: Market ended lower for the second consecutive day on December 6 with Nifty closing below 17,000 amid rising concern over Omicron variant.

At Close, the Sensex was down 949.32 points or 1.65% at 56,747.14, and the Nifty was down 284.40 points or 1.65% at 16,912.30. About 1340 shares have advanced, 1948 shares declined, and 165 shares are unchanged.

Except UPL, all other stocks under Nifty50 ended in the red with Coal India, IndusInd Bank, Tata Consumer Products, Bajaj Finserv and HCL Technologies were among the top Nifty losers.

Market Close: Market ended lower for the second consecutive day on December 6 with Nifty closing below 17,000 amid rising concern over Omicron variant.

At Close, the Sensex was down 949.32 points or 1.65% at 56,747.14, and the Nifty was down 284.40 points or 1.65% at 16,912.30. About 1340 shares have advanced, 1948 shares declined, and 165 shares are unchanged.

Except UPL, all other stocks under Nifty50 ended in the red with Coal India, IndusInd Bank, Tata Consumer Products, Bajaj Finserv and HCL Technologies were among the top Nifty losers.

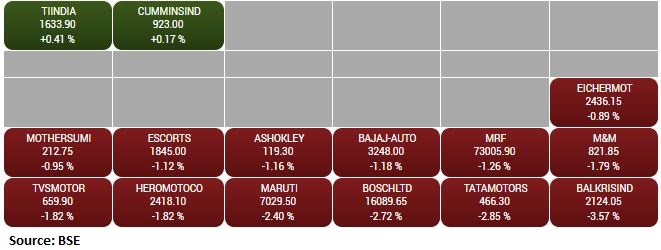

Among sectors, IT index fell over 2 percent, while other sectors lost a percent each. The BSE midcap and smallcap indices fell over 1 percent each.