It is a particularly difficult time to be an equity investor right now.

Global financial heavyweights are suddenly imploding, geopolitical flashpoints refuse to die down, inflation is still at excruciating levels, consumers are apprehensive about the future, and central banks are not done jacking up rates.

No wonder Sensex and Nifty have given nil returns for the past 1-year period. The scenario in the midcap and smallcap universe is even more dismal.

As if to add salt to the wounds, everyday banks are coming out with advertisements offering tantalizing returns for fixed deposits.

Why should one crank up one’s blood pressure for negligible gains when FDs are generating tension-free returns of 7 percent and more?

Warren Buffett, the patron saint of value investors, addressed this concern during the annual shareholders’ meeting of Berkshire Hathaway in 2000.

When questioned by a worried investor about the performance of Berkshire Hathaway’s key picks like Coca-Cola and Gillette at a time when the Federal Reserve was raising rates, Buffett underlined the importance of patience for an equity investor.

“The best time to buy stocks, actually was, in recent years, you know, has been when interest rates were sky high and it looked like a very safe thing to do to put your money into Treasury bills at - well, actually the primary got up to 21 1/2 percent - but you could put out money at huge rates in the early ’80s,” noted Buffet.

“And, as attractive as that appeared, it was exactly the wrong thing to be doing. It was better to be buying equities at that time, because when interest rates changed, their values changed even much more,” he added.

To put it in poetic terms, the best time to bet on the onset of dawn is when the night is the darkest.

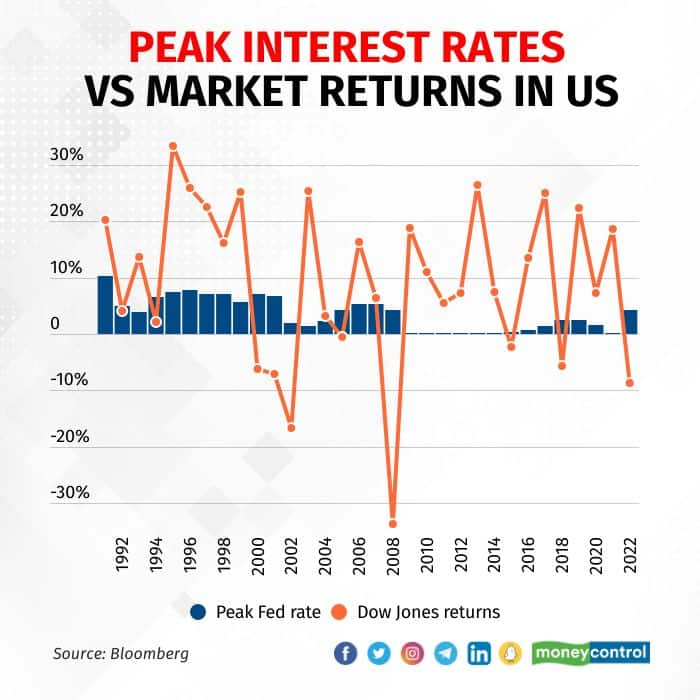

An analysis of data for the past 30 years demonstrates this maxim clearly.

The peak Fed funds rate crossed the 7 percent mark (unusually high for the US) on multiple occasions, making investors drool over fixed-income securities. However, the markets always made a resounding comeback and easily surpassed the peak interest rates.

Similarly, in India, there were times when the repo rate touched 9 percent and bank FDs were generating 13-14 percent returns, making stock market investors question their very existence.

But those who stayed the course, and the courageous few who doubled down on their equity bets, made head-spinning profits.

Buffett has repeatedly underscored the long-term outperformance of stocks compared to fixed-income assets.

“If you had to choose between buying long-term bonds or equities, I would choose equities in a minute,” he told CNBC in an interview in 2018. “If I were going to own a 30-year government bond or own equities for 30 years, I think equities will considerably outperform that 30-year bond.”

In a freakish prophecy of the Silicon Valley Bank debacle, the Oracle of Omaha asserted that it was incorrect to assume high-grade bonds were risk-free.

“It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals — to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk,” Buffett said.

Of course, it is difficult for mere mortals like us to emulate Buffett’s long-term outlook, sunny optimism or steady resolve in the face of financial market upheavals.

But as we count down to the Federal Reserve’s March 22 policy announcement amid the current market turmoil, it would be prudent to step back, take a few deep breaths and focus on the golden glow of the horizon instead of the deep red of our portfolios.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.