March 14, 2022 / 16:35 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

For the fifth straight day in a row, the benchmark indices continued the positive momentum as these indices successfully cleared the short term technical resistance on the charts. Banking and financials stock outperformed, rallied over two percent, whereas some profit booking was seen in realty and metal stocks.

Technically, after a long time the Nifty succeed to close above 20- days SMA. It has formed bullish candle on the daily chart.

We are of the view that as long as Nifty trading above 16700 the uptrend will continue in the near future. For the bulls immediate hurdle would be 17000 or 200-Day SMA.

On the downside, below 16700 strong possibility of quick intraday correction on the Nifty is not ruled out. Below 16700 Nifty could retest 16620 and 16550.

March 14, 2022 / 16:31 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started the week on a buoyant note and gained over one and a half percent, in continuation of the prevailing rebound. After the flat start, the benchmark inched gradually higher, thanks to healthy buying in banking and IT majors and finally ended around the day’s high. Meanwhile, the broader indices traded mixed and closed with marginal gains.Upbeat global cues combined with bargain hunting in index majors are pushing the markets higher.

Markets will first react to the inflation data in early trade on Tuesday.Besides, updates on prevailing geopolitical tension and the performance of global markets will remain in focus.

Since Nifty has surpassed the critical hurdle at 16,800, it can extend the rebound to a 17,100+ zone. In case of any dip, 16700 would act as immediate support. Meanwhile, participants should maintain their focus on sector/stock selection.

March 14, 2022 / 16:04 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty has given breakout from a falling channel on the daily timeframe suggesting a rise of bullishness. In addition, the benchmark index has moved above the previous swing high which is again a bullish set-up.

The trend may remain positive as long as it sustains above the said channel. On the lower end, support is visible at 16650 whereas on the higher end resistance is pegged at 17000.

March 14, 2022 / 16:02 IST

Rahul Sharma- Equity 99:

Markets are expected to remain volatile this week mainly driven by US Federal Reserve's interest rate decision and the release of domestic inflation data. Also despite talks between Russia and Ukraine tensions still persists.

The date of LIC`s IPO will also be key factor in determining the direction of markets in coming days. Investors are advised to take new position only after things get cleared out and keep strict stop losses to positions.

Fir Nifty50 16800 will act as very strong support level, if this level is breached intraday than 16690 will act as next strong support, post which 16600 will be next support level.

On the upper side 17000 will be 1st hurdle, once this level is breached on upper side than next resistance will be at 17100 levels post which 17220 will act as next strong resistance level.

March 14, 2022 / 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services:

We are gaining traction as strategy is shifting from tactical sell to tactical buy. Investments are chipping in as commodities prices are reverting.

FIIs selling and crude prices are subsiding, which is expected to continue based on diplomatic developments and provide an edge to the domestic market.

Globally, investors are bracing for rate hikes as expected. Domestic WPI has spiked up however market is ignoring as future prices can get gloomy.

March 14, 2022 / 15:34 IST

Market Close:

Benchmark indices ended higher for the fifth consecutive session on March 14 led by the IT, auto and banking names.

At close, the Sensex was up 935.72 points or 1.68% at 56,486.02, and the Nifty was up 240.80 points or 1.45% at 16,871.30. About 1684 shares have advanced, 1706 shares declined, and 134 shares are unchanged.

Infosys, SBI, HDFC Bank, Maruti Suzuki and Axis Bank were among the top Nifty gainers, while losers were IOC, ONGC, HUL, Tata Motors and HDFC Life.

On the sectoral front, IT and bank indices rose 2 percent each, while Realty index down nearly 2 percent. The BSE midcap index ended flat, while smallcap index gained 0.3 percent.

March 14, 2022 / 15:24 IST

JPMorgan view on Jubilant FoodWorks:

JPMorgan has downgraded Jubilant FoodWorks to 'neutral' from 'overweight' on rising demand/margin risks.

It has cut the target price to Rs 3,000 from Rs 4,025 per share and lower FY23/24 EPS estimates by 11 percent/8 percent largely on back of margin cuts.

According to the broking firm, the unexpected CEO resignation adds to the uncertainty.

However, it continue to believe in mid-to long-term story of the company.

Jubilant FoodWorks touched a 52-week low of Rs 2,444 and was quoting at Rs 2,510.80, down Rs 353.30, or 12.34 percent on the BSE.

March 14, 2022 / 15:22 IST

Govt plans to float EoI for its stake sale in IDBI Bank next month:

The government plans to invite expression of interest to sell its stake in LIC-controlled IDBI Bank by the next month-end, a senior official has said.

As part of the divestment, the government plans to sell its entire 45.48 per cent stake eventually.

The government may look to sell around a 26 per cent stake in the bank, along with management control to attract investors, the official said.

IDBI Bank became a subsidiary of LIC with effect from January 21, 2019, following the acquisition of an additional 8,27,590,885 equity shares.

March 14, 2022 / 15:19 IST

DLF to invest Rs 550 crore to set up Standard Chartered Global Business Services’ campus in Chennai:

DLF is planning to invest close to Rs 550 crore to set up a one million sq ft office building for Standard Chartered Global Business Services’ campus in Chennai which is expected to be up and running by mid-2024, said Sriram Khattar, managing director, DLF on March 14.

The DLF Downtown-Chennai project, spread over 27 acres and comprising a 6.5 million square feet area, is being developed by DLF Cyber City Developers Ltd (DCCDL) with an investment of Rs 5,000 crore.

March 14, 2022 / 15:17 IST

BSE Power index shed 0.5 percent dragged by the ABB, Adani Transmission, Adani Green

March 14, 2022 / 15:10 IST

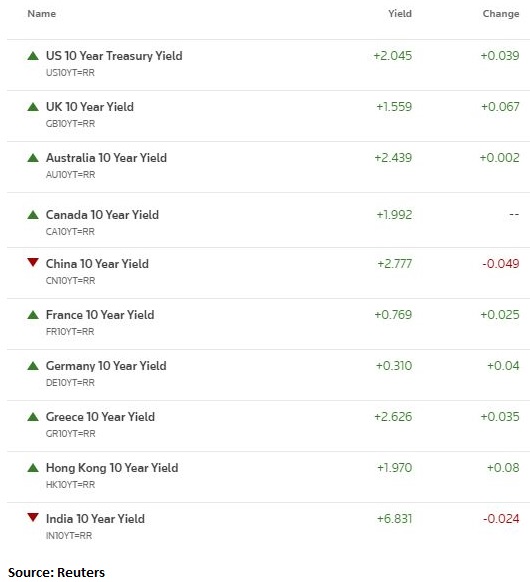

Bond Yields Updates:

March 14, 2022 / 15:07 IST

Jefferies view on HDFC Bank:

The broking house Jefferies has kept buy call on HDFC Bank with a target at Rs 2,160 per share.

RBI lifting the ban would push the launch of new platforms, even BAU initiatives would get simpler with this clarity from RBI.

The macro headwinds are at play, but key stock-specific overhang is behind now.

HDFC Bank was quoting at Rs 1,444, up Rs 47, or 3.36 percent on the BSE.

March 14, 2022 / 15:03 IST

Market at 3 PM

Benchmark indices further extended the intraday gains and trading near the day's high level in the final hour of the trading led by IT and banking names.

The Sensex was up 951.13 points or 1.71% at 56501.43, and the Nifty was up 246.20 points or 1.48% at 16876.70. About 1687 shares have advanced, 1579 shares declined, and 120 shares are unchanged.