When a storm hits the sea, land seems to be a safe place. In that context, when COVID-19 hit the Street, investors looked to take cover in safe sectors to protect their capital.

Story continues below Advertisement

PSUs are considered safe bets, and the big dividend payouts are lucrative. Investors should allocate some percentage of their portfolio towards PSU stocks at any given time. There are around 10 companies that are top portfolio bets of fund managers, FIIs as well as insurance companies.

Many of them are common across MFs, FIIs as well as insurance companies. Most of these stocks have sound fundamentals and have corrected sharply since January.

Top PSU companies in which fund managers hold their trust as per March quarter data include NTPC, BPCL, Power Grid, Coal India, ONGC, IOC, BEL, HPCL, GAIL India, and PFC, according to a report by LKP Securities.

“If we see Nifty PSE index, Oil &Gas companies have the most weightage of around 40 percent followed by power companies with around 31 percent and metals with around 15 percent,” Gaurav Garg, Head f Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“The major reason why various financial institutions have bet huge proportion of amount in these sectors is the percentage of the holding of the government, and that these sectors are the key to any economy of the world,” he said.

Garg further added that any announcement or change in policies in these sectors by the government will also impact the government holdings. We may say that these are dependable sectors which the financial institutions watch for.

Story continues below Advertisement

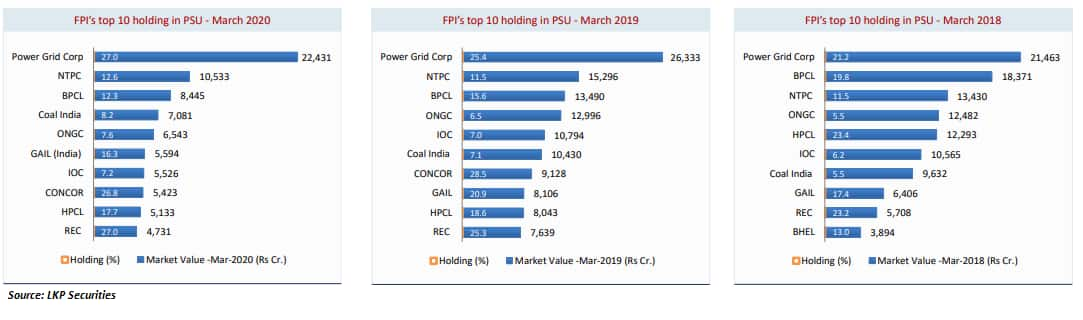

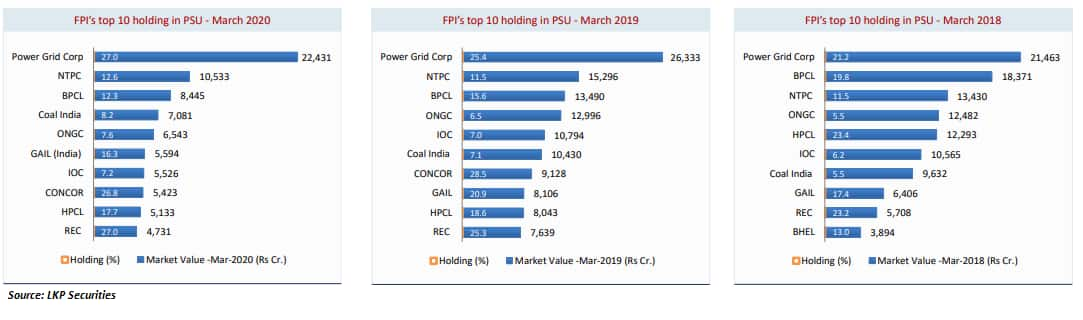

Top stocks in the foreign institutional portfolios include Power Grid, NTPC, BPCL, Coal India, ONGC, GAIL India, IOC, Container Corp, HPCL, and REC etc., as of March quarter, according to a report from LKP Securities.

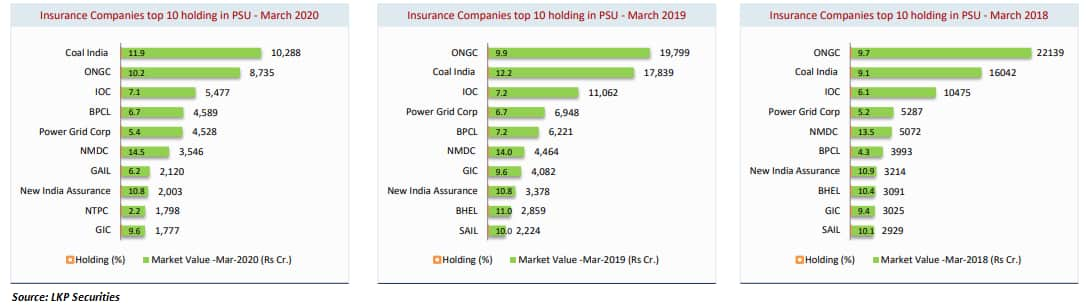

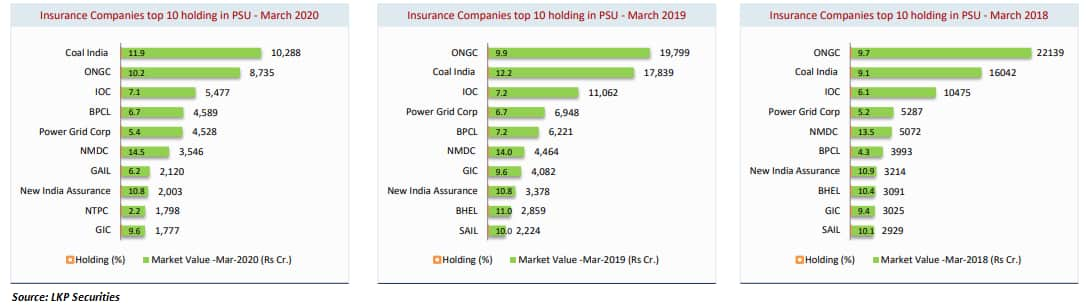

Insurance companies bet on Coal India, ONGC, IOC, BPCL, Power Grid, NMDC, GAIL India, New India Assurance, and GIC, data from LKP Securities showed.

“The companies mentioned above have a decent fundamental track record. However, in the current scenario, they are also witnessing significant pressure in their respective businesses due to overall demand slowdown,” Ajit Mishra, VP Research, Religare Broking Ltd told Moneycontrol.

“Recently, the government has laid out a public sector policy that would aid higher efficiency in these companies through an increase in private sector participation and privatization. While this is positive for long term growth prospects, they could underperform in the near term due to overall economic slowdown,” he said.

How much should one invest?

The recent announcement made by the government put PSU stocks in a commanding position even though they might have been underperformer in the recent past.

The government would formulate a new public sector policy wherein all sectors will be opened up for private firms and PSUs will be privatized in non-strategic sectors.

This will not only help improve efficiency in the system but also raise resources for the government, suggest experts. Further sectors like coal, power, refining, defence, and aviation would see greater participation of private players, they say.

“Though PSU’s are high dividend-paying companies, they have been underperforming the benchmark indices for quite some time and have eroded a large amount of investors’ money due to poor financial performance,” said Mishra of Religare Broking Ltd.

“Despite the recent plunge in the stock prices, we suggest investors not to invest more than 10 percent of their investable corpus until there is any meaningful sign of revival in the company’s financial,” he said.

From the past couple of years, it is observed that the Indian economy is moving slowly, and the government is trying to boost it with various reforms and stimulus packages.

“The recent announcement of Rs 20 lakh cr package which is focused on various sectors might help to uplift the economy, but one must notice that it might take 2-3 years to see the results of these announcements. An individual investor one may consider 15-20 percent of investment into the PSU’s,” says Garg of CapitalVia Global Research Limited- Investment Advisor.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.