Dear Readers,

Indian markets broke a two-week losing streak and closed nearly one percent higher. However, the much-needed move was smaller than the 5.85 percent jump seen in S&P500 during the week and 5.3 percent rise in the MSCI index. Both S&P500 and MSCI rose the most since November 2022.

Aiding the rise was the Fed's decision to maintain the status quo, resulting in the US dollar dropping to a six-week low and the benchmark 10-year US Treasury yields falling to five-week lows. A slowing of US job growth underscored views that the Fed may be done with hiking interest rates.

According to the CME Group's FedWatch Tool, traders are now pricing in only a 5 percent chance of a Fed rate hike in December, down from 20 percent earlier, while the odds of a January increase have slipped to 11 percent from 28 percent.

Structural Weakness persists

In our previous weekly outlook, we expected the market to test the previous lows. However, a global market rally and the sharp move after the Fed decision saw some strength in the Indian market, though not as much as in global markets.

Nifty rebounded after testing the 40-week exponential average and the lower Bollinger band. Many indicators that were in the oversold zone started to rebound.

The daily swing touched the 90 mark this week as the Nifty rebounded. Currently, the daily swing reading has cooled off to 78. However, the average swing is at 64 and has more room on the upside. We can have two scenarios developing here. First, there is a possibility of a negative divergence in the daily swing (Nifty making higher highs but the swing making lower lows); or second, where the swing continues to move higher, and the average swing may touch the overbought zone at 80, which should be supportive for the Nifty in the near-term.

Source: web.strike.money

Source: web.strike.money

The 20-day Advance-Decline (A/D) ratio has seen some rebound from the first red line, but the market is not out of the woods yet. A look at the few instances of correction highlighted in the chart shows that the ratio does bounce back for a while. Still, eventually, the market dips again and makes lower lows, forming a positive divergence before bottoming out. Usually, after such a big rally, we may see the ratio testing the second line. To conclude, there can be an interim bounce in the market, but once the pullback fizzles out, we can see a market correction again. Source: web.strike.money

Source: web.strike.money

As for the broader market, the number of Nifty 500 stocks below the 20dma has rebounded after testing the extreme oversold zone. But can we say the bottom is made for the broader market? Previous instances show that if the recent correction is just a pullback in an ongoing bull market, the Nifty 500 index may have bottomed out, but if the Nifty 500 index is headed in a prolonged corrective phase, which is highlighted in the chart, then we may see a minor pullback from time to time and the Nifty 500 index keeps forming lower lows before the correction ends. How the market behaves in the coming days and weeks will help us resolve this puzzle.

Source: web.strike.money

Source: web.strike.money

FIIs Stay Bearish

Foreign investors continued to be bearish on equity markets, selling Rs 5,522.38 crore worth of shares during the week.

In the derivative market, the FII’s net short position in the index futures figure touched the second lowest on record, i.e. -175698 contracts. In Friday’s trading session, the FIIs covered some short positions and are now holding 162694 contracts.

In the past two instances, the Nifty index had seen a significant up move when the short-covering rally unfolded. What is the maximum pain point for the FIIs if the market rallies and they throw in the towel will be known in the next few days. Simultaneously, if the market falls, whether these FIIs increase their short position to the record low of -196378 contracts has to be seen.

Source: web.strike.money

Source: web.strike.money

Options Data

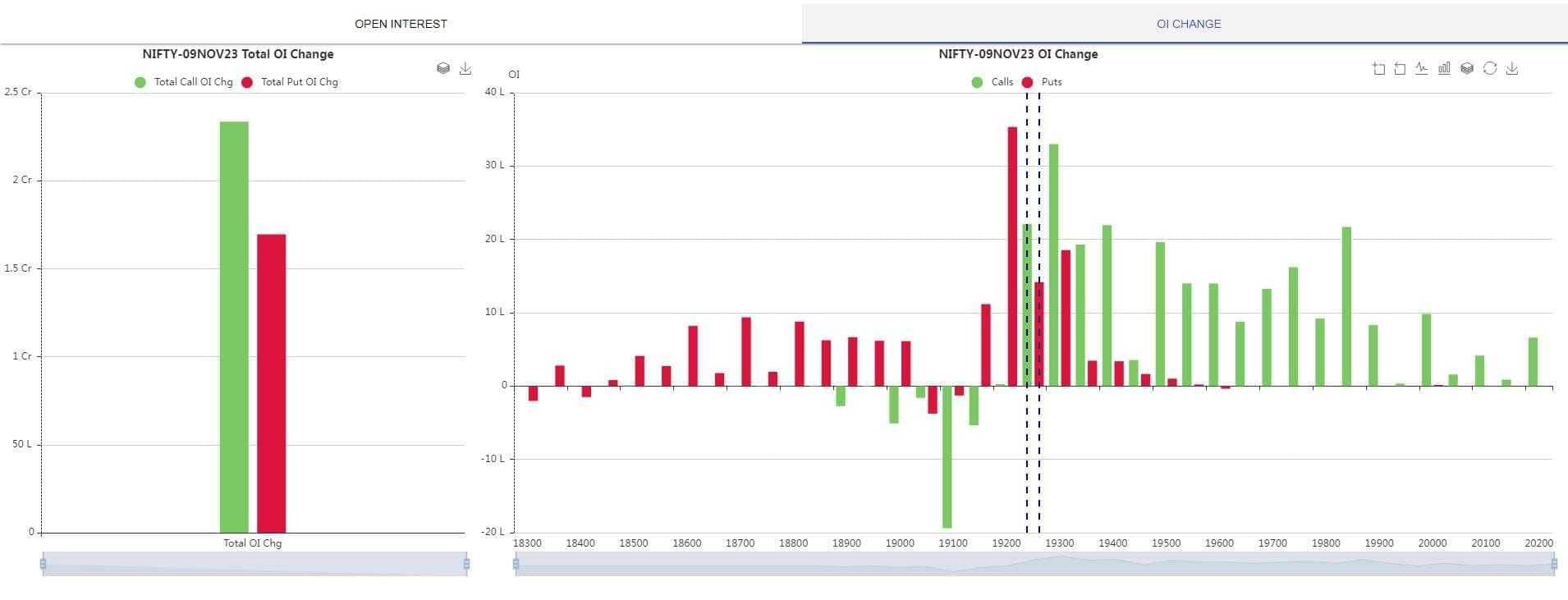

Even though the market moved higher by nearly one percent, call option sellers shifted their position back. There are still more call writers in the market than put writers, indicating expectations of further weakness. The chart below shows the change in open interest, with call sellers shifting their positions.

Source: Icharts.in

Source: Icharts.in

Indices and Market Breadth

Global bullishness pulled up Indian markets, with the Sensex closing 0.91 percent higher and Nifty gaining 0.96 percent during the week. The BSE Smallcap Index rose nearly 2 percent while Largecap gained 1.2 percent.

The Real Estate sector was the top performer, with the BSE Realty index shooting up by 10 percent followed by telecom at 5.3 percent and the oil & gas index gaining 3.6 percent. Despite strong monthly sales numbers, the auto index lost nearly one percent during the week.

Among the top gainers were Jaiprakash Associates rising by 39.29 percent, SEPC by 35.11 percent and Greenlam Industries by 29.64 percent. The top losers were Vikas WSP, losing 17.01 percent, Syrma SGS Technology which fell by 15.12 percent and Archean Chemical dropping by 14.75 percent.

Global Markets

The US Fed announcement, moderate crude oil prices and lower bond yields resulted in a strong equity market globally, with the US indices and MSCI index recording their best weekly performance in a year. While the S&P500 gained 5.85 percent during the week, the Nasdaq was up 6.61 percent and Dow Jones rose by 5.07 percent.

European markets, too, joined the party, with Euro Stoxx 50 gaining 4.04 percent, CAC 40 by 3.09 percent, DAX by 3.42 percent and FTSE 100 by 1.73 percent. Bank of England also kept interest rates steady for the second consecutive meeting, though it highlighted that rates will remain higher for longer.

Asian markets were moderately higher, with Nikkei 225 rising by 3.09 percent after the government announced a new stimulus package exceeding $110 billion. The Chinese market fell after its manufacturing data posted a contraction in October, but the US market gains helped it close in the green, with the Shanghai index gaining by 0.43 percent. Hang Seng posted a better performance, rising by 1.66 percent during the week.

Stocks to Watch

Among the stocks showing momentum are Canara Bank, Chambal Fertiliser, Granules, IEX, Dr Lal Pathlab, and MCX.

Stocks that can be a good risk-reward play are Asian Paints, Ambuja Cements, HDFC Bank, and ITC, among the frontline stocks.

Cheers,Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.