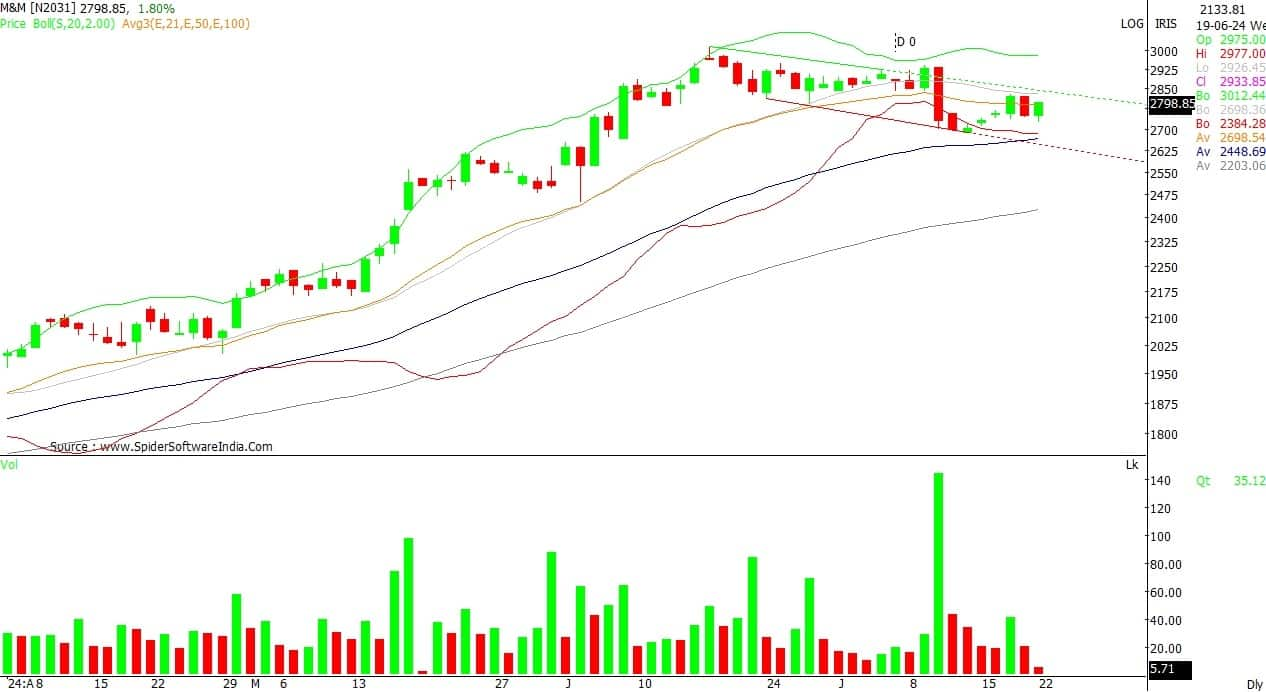

M&M Ltd shares are trading in a cycle of higher highs and higher lows, poised to breakout above recent resistance levels on the daily charts. At 11 am on July 22, the stock was trading at Rs 2,793.00, up 43.70 points or 1.59 percent.

"The recent price performance in the stock indicates strength and is expected to continue the positive momentum in the coming days as well," said Arun Kumar Mantri, Founder of Mantri Finmart.

To capture the upside potential, Mantri recommends taking a long call strategy:

Trade Details:

Position: Buy M&M July 2820 CE

Entry: Rs 30-33

Target: Rs 54-65

Stop Loss: Rs 20

Holding Period: 5-6 trading sessions

Technical View:

Mantri highlights that the stock is in a cycle of higher highs and higher lows, on the verge of breaking above recent resistance levels on the daily charts. The recent price performance indicates strength, and the positive momentum is expected to continue. "Technical indicators suggest that the bullish up move is likely to persist. The support for the stock is around Rs 2,700, while resistance is at Rs 2,880-2,900 levels on the higher side," said Mantri.

Mantri notes that the stock is trading comfortably above its 21, 50, 100, and 200 DEMA on daily and weekly charts, indicating strength. Leading indicators like the Parabolic SAR and MACD also suggest a positive trend in the near term.

Derivatives Data:

Mantri observes that in the option chain for the June series, the counter is standing above the strong support zone of Rs 2,750 to 2,800, where heavy put writers are positioned, with 8.75 lakh shares outstanding in the 2,800 strike put option of the current series. "The recent price action is accompanied by good volumes even in the derivatives front, indicating that the underlying strength is expected to remain in the short-term trade," he added.

He believes that the counter has added significant open interest in the last session, indicating that the upward move is likely to continue in the near term, with the price expected to test the Rs 2,880-2,890 levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.