December 23, 2022 / 16:23 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services

Domestic equities witnessed free fall as surge in covid cases around the globe has spooked investors. Nifty opened gap down and headed southwards below 18k zones. Broader market saw sharp decline with Nifty midcap 100 down 4% while Nifty smallcap 100 down 5%.

Selling was seen across the sectors with PSU Banks, Metals, Oil & Gas and Realty bearing major brunt.

Going ahead, we expect further weakness in the equity given the worry over the potential risk from surging Covid and recessionary fears as central banks globally continue to remain hawkish.

We expect sectors like Entertainment, QSR, Hotels, Travel & Tourism to see decline as government has initiated various precautionary measures. However, any decline will be good opportunity to gradually accumulate fundamentally quality stocks.

December 23, 2022 / 16:05 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets plunged sharply lower, in continuation to the prevailing corrective trend. After the gap-down start, Nifty gradually inched lower as the session progressed and finally settled closer to the day’s low to close at 17,806.8 levels.

The pressure was widespread wherein PSU banks, metal and energy stocks were hammered badly. The broader indices underperformed the benchmark.

Indications are pointing towards the prevailing corrective move to extend further, with a marginal rebound in between. Meanwhile, mixed global cues will keep the volatility high thus we recommend keeping a check on leveraged positions and preferring a hedged approach.

December 23, 2022 / 15:49 IST

Amol Athawale, Deputy Vice President - Technical Research at Kotak Securities

Markets were caught in frenzied selling as weak global cues and bearish external factors pushed both the key benchmark indices below the psychological levels. Besides spurt in Covid cases in China & Japan, the better than expected US Q3 GDP numbers further raised concerns that the Fed will go for more rate hikes to tame inflation, which further accentuated selling pressure in the markets.

Technically, after a long time the index closed below the 50-day SMA (Simple Moving Average) and also formed a long bearish candle on weekly charts which is broadly negative.

For traders, as long as the index is trading below 18,000, the correction wave is likely to continue and below the same, the index could slip till 17,600-17,500. On the flip side, 18,000 could act as sacrosanct resistance zone. The dismissal of 18,000 could push the index till 50-day SMA or 18,150-18,200.

December 23, 2022 / 15:35 IST

Rupee Close:

Indian rupee closed 10 paise lower at 82.86 per dollar on Friday against previous close of 82.76.

December 23, 2022 / 15:30 IST

Market Close

: Benchmark indices ended lower for the fourth consecutive session on December 23 with Nifty around 17,800.

At Close, the Sensex was down 980.93 points or 1.61% at 59,845.29, and the Nifty was down 320.50 points or 1.77% at 17,806.80. About 468 shares have advanced, 3018 shares declined, and 61 shares are unchanged.

Adani Ports, Adani Enterprises, Hindalco Industries, Tata Steel and Tata Motors were among the biggest Nifty losers.

All the sectoral indices ended in the red.

The BSE midcap index lost 3.4percent and smallcap index slipped 4 percent.

December 23, 2022 / 15:21 IST

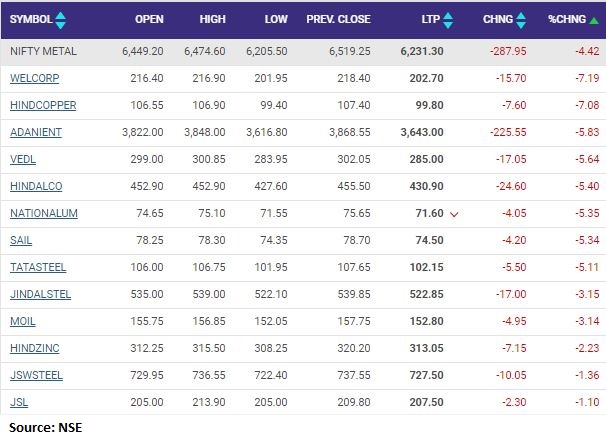

Nifty Metal index slipped 4 percent dragged by Welspun Corp, Hindustan Copper, Adani Enterprises

December 23, 2022 / 15:19 IST

Morgan Stanley keeps 'Overweight' rating on SBI Cards

-Overweight call, target at Rs 1,100 per share

-Continued to gain market share in cards in force

-Spends market share marginally improved MoM to 18.3 percent in November

SBI Cards & Payment Services was quoting at Rs 770.75, down Rs 16.50, or 2.10 percent and touched an intraday high of Rs 794.85 and an intraday low of Rs 768.70.

December 23, 2022 / 15:13 IST

Citi keeps 'Sell' rating on JK Cement, target Rs 2,400

-Sell call, target at Rs 2,400 per share

-Acro paints investment is in-line with its plan

-Company plans to invest Rs 600 cr over next 5 years into paints biz

-Elevated & rising competitive intensity is an issue & execution will be key

J. K. Cement was quoting at Rs 2,921.10, down Rs 118.15, or 3.89 percent.

December 23, 2022 / 15:07 IST

BSE Smallcap index down nearly 4 percent dragged by Goodluck India, Lancer Container Lines, EKI Energy Services

December 23, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices extended the losses and trading at day' low point with Sensex below 60000.

The Sensex was down 908.04 points or 1.49% at 59918.18, and the Nifty was down 299.30 points or 1.65% at 17828. About 334 shares have advanced, 3002 shares declined, and 51 shares are unchanged.

December 23, 2022 / 14:55 IST

Motilal Oswal Financial Services keeps 'Buy' rating on Reliance Industries

-Buy call, target at Rs 2,850 per share

-Metro Cash & Carry a good deal at a reasonable valuation

-Metro Cash & Carry at close to breakeven, will contribute 15 percent to topline

Reliance Industries was quoting at Rs 2,510.90, down Rs 67.00, or 2.60 percent.

December 23, 2022 / 14:51 IST

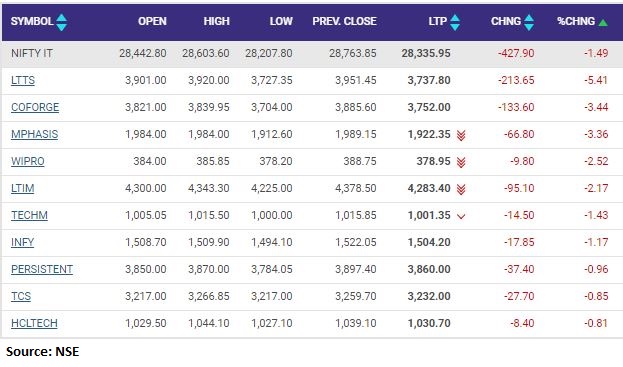

Nifty Information Technology index shed 1 percent dragged by L&T Technology Services, Mphasis, Coforge

December 23, 2022 / 14:45 IST

Kansai Nerolac Paints in focus after Rs 11 crore investment in Sri Lankan subsidiary

Kansai Nerolac Paints has invested Rs 10.99 crore in its subsidiary in Sri Lanka, Kansai Paints Lanka, wherein it holds 60% stake. Sri Lankan subsidiary has allotted 8.1 crore ordinary shares at LKR 6 per share to Kansai Nerolac.

Kansai Nerolac Paints was quoting at Rs 419.00, down Rs 9.55, or 2.23 percent.