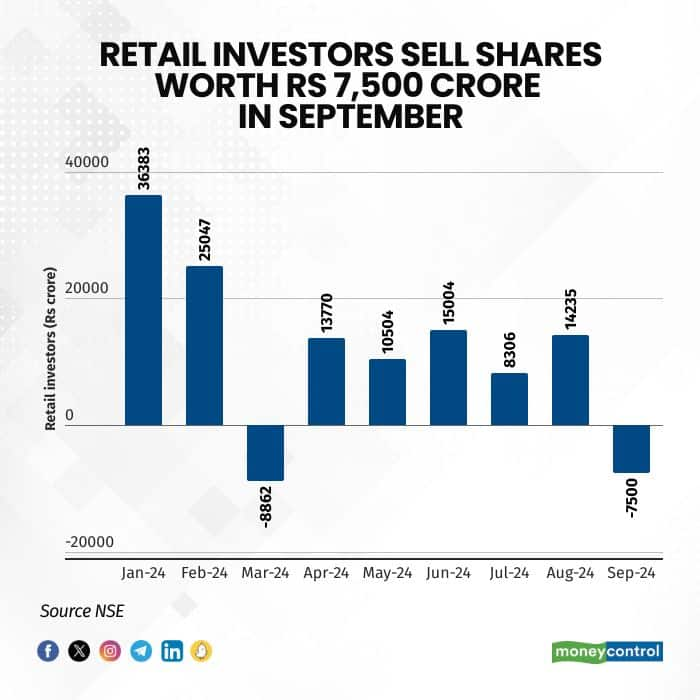

Retail investors turned net sellers in September, ending a five-month buying streak, by offloading shares worth Rs 7,500 crore in the month.

The selling contrasts with foreign and domestic institutional investors, who continued to invest funds, sending Indian markets to record highs.

Catch all the market updates on our live blog

So far in September, retail investors have sold shares over Rs7,500 crore, marking the largest sell-off since March 2024. Meanwhile, domestic investors bought shares worth around Rs 17,421 crore, while foreign investors bought Rs 55,855 crore worth of shares in September.

Analysts, meanwhile, attribute the secondary market retail activity to profit booking and also the rush of public issues that is leading to many small investors booking profits to invest in initial public offers (IPOs).

While the Sensex and Nifty, along with MidCap and SmallCap indices, have rallied since the start of the year, retail investors have been booking profits at higher levels, they say, adding that retail investors have also sold newly listed IPO stocks, even those that debuted with significant listing gains.

Deepak Jasani, Head of Retail Research at HDFC Securities, noted that retail investors' actions reflect concerns about current market conditions. "Many are likely shifting from secondary markets to IPOs, given the strong IPO market, to increase their chances of allotment," he said.

"Investors may also be reallocated to other asset classes such as real estate, gold, or other investments. This reflects both the current market levels and the need to deploy funds elsewhere, or to raise cash for future opportunities," he added.

In September, 13 companies launched their IPOs with the cumulative size pegged at Rs 11,890 crore. Of these, only one IPO listed in negative territory, while three saw marginal gains over their issue price. The remaining nine IPOs listed with gains ranging between 18% and 135%. Year-to-date, 63 firms have raised Rs 65,345 crore through IPOs.

Another reason retail investors may be pulling out of Indian equities is the market's elevated levels, which are causing hesitation among investors who are waiting for a correction, say experts.

Although analysts expect the markets to continue performing well, they also caution that the current risk-reward ratio is not favourable while highlighting that no immediate correction is anticipated.

So far in September, both the Sensex and Nifty have gained 3.9 percent and 3.7 percent, respectively, while the broader markets, BSE MidCap and SmallCap, have risen by 0.9 percent and 1.91 percent.

Year-to-date, the Sensex and Nifty have surged by 18.5 percent and 20 percent, respectively, with mid- and small-cap indices both posting gains of 34 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.