Stocks of public sector banks (PSBs) have emerged as the champions of the Indian banking sector in the last one year, leaving private sector counterparts trailing behind and drawing further optimistic forecasts. Analysts are now eyeing continued growth in PSU banks, likely to be propelled by consolidation efforts, credit growth and improving asset quality.

Over the past one year, shares of PSBs such as UCO Bank and Punjab & Sind Bank have given astonishing returns of over 187 percent and 148 percent, respectively. Bank of Maharashtra and Central Bank of India have also gained significantly, rising 126.12 percent and 92.72 percent, respectively.

Amid turbulent market conditions marked by high interest rates and inflation, the Nifty PSU Bank Index tracking the performance of PSBs has surged by a noteworthy 52 percent over the past year. This is far higher than the Nifty Bank Index’ 12 percent gain in the same period.

For the week (September 8-15), Nifty PSU Bank index rose 7.2 percent, while Nifty Private Bank index up nearly 2 percent.

PSB stocks cheer, private bank stocks face challengesThe rebound in the PSB stocks is in stark contrast to the mixed performance in private sector banks. While HDFC Bank posted a respectable 9.28 percent return over the past year, it remained relatively modest compared to PSB counterparts. Kotak Mahindra Bank grappled with challenges, registering a return of -5.93 percent. However, ICICI Bank maintained stability with a return of 7.15 percent. Axis Bank and IndusInd Bank displayed more robust performances, with returns of 23.58 percent and 27.28 percent, respectively.

Also Read: Insurance houses bought Bajaj Finance, IndiGo in August, trimmed HDFC BankHowever, while analysts remain bullish on the banking sector, the implementation of Expected Credit Loss (ECL) guidelines is expected to play a pivotal role, with assessments suggesting a potential impact ranging from 1 to 2.5 percent of loans for PSBs, according to Morgan Stanley.

This has led a few brokerages to become more selective with state-run banks, with Punjab National Bank (PNB) being downgraded to "underweight". In contrast, BOB, Bank of India (BOI) and SBI are viewed favorably due to their stronger balance sheets.

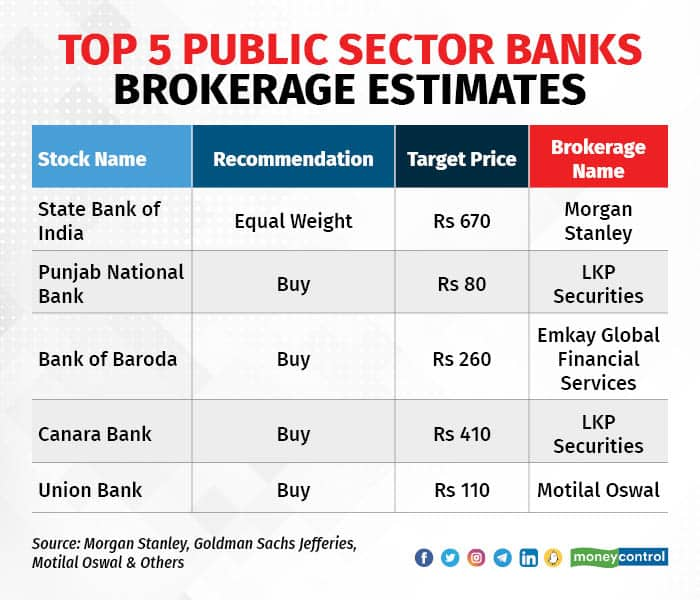

Brokerage views on PSBsMorgan Stanley on SBI, PNB and BOBAnalysts at Morgan Stanley have given SBI an "equal-weight" rating with a target price of Rs 670 per share. They highlight SBI's strong performance in the retail and small and medium enterprises (SME) segments. However, domestic loan growth has slowed a bit, leading the bank to focus more on its overseas loan book. SBI has also reiterated its guidance of 12-14 percent loan growth for FY24. The brokerage notes that SBI's management expects some margin moderation as funding costs catch up.

Top 5 Public Sector Banks Brokerage Estimates

Top 5 Public Sector Banks Brokerage EstimatesHowever, in a note, the analysts explained their rationale for being cautious, stating, "We get more selective on SoE (state-owned enterprise) banks after strong performance over the past month and likely peaking of rates: Banks that face greater impact from ECL norms are likely to see a delay in the re-rating cycle, even as earnings estimate upgrades are set to continue,"

Morgan Stanley on the other hand downgraded PNB from "equal weight" to "underweight" in a recent report citing a relatively higher potential impact from ECL provisioning. The note mentioned lower coverage ratios, higher gross and net non-performing loans formation and historical credit costs as contributing factors. Comparatively, Bank of India (BOI) and Bank of Baroda (BOB) have better capital and coverage, providing some relative comfort.

BOB received a favorable mention, with the brokerage firm noting its good capital and coverage, as well as a better asset quality track record compared to other banks.

Brokerage Views on private sector banksBrokerage firm Mirae Asset Securities in a sectoral report on banks released on September 7 stated, “FY24 starts on a good note with healthy earnings performance, albeit minor hiccups in net interest margins (NIM). Overviewing the performance of 10 private banks (from Nifty Private Bank Index) and 12 PSU banks (Nifty PSU Index) for 1QFY24, earnings performance was largely on-track.”

Also Read: No US Fed rate cuts until next year, says Julius Baer’s Mark MatthewsThe report added, “The PSU Bank Index continues to outperform (~54 percent) compared to Private Bank Index (14 percent) over the past one year. PSB valuation discount with private banks remains in the range of 60-70 percent. If current earnings trend sustains throughout FY24 along with conducive macro indicators supporting narrowing of the ROA (return on assets) gap, we believe ~50 percent valuation gap is possible for PSBs. We believe for private banks steady performance will ascertain further upside.”

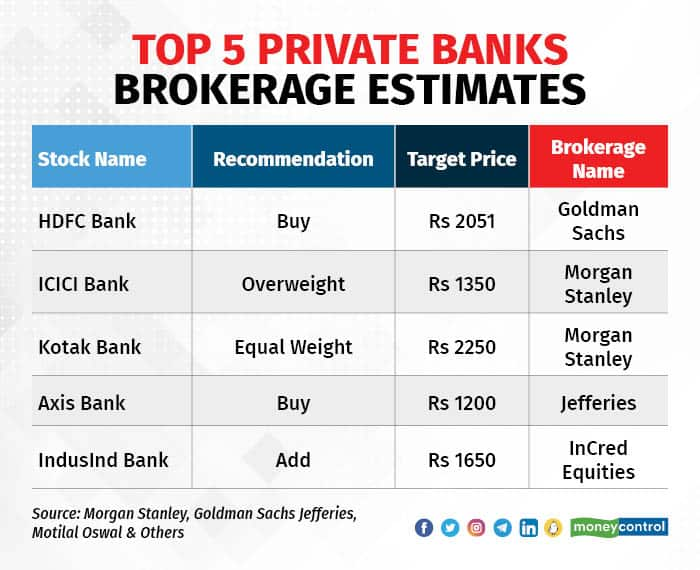

Goldman Sachs on HDFC Bank and Kotak Mahindra BankGoldman Sachs assigned HDFC Bank a "buy" rating with a target price of Rs 2,051 per share in a recent report. It discussed the recent decision to withdraw incremental cash reserve ratio (ICRR) in a phased manner, estimating an impact of $48 million or Rs 400 crore. Despite this, however, they note that the bank has lost a significant market capitalization of $3.5 billion or Rs 29,000 crore since the announcement. Goldman Sachs remains positive, as it believes the core thesis remains intact and forecast sector-leading earnings growth of 17 percent in FY23-26.

Top 5 Private Banks Brokerage Estimates

Top 5 Private Banks Brokerage EstimatesKotak Mahindra Bank is rated "equal-weight" by Morgan Stanley, with a target price of Rs 2,250 per share. The report mentions healthy loan demand in the retail and SME segments, improved margins in FY23 (peaking in Q4FY23), and benign asset quality. Operating costs remain elevated due to higher growth momentum and tech investments.

Morgan Stanley on ICICI BankICICI Bank receives an "overweight" rating from Morgan Stanley with a target price of Rs 1,350 per share. The bank's strong loan growth and competitive intensity are noted. Management has reiterated its guidance of maintaining FY24 margins at levels similar to FY23. Over the medium term, the bank expects operating leverage to come into play.

Jefferies on Axis BankAxis Bank is given a "buy" rating by Jefferies with a target price of Rs 1,200 per share, citing the management's confidence in achieving a sustainable 18 percent return on equity. It also emphasises the bank's focus on improving its funding profile to reduce volatility. Margin stability and attractive valuations make Axis Bank its top pick.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.