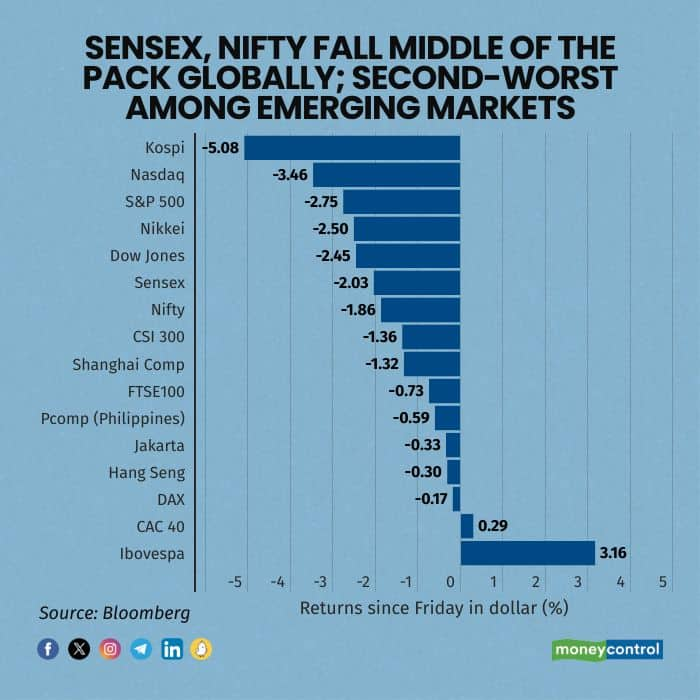

Since Friday, Indian markets experienced middling falls among global markets and recorded the second-largest decline among emerging markets. South Korea's KOSPI was the biggest loser, dropping over 5 percent in dollar terms. India’s flagship indices, the Sensex and Nifty, fell by 2.03 percent and 1.86 percent, respectively, in dollar terms.

After South Korea, the Nasdaq experienced the steepest decline, falling by 3.5 percent. This was followed by the S&P 500 and Nikkei, which dropped by 2.8 percent and 2.5 percent, respectively.

In emerging markets, after South Korea and India, China’s Shanghai Composite fell by 1.3 percent, followed by the UK’s FTSE 100 and the Philippines' PSEi, which lost around 0.7 percent and 0.6 percent, respectively.

Read: Sensex falls 300 pts, Nifty dips below 24200 amid weak cues; eyes on RBI policy outcome

Other emerging markets saw marginal declines, with Jakarta and Hang Seng losing just 0.3 percent, while the DAX dropped 0.2 percent. Meanwhile, Brazil's Ibovespa was the biggest gainer, up 3.16 percent, followed by France’s CAC 40, which gained 0.3 percent.

This week, equity indices were gripped by global market carnage due to a confluence of external factors. Recession fears in the US, fueled by weak jobs data, an interest rate hike in Japan affecting the yen-carry trade, and a raging Middle East conflict triggered a massive sell-off across the board.

Following this, foreign investors have sold around $1.2 billion since Friday. Market participants believe that while Indian markets will feel the impact of global concerns, the attractive returns and strong economic outlook in India will help mitigate these effects, potentially stabilizing FPI flows soon.

Read: Protean eGov Tech sees Rs 236 crore block deal as Standard Chartered likely exits

In the last two sessions, Indian markets have recovered some of their losses. Analysts suggest that following FII selling, countervailing investments by DIIs can impart resilience to the market. However, the crash in the broader market has dampened the exuberance of retail investors.

Despite the recovery, market valuations remain elevated. Analysts see value in financials and advise investors to prioritize large-cap investments over mid and small-caps at this juncture.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.