Vedanta, Zee Entertainment, Bharti Infratel and GAIL are expected to be removed from the Nifty50 index in the next semi-annual review by the National Stock Exchange (NSE).

The index is reviewed every six months (on a half-yearly basis) and a four weeks' notice is given before making changes to the index set.

Edelweiss Securities feels semi-annual review for rebalancing the Nifty index this time throws up a pretty long list.

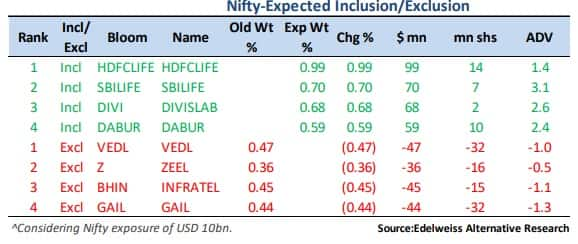

Currently, on the basis of float market-capitalisation and other conditions for inclusion, the brokerage expects inclusion of HDFC Life Insurance Company, SBI Life Insurance Company, Divis Labs and Dabur India in the Nifty50 Index.

According to the Nifty Index inclusion criteria, one key criterion for the stock to get included in Nifty is it should be a part of the F&O segment.

As all these above mentioned four stocks are already in the NSE F&O segment, the key criteria is cleared.

"On the exclusion part, we expect Vedanta, Zee Entertainment, Bharti Infratel and GAIL to get excluded from the index," said the brokerage.

Edelweiss expects index changes to be announced by the fourth week of August, and the same would take effect on September 25 (adjustment on September 24).

The brokerage said it would review the inclusion/exclusion after the close of July 31.

Here is eligibility criteria for inclusion of stocks in the Nifty50:

Liquidity

For inclusion in the index, the security should have traded at an average impact cost of 0.50 percent or less during the past six months for 90 percent of the observations for a portfolio of Rs 10 crore.

Index criteria

Constituents of NIFTY100 Index shall form the universe for NIFTY50.

Float-adjusted market cap

Companies will be included if free-float market capitalisation is 1.50x the free-float market capitalisation of the smallest constituent in the respective index.

F&O criteria for stocks in Nifty50

The stock must be available for trading in NSE’s Futures & Options segment.

Domicile

The company must be domiciled in India and traded (listed & traded and not listed but permitted to trade) on the NSE.

Trading frequency

The company's trading frequency should be 100 percent for the past six months.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!