December 08, 2021 / 16:37 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities

Nifty after making an all-time high of 18604 in mid-October went through a corrective phase over last 2 months. The putative swing low made during this period was at around 16800 levels. However, at sub-17000 levels, the aggression from Bears was found to be missing leading to an eventual recovery which we are witnessing presently.

This could be partly explained by the oversold readings at lower levels coupled with the support coming in at the 16900 mark from the 38.2% retracement (of the rally from the April’21 lows of 14151 up to the all-time highs of 18604).

December 08, 2021 / 16:24 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Indian equity market witnessed strong positive momentum for the second consecutive day on the back of positive global cues and status quo maintained by RBI policy committee. Nifty opened positive and witnessed by interest throughout the day and closed with gains of almost 300 points.

Both Sensex and Nifty gained around 1.7% for the day. Broader market to performed in line with midcap and smallcap indices gaining 1.6- 1.8%. Strong buying was seen in rate sensitive like PSU banks, auto, banking and realty stocks. Metals too were in focus.

RBI in its monetary policy meeting decided to keep repo rate unchanged at 4%. The central bank retained its GDP growth forecast at 9.5%, and inflation at 5.3% for the full year. Both Nifty and Bank Nifty are recovering well from the recent correction. Strength is clearly visible along with strong buying interest in the market. Hence, traders are advised to maintain buy on dips strategy for the next few days.

December 08, 2021 / 16:22 IST

Jio-bp and Mahindra Group sign MoU for EV and low-carbon solutions

Reliance BP Mobility Limited (RBML), operating under the brand name Jio-bp and The Mahindra Group, today announced a non-binding MoU for exploring creation of EV products and services, alongside identifying synergies in low-carbon and conventional fuels.

The MoU also covers evaluating charging solutions by Jio-bp for Mahindra vehicles including electric 3 and 4 wheelers, quadricycles and e-SCV (Small Commercial Vehicles – sub 4 ton). This would include captive fleets and last-mile mobility vehicles of Mahindra Group.

December 08, 2021 / 16:15 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

RBI's decision to keep the policy rate unchanged and maintaining an accommodative stance helped benchmark indices propel sharply for the second straight session. Post reversal, the market has maintained an uptrend continuation formation, and on daily charts it has formed a bullish candle.

The texture of the market is positive and is likely to continue in the near term. But due to an overstretched rally, some profit booking at higher levels cannot be ruled out.

For Nifty, 17400 -17340 would act as a key intraday support, while 17575-17620 could act as a strong resistance zone for the day traders.

December 08, 2021 / 16:07 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets extended gains for the second consecutive day and rose over one and a half percent. Firm global cues triggered a gap up start which further strengthened following the dovish stance of the RBI. Consequently, the Nifty index closed around the day’s high to settle at 17,469 levels. The broader markets as well as all the sectoral indices ended in the green.

As RBI policy is behind us, the focus will shift back to global cues and upcoming macro data (IIP & CPI). Further, as the number of IPOs is lined up, primary markets will keep investors busy. Given the high volatility in the market, we would remain cautiously optimistic on the markets.

December 08, 2021 / 16:01 IST

Mohit Nigam, Head - PMS, Hem Securities:

Benchmark Indices continued its upward journey on the second consecutive day with Nifty and Sensex hovering near day’s high. The Nifty reclaimed 17450 levels. Among sectors, all the key indices were trading with a positive momentum. The European markets are trading flat today.

RBI keeps accommodative stance with interest rate unchanged at 4% and reverse repo rate at 3.35% and will maintain this stance as long as necessary to revive and sustain growth which gives a clear signal that RBI is giving a strong & durable support to the economy without downsizing any support which will be beneficial for the equity markets as well.

Hence, the markets have given a stellar run up today giving a thumbs up to RBI's comments today. Despite record equity selling by FIIs, RBI has done well to defend the currency and made sure that imported inflation is under check.

Immediate support and resistance for Nifty 50 is 17200 and 17700 and for Bank Nifty is 36900 and 37800.

December 08, 2021 / 15:54 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Fears over Omicron faded as recent reports suggested that the new virus isn’t deadly as earlier anticipated and this helped the market to add-on to recent strong gains.

The market turned positive over RBI’s continued accommodative stance and MPC kept the rates unchanged. The GDP forecast for FY22 remained high at 9.5% showing confidence over economic recovery and inflation forecast is below the market estimates.

December 08, 2021 / 15:48 IST

Sachin Gupta, AVP, Research at Choice Broking:

The benchmark index has extended the gain consecutively for the second day in a row. The Nifty settled at 17469.75 levels with 1.7% gains while the Bank Nifty increased by 1.75% to close at 37285.80 levels.

Technically, the Nifty index has taken support at Lower Bollinger Band and settled above 100-days Moving Average, which suggests further upward move in the coming day. The index has also formed a Double Bottom pattern on an hourly chart, which indicates bullish sentiments.

A momentum indicator RSI & Stochastic have suggested positive crossover on the daily chart. At present, the index has support at 17300 levels while resistance comes at 17600 levels.

On the other hand, Bank Nifty has support at 36800 levels while resistance at 38000 levels.

December 08, 2021 / 15:37 IST

S Ranganathan, Head of Research at LKP Securities:

Positive global cues coupled with the continuation of an accomodative policy stance of the RBI by holding rates fired up the bulls today even as the Central Bank decided to enhance the variable reverse repo rate auctions to rebalance liquidity.

The bullish undertone was reflected in the sectoral indices as well as in advance-declines as the market breadth was healthy with small & midcaps too participating in the rally. Several smaller companies today have access to capital and this is getting reflected in the markets as well.

December 08, 2021 / 15:34 IST

Market Close:

Benchmark indices ended strong for the second consecutive day on December 8 after Reserve Bank of India (RBI) kept the key rates unchanged.

At close, the Sensex was up 1,016.03 points or 1.76% at 58,649.68, and the Nifty was up 293.10 points or 1.71% at 17,469.80. About 2270 shares have advanced, 941 shares declined, and 121 shares are unchanged.

Bajaj Finance, Hindalco Industries, Maruti Suzuki, SBI and Bajaj Finserv were among the top Nifty gainers. Losers included HDFC Life,

Kotak Mahindra Bank, Power Grid Corp, Divis Labs and IOC.

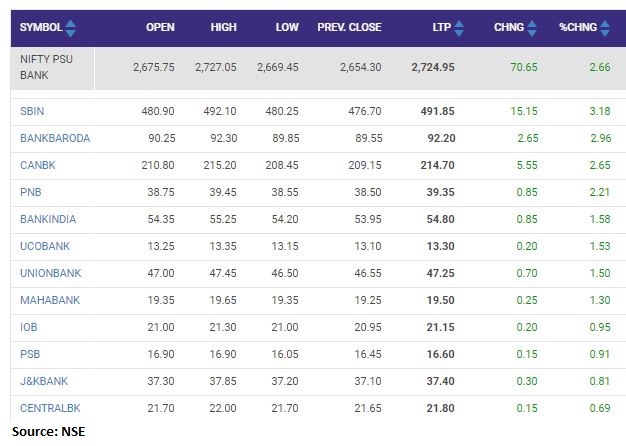

All the sectoral indices ended in the green, with PSU bank, auto, II indices rising 2 percent each. BSE midcap and smallcap indices rose over 1 percent each.

December 08, 2021 / 15:24 IST

Nikhil Gupta, Chief Economist, Motilal Oswal Financial Services

As expected, RBI keeps all policy rates unchanged today. Further, the RBI maintains its FY22 real GDP growth/inflation projections at 9.5%/ 5.3%.

Going forward, we fear that real GDP growth could be lower than the RBI projections, with inflation falling broadly in line. Along with the rising threat from the Omicron variant, there is a possibility that a hike in reverse repo could be postponed further to April 2022.

However, if growth turns out to be better than our expectations (or in line with/better than RBI projections) and Omicron threat doesn't materialize, a 15bps hike in reverse repo rate in Feb'22 cannot be ruled out. In any case, the Union Budget 2022-23 will also play an important role in the next MPC meet.

December 08, 2021 / 15:20 IST

Nifty PSU Bank index rose 2 percent led by the SBI, Bank Of Baroda, Canara Bank, PNB