Markets participants are keenly going to watch the presentation of the first Budget of the third consecutive NDA government under the leadership of Prime Minister Narendra Modi tomorrow by Union Finance Minister Nirmala Sitharaman.

Yesterday, Indian benchmark indices ended marginally lower in the volatile session on July 22. Nifty closed at around 24,500 levels trading rangebound throughout the day. While At close, the Sensex was down 79.43 points or 0.10 percent at 80,525.22.

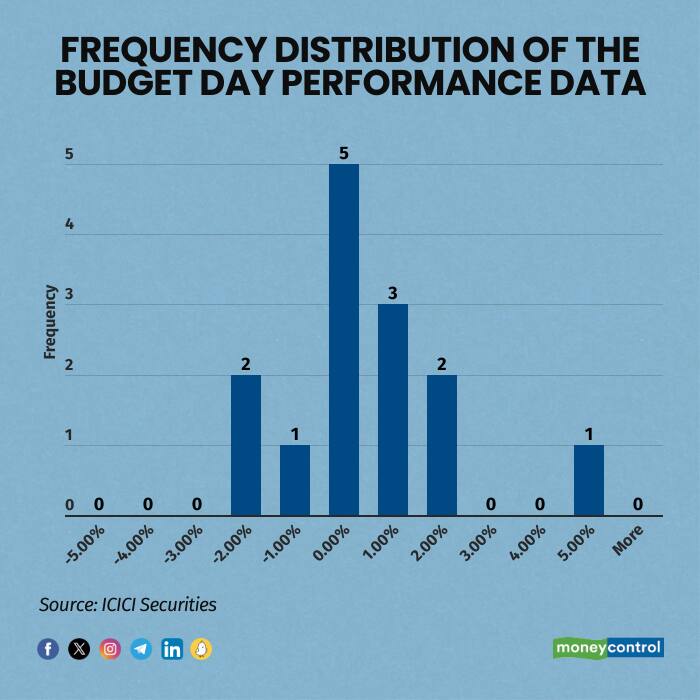

An analysis of past data shows that historically, Nifty has moved within a 4 percent range on Budget day.

According to Jay Thakkar, Head of Derivative and Quantitative Research at ICICI Securities, “Nifty closes within a range of -2 to +2 percent in 13 out of those 14 budget day sessions, indicating that the 4 percent range is well-defined over the past decade.”

Thakkar said that 2021 was an exception when the Nifty closed 4.7 percent (above) its previous close.

“Generally, ahead of such events, the options' implied volatilities (IVs) increase, and in the absence of significant changes in the Index, the IVs tend to cool down,” Thakkar added

A high IV means traders expect big price swings (either up or down), and low IVs mean traders expect the price to stay relatively stable.

Thakkar believes that to benefit from the IV momentum ahead of the event, non-directional strategies should be considered, such as the Short Iron Butterfly or Short Iron Condor.

These are four-legged option strategies, involving simultaneously selling and buying of calls and puts.

Historical Data Analysis

The data below reveals Nifty's performance during the past years Budget sessions and the frequency distribution of the same.

Short Iron Butterfly

The Short Iron Butterfly strategy involves four options contracts with the same expiration date but three different strike prices. The goal is to profit from minimal movement in the underlying asset's price. This setup includes selling one at-the-money (ATM) call and one ATM put, while simultaneously buying one out-of-the-money (OTM) call and one OTM put.Short Iron Condor

The Short Iron Condor strategy also involves four options contracts with the same expiration date but uses four different strike prices. It is similar to the Short Iron Butterfly but with a wider range of strikes, making it a less aggressive strategy. This setup includes selling one lower-strike put and buying one even-lower-strike put, while also selling one higher-strike call and buying one even-higher-strike call.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.