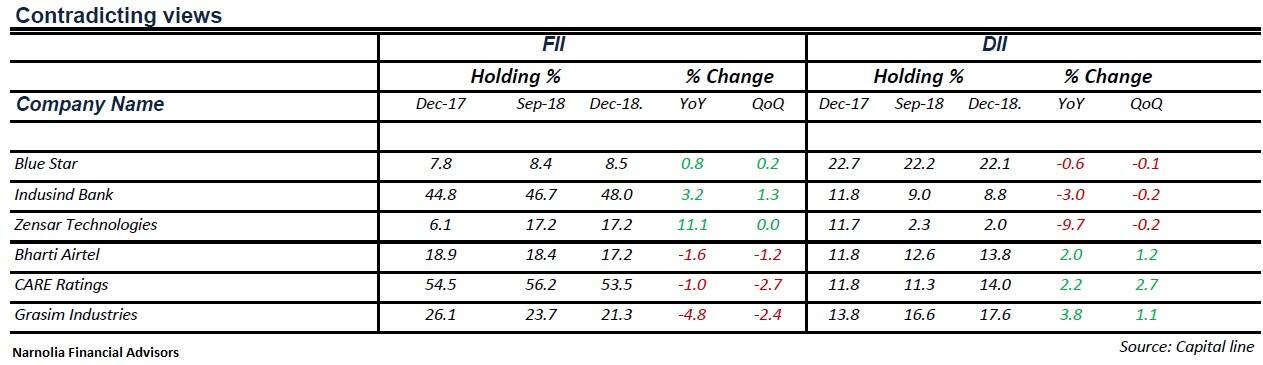

Stocks where views of FIIs & DIIs differ

In the December quarter, FIIs raised stake in Blue Star, IndusInd Bank and Zensar Technologies on a YoY basis and sequentially, while DIIs pared stake in these stocks in the same period.

On the other hand, FIIs pared their stake in Bharti Airtel, CARE Ratings, as well as Grasim Industries on a YoY basis as well as sequentially, but DIIs upped their exposure in these stocks in the same period.

What should investors do?

Both FIIs and DIIs have their own approach to investing. Hence, investors are advised to use their own research before putting money into stocks, especially when there are conflicting views on a stock.

“As fund managers cannot keep the funds idle due to the statutory requirement we have seen them increase their holding. In case of an individual investor, there is no such compulsion and one is free to do his own study before deploying the money,” Atish Matlawala of SSJ Finance & Securities told Moneycontrol.

“Individual investor can shortlist the stocks preferred by fund managers but that should only act as a starting point. Apart from this, one should look at the valuations and future growth for the company and the most paramount is corporate governance. A retail investor should not buy the company where corporate governance is questionable,” he said.

Investors should avoid following herd mentality for investments and should stick with the fundamental outlook of the company.

This makes sense to keep it as a first-level of screening mechanism, and top-up with self-research on the basis of ratios like ROCE, EBITDA Margin, leverage ratio, and cash flow position among others, suggest experts.

Only those stocks which fit into those ratios should be part of the portfolio, and more importantly, follow a staggered approach at current juncture of volatility.

Before screening stocks, it is equally important to evaluate performance on the portfolio level of fund manager on stock selection through past track record. The data is readily available on most of the financial websites.

“A basic ratio which should be considered is ‘tracking error’ and what ‘alpha’ it generated. It should also look for optimum risk-adjusted return which should be compared with the benchmark as well as peers which highlights performance of fund manager in a quantitative measure,” Dinesh Rohira, CEO and Founder, 5nance.com told Moneycontrol.

“Post this exercise depending on the performance an investor can shortlist the stocks on the basis of fundamental outlook, and not solely on basis of fund manager’s selection. Therefore, these stocks should be evaluated on a ratios like valuation, RoCE/RoE, EBITDA margin, leverage ratio, cash-flow position and consistency of this growth. This will help to identify quality stocks in the portfolio for investment purpose,” he said.

Disclaimer: The stocks mentioned are for reference only and not buy or sell ideas. The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.