Growth of the companies versus the valuations they trade at has been a big debate among investors as 2023 has seen some great performances, especially in the midcap segment. While bullish investors have basked in the glory of this stupendous surge, others have voiced apprehensions regarding the rising valuations, calling the rally irrational exuberance.

One metric that may give a factual picture of how much growth is factored into valuations is ‘implied growth’. This metric reveals some segments of the market are already factoring in very high growth rates, while others may not be.

Also Read: Nifty at 21k: Four solid reasons why you should not be worried about a correction

Implied growth gives a very good sense of whether a company is undervalued or overvalued. What investors need to do is to simply gauge whether the actual growth, based on their own expectations, will be higher or lower than the growth rate implied rate by the prevailing price. If actual growth is higher than implied growth, then the stock is undervalued, and vice versa.

Now, how do you arrive at this?

We have sourced this data from Bloomberg. Implied growth is calculated, based on the divided discount model, by solving for the earnings growth ‘required’ in the stock based on the expected rate of return (risk free rate or what you’ll earn in a government bond plus the additional return you demand to take on the additional risk of uncertainty in equities or what is called ‘equity risk premium’) to justify the current stock price.

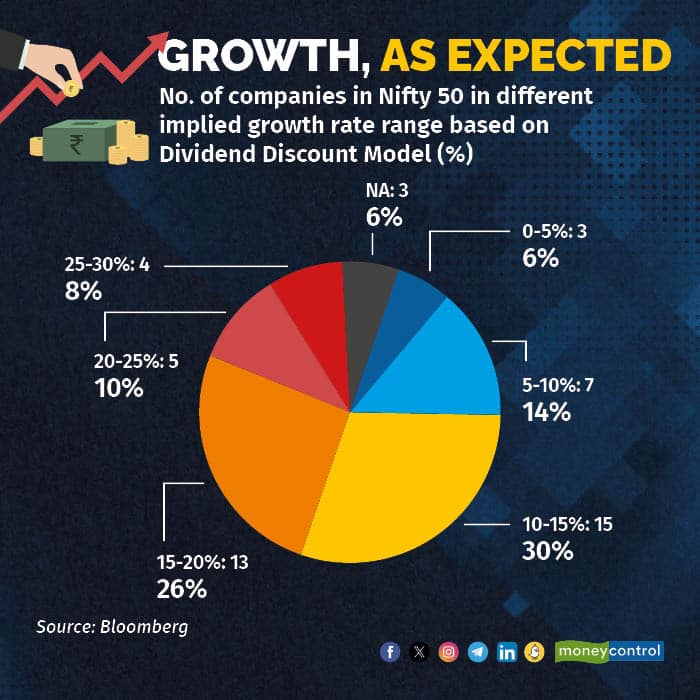

Looking at the implied earnings growth in the Nifty 50 index, stocks seem to be skewed towards overvaluation. About two-third of the stocks in the 50 Nifty basket are implying a growth rate of above 12 percent, the nominal GDP growth India is capable of with a real GDP growth of 8 percent and 4 percent inflation target.

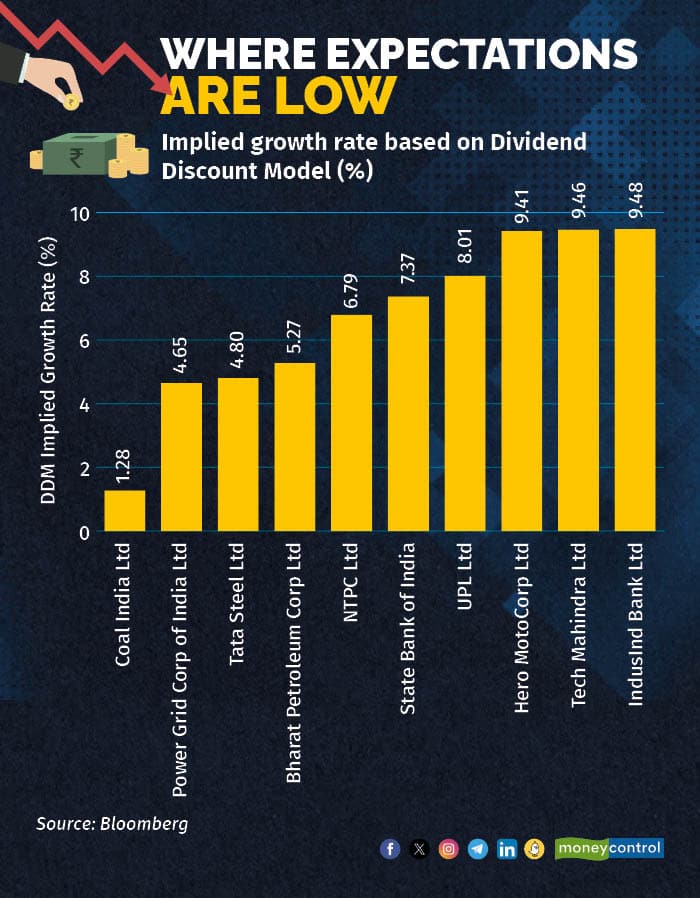

But what is interesting is the stark contrast in the way the market is valuing future growth. Despite the strong run up in prices, government-owned companies like Coal India, Power Grid Corporation, and Bharat Petroleum display remarkably low implied growth rates. For example, while there is now near consensus that as an economy, we may not be able to do away with coal, and more thermal power plants will be in the works, the Coal India’s market price suggests the stock is reflecting only a growth of 1.28 percent.

Top three out of the top 5 companies, and top 5 out of the top 10 companies in terms of lowest implied growth (below 10 percent) are public-sector companies. Apart from select PSUs, companies in the metals space like Tata Steel and Hindalco, autos and tech stocks as well as UPL - which has been the only company in the Nifty 50 in the red over the past year because of its high debt levels - show implied growth lower than 15 percent.

Also Read: Sensex eyes 73,000, markets enjoying 'goldilocks' momentum but watch valuations, say analysts

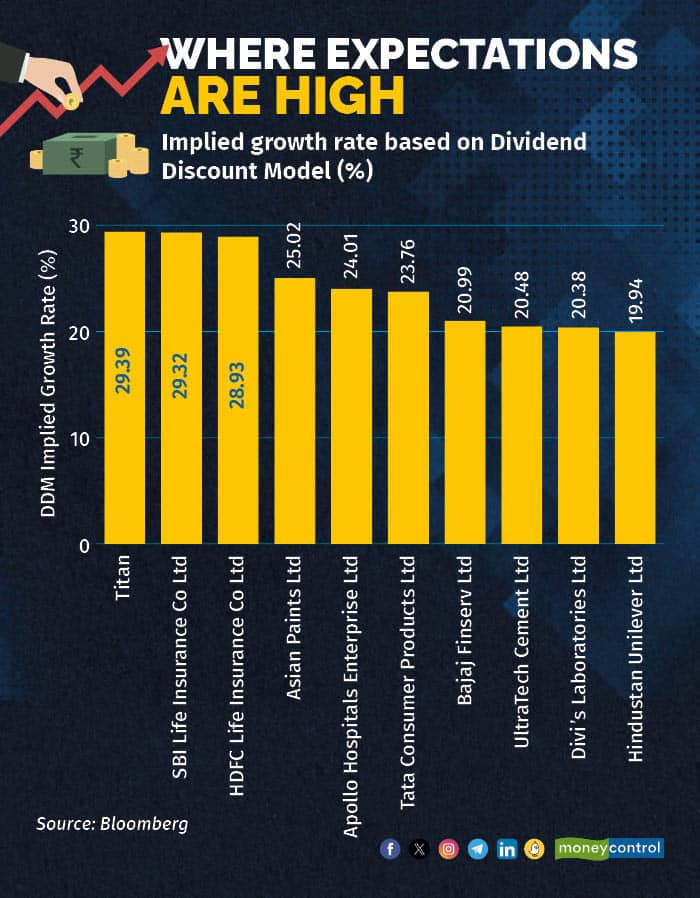

At the other end of the spectrum, life insurance companies like SBI Life Insurance and HDFC Life Insurance suggest implied growth rates exceeding 28 percent. Titan reflects a high implied growth rate of 29 percent, and so do other stocks like Asian Paints (25 percent), Apollo Hospitals (24 percent), Tata Consumer (24 percent) and Bajaj Finserv (21 percent).

Whether these growth rates are achievable or not is a judgement call every investor has to take. There could be arguments on both sides, because we are looking at growth rates in perpetuity and small changes in these growth rates can have a profound impact on the final outcomes and the ‘intrinsic value’ of a stock. Baring the role of chance, that is the skill investors are rewarded for and what legitimately creates opportunities for alpha.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.