The market regulator has given the go-ahead to Roshni Nadar Malhotra to acquire a majority shareholding in two promoter group companies of HCL Technologies Ltd from her father and founder of HCL Group Shiv Nadar.

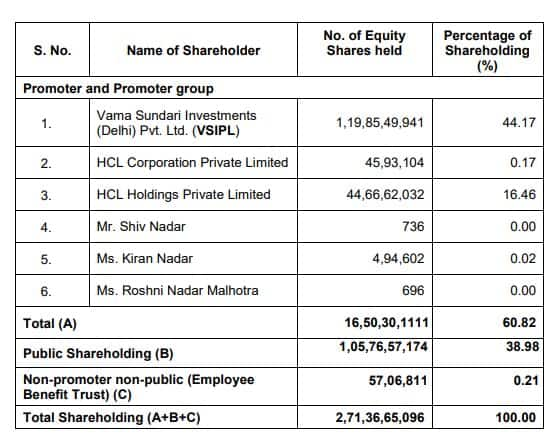

This is part of the succession planning of the Nadar family and, subsequent to the transfer, the aggregate shareholding of the promoter and promoter group of HCL Tech would remain unchanged at 60.82 percent.

The exemption order passed by the Securities and Exchange Board of India (SEBI) on November 22 allowed Roshni Nadar to acquire shares of Vama Sundari Investments (Delhi) Pvt Ltd (VSIPL) and HCL Corporation Private Ltd (HCL Corp).

HCL Corp is a non-deposit taking systematically important non-banking finance company (NBFC) registered with the Reserve Bank of India.

VSIPL holds 44.17 percent and HCL Corp holds 0.17 percent in HCL Tech.

Source: SEBI Order

Source: SEBI Order

Roshni Nadar had applied to SEBI for allowing the transfer of 47 percent of the share capital of VSIPL from Shiv Nadar and 47 percent of the share capital of HCL Corp from him.

Also read: SEBI proposes involving external agency, regulator in hiring of KMPs of stock exchanges, other MIIs

Currently, Roshni Nadar holds 10.33 percent of VSIPL's shareholding and Shiv Nadar holds 51 percent of the same; and she holds 10.33 percent of HCL Corp and Shiv Nadar holds 51 percent of the same.

After the transfer, Roshni Nadar would hold 57.33 percent of VSIPL and Shiv Nadar would hold 4 percent of the same; and she would hold 57.33 percent of HCL Corp and Shiv Nadar would hold 4 percent of the same.

The SEBI order made the following observations among others:

1.The Application submitted is in respect of the proposed indirect acquisition of shares and voting rights in the Target Company (HCL Tech).

2.The proposed indirect acquisition would not affect or prejudice the interests of the public shareholders of the Target Company in any manner.

3. There shall be no change in control of the Target Company pursuant to the proposed acquisition.

4. The Target Company shall continue to be in compliance with the Minimum Public Shareholding requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!