Dear Reader,

Indian markets remained under pressure throughout the week, with selling spanning most sectors. The Nifty50 declined 229.8 points, or 0.89 percent, to close at 25,492.30, while foreign institutional investors continued their selling streak, offloading shares worth Rs 1,632.66 crore.

The sectoral picture was largely negative. The Media index suffered the steepest loss, at 3.2 percent, followed by Defence, down 2 percent, Metals, falling 1.7 percent, and IT, shedding 1.6 percent. A notable exception was the Nifty PSU Bank index, which bucked the trend with a 2 percent gain.

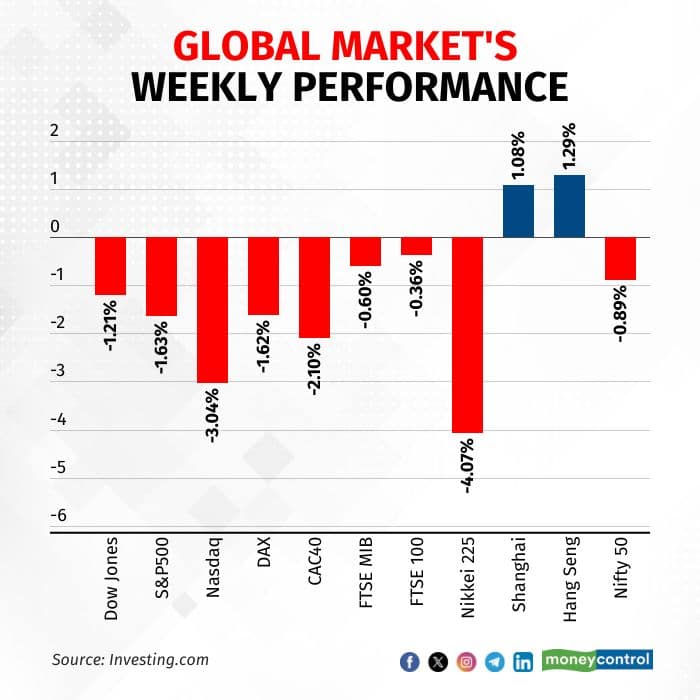

The domestic weakness mirrored broader global market concerns. US indices finished lower for the week as investors grappled with elevated valuations and mounting questions about artificial intelligence spending—factors that have begun weighing on the growth-oriented stocks that propelled the market's sharp rally since early April.

Adding to the uncertain climate, the US federal government shutdown, which had already extended to a record length, further dampened investor sentiment during the week. With the shutdown limiting the release of key government economic data, investors have grown increasingly reluctant to maintain their positions amid this information vacuum and heightened uncertainty.

With domestic catalysts absent, Indian markets are likely to follow global trends, particularly those driven by foreign institutional investor flows and the performance of the US market. The extended US government shutdown is making American markets increasingly jittery, and this nervousness could easily transmit to Indian equities in the absence of independent domestic drivers.

Oversold indicators

The market's recent two-week decline, which erased roughly half of its previous gains, has swept away the optimism that had begun taking root among investors. Yet despite this setback, the correction hasn't fundamentally undermined the broader weekly momentum trends. The market continues to hold above its 20-week moving average—a technically significant threshold that suggests the underlying structure remains intact.

This week's pressure came predominantly from weakening global market sentiment, which cast a shadow over domestic trading. However, amid the broader weakness, the Banking and Financials sectors demonstrated notable resilience, standing firm even as other areas faltered. This selective strength offers an encouraging signal about the market's internal health, suggesting that quality sectors can still attract investment interest despite headwinds.

From a technical perspective, Friday's session provided hints that the selling may be exhausted. The daily swing indicator dropped into single digits during intraday trading before closing at 28. Notably, Thursday's intraday reading of 15 had already signalled oversold conditions, making Friday's intraday weakness a potential indication that the market had overcorrected. Historically, the average swing indicator tends to confirm oversold conditions with a brief lag of one to two days. When both indicators align in oversold territory, they often mark important inflexion points where the market is poised to reverse direction.

Source: web.strike.money

The percentage of RMI buy signals among Nifty 50 stocks has dropped to just 12 percent, pushing the index back into oversold territory as bearish signals now dominate most constituents. Interestingly, the midcap segment tells a different story—this same measure shows no comparable oversold reading, reflecting the fact that midcaps have experienced shallower declines. The recent volatility has been driven primarily by large-cap stocks, resulting in a notable divergence in market behaviour across capitalisations.

While the Nifty has experienced a significant decline, the critical question now is whether the broader market can maintain its footing. Friday's session highlighted these disparities further as the small-cap index plunged sharply to its lower Bollinger Band. In contrast, the mid-cap index showed relative strength, recovering back above its 20-day moving average.

These technical patterns reveal substantial differences between large-cap and mid-cap stocks. Most notably, midcap stocks have been conspicuously absent from recent market movements.

Source: web.strike.money

Client positions have shifted back to net long, as large institutional traders continue buying during market pullbacks. However, despite this persistent support, the market has yet to push through to new highs.

The sentiment remains constructive, with major players consistently adding exposure during weakness. Yet the inability to break through to fresh highs despite this steady institutional demand suggests that selling pressure at higher levels remains formidable.

Source: web.strike.money

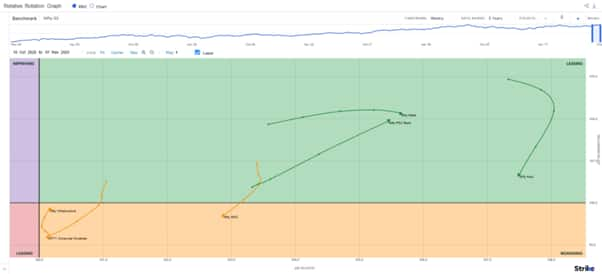

Sector Rotation

Nifty 50 – The Benchmark Index ended lower by -0.89 percent this week and closed at 25,492.30.

Weekly RRG:

Leading Quadrant: Nifty PSU Bank continues to show strong momentum as well as relative strength this week. However, the momentum of the Nifty Metal index declined marginally after several weeks of an uptrend. The Nifty Auto index continues to exhibit declining momentum and relative weakness.

Weakening Quadrant: Nifty MNC has entered the weakening quadrant this week, experiencing deterioration in both momentum and relative strength. Nifty Consumer Durable also continues to see deterioration in momentum as well as relative strength. This is the second week where Nifty Infra has gained momentum, as well as relative strength. If this trend continues, then this index can return to the leading quadrant.

Improving Quadrant: Within the improving quadrant, it is the only index that has seen sharp deterioration in momentum as well as relative strength this week. Other indices, such as Nifty Private Bank, Nifty PSE, Nifty Energy, and Nifty Oil & Gas, have entered the improving quadrant and have seen significant improvements in momentum and relative strength this week.

Lagging Quadrant: Nifty Bank and Nifty Financial Services have seen significant improvements in momentum and relative strength this week. Nifty Reality has also gained momentum as well as relative strength. Nifty Pharma, Nifty FMCG and Nifty Media have seen deterioration in momentum as well as relative strength.

Stocks to watch

Among the stocks expected to perform better during the week are Adani Ports, Eicher Motors, Muthoot Finance, Maruti, Nestle, TVS Motors, M&M, Hero Moto, and Bajaj Finance.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.