The proposed Goods and Services Tax (GST) overhaul could be one of India’s most significant indirect tax reforms, according to Neelkanth Mishra and other economists at Axis Bank. According to reports, the GST structure would be simplified to two key slabs of 5 percent and 18 percent, with sin goods taxed at 40 percent.

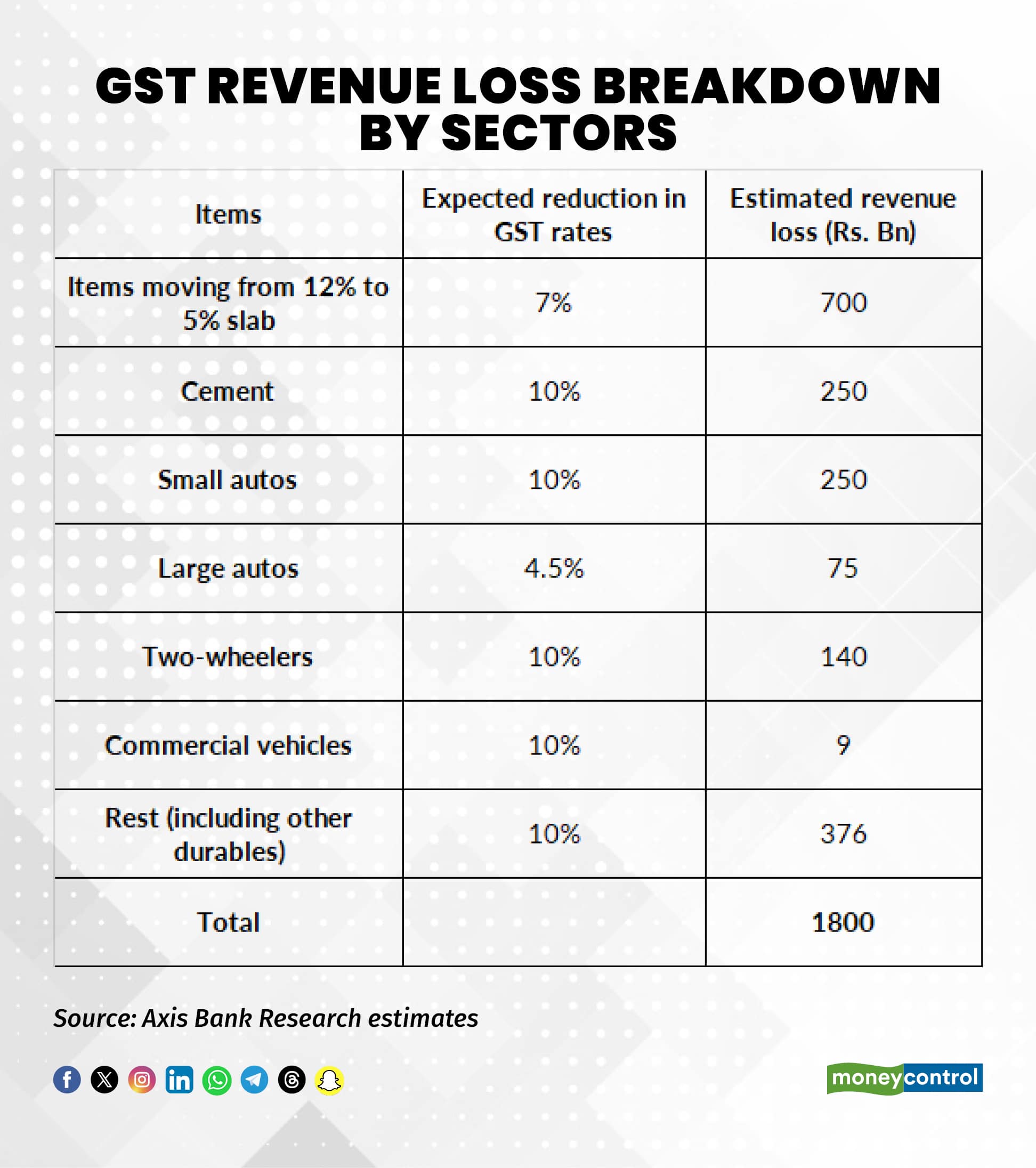

If implemented, the move may lower GST revenues by an estimated Rs 1.8 lakh annually (0.5 percent of GDP) spread over FY26 and FY27. In FY26, the revenue loss for the Centre could be Rs 45,000 crore or 0.12 percent of the GDP, though improved compliance, higher volumes and lower costs are expected to offset part of the loss over time, noted Mishra.

Further, nearly all items currently taxed at 12 percent are likely to shift to the 5 percent slab, while about 90 percent of goods in the 28 percent category may move to 18 percent. Around 13-15 percent of all GST collections from the 28 percent slab, while the 12 percent accounts for 5-6 percent of the collections.

Axis Bank economists estimate this change could reduce GST revenues by about Rs 1.8 lakh crore a year (0.5 percent of GDP), with the Centre bearing a slightly higher share of the loss. The effective GST rate may also drop to 10.3 percent.

Axis Bank economists estimate this change could reduce GST revenues by about Rs 1.8 lakh crore a year (0.5 percent of GDP), with the Centre bearing a slightly higher share of the loss. The effective GST rate may also drop to 10.3 percent.

"We estimate GST collections to be affected by 8.5 percent of FY26 budget. General government revenue impact would be 0.25 percent in FY26 (rest in FY27), skewed slightly towards the central government," added the report.

Axis Bank expects the initial revenue loss to be partly offset over time by better tax compliance, especially from goods moving out of the 28 percent slab. Lower GST rates could also cut prices by 7 to 10 percent, which will demand in some categories.

Since the compensation cess of Rs 1.6 lakh crore a year was anyway set to end after FY26, the overall revenue impact may be limited, as some sin and demerit goods such as cigarettes, online gaming, large cars, and sugary drinks will continue to be taxed at higher rates under a new 40 percent slab.

"The decisiveness of the announcement, especially the promise of price cuts for consumers should reduce political pushback from states. However, some states may lose more revenue than others and are likely to resist," added the report.

Separately, near-term there is likely to be some economic disruption as the channel may now be reluctant to build inventory ahead of Diwali in categories seeing rate cuts. Post the cuts the economic momentum should pick up sharply, the report noted.

Follow our market blog to catch all the live updates

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.