Shares of NTPC have been in the limelight in the recent past as subsidiary NTPC Green Energy came to the market with an IPO, which will close tomorrow (Friday). With the PSU major’s subsidiary set to make its debut next week, all eyes will also be on NTPC, as investors would want to know what lies ahead for the power major with the IPO trigger behind.

Most analysts Moneycontrol spoke to remain positive on the stock, based on order book and demand in the core business, although some concerns on recent earnings performance remain.

The shares of NTPC have fallen a little over 16 percent over the last one month. On Thursday, the shares lost 2.73 percent to close at Rs 356.10. Experts, however, expect correction to continue in the next few months based on market movements.

Siddharth Khemka, Head of Research (Retail) at Motilal Oswal Financial Services Limited (MOFSL), said that the market sentiment may have been impacted by external factors including the US election results and below expectations Q2 results from NTPC.

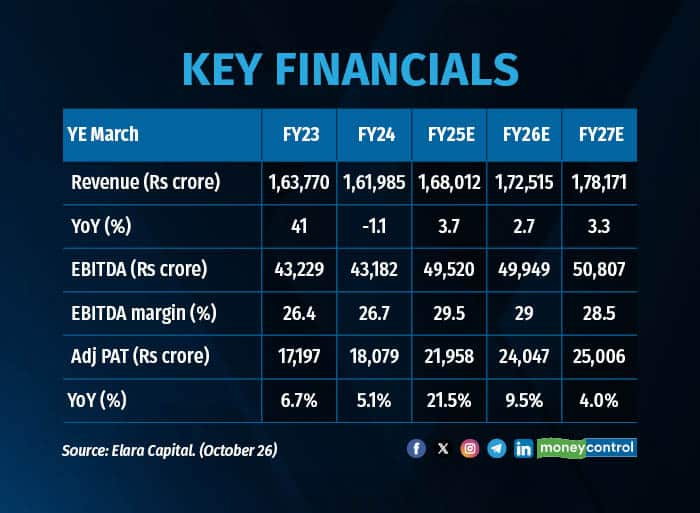

According to MOSL analysts, NTPC reported a slightly disappointing Q2FY25 numbers, although they believe that the long-term drivers for the segment remained intact. Analysts at Elara Capital are of the view that NTPC reported a flat top line due to reduced power and fuel prices. While EBITDA declined eight percent YoY to Rs 97 billion, operating margins contracting 200 basis points (bps) to 24 percent.

Meanwhile, NTPC’s installed capacity was 76,443MW at the group level and 59,168MW on a standalone basis for the quarter.

According to Rupesh Sankhe, Senior Research Analyst at Elara Capital, the listing of NTPC Green Energy as a separate entity will likely lead to a holding company discount. “That’s why the incremental value on the NTPC Green side will result in a discount for NTPC’s current shareholders. So, in SOTP (Sum of the Parts), you will see some value coming down,” said Sankhe adding that this has already been factored in by the market.

But he remains optimistic about the long-term prospects, citing that NTPC's conventional assets are currently valued at around 2X book value, which he believes is very reasonable.

“A lot of renewable energy capacities are being added, giving investors options on the renewable side. NTPC holds about 90 percent of NTPC Green. But if you take out this value in SOTP, the conventional assets of NTPC are now available at an attractive valuation,” he added.

According to Elara, the stock is currently trading at 2.0x FY27E P/B, which is attractive.

Core business outlook remains strongMost analysts agree that the outlook for the existing core thermal business remains attractive on the back of India's growing demand for power.

Khemka suggests that despite some near-term volatility, NTPC’s core power generation business remains stable. “We expect earnings to remain flat for FY25, with growth picking up to 19 percent in FY26. This could renew investor interest, but it will take time,” he added.

Similarly, Nirav Karkera, Head of Research at Fisdom, is of the view that NTPC is well positioned to continue to grow. “NTPC has executed its capacity expansion plans very well. They are on track to expand their operational capacity, with a 5 GW target. Given its position, growth outlook, and sectoral demand developments, NTPC presents a strong value proposition for investors,” said Karkera.

A recent report by Axis Securities stated that while Q2 was weak, the stock continues to see long-term drivers for growth. “NTPC’s robust thermal assets provide cash flow visibility. NGEL IPO will unlock the RE (renewable energy) business value with its aggressive RE capacity addition targets. We believe NTPC is a good portfolio bet given its stable dividend yield, and a further rerating potential cannot be ruled out if the peak deficits increase in future,” stated the report.

Some scepticism as wellHowever, not all share the same optimism. Prasanna Bidkar, Portfolio Manager, Paterson PMS expressed some level of caution, particularly about NTPC’s valuations, which he feels may be too high.

“After reaching Rs 450, valuations appear high, and the results haven’t met expectations. We’re also cautious about the power sector as a whole,” said Bidkar. Overall, the power sector, according to Bidkar, could face overcapacity and raw material shortages, predicting that a recovery could take between 6 to 12 months.

The Rs 10,000 crore NTPC Green Energy IPO is set to be listed on bourses on November 27. The IPO was subscribed 92 percent on its second day, November 21, with bids received for 28.3 crore shares against 59.3 crore shares on offer in the price band of Rs 102 to Rs 108 per share.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.