Dear Reader,

The Nifty index has continued its downward trend, marking the third consecutive week of negative closings. Investors have been hesitant to enter the market due to several factors, including foreign institutional investor (FII) selling, disappointing corporate earnings reports, and the anticipation of the upcoming budget.

While the benchmark indices experienced a decline of approximately 0.55 percent, certain sectors faced more significant losses. The realty index plummeted 9 percent, while energy stocks fell 4 percent. Media and oil & gas sectors both dropped by 4.5 percent. Small and mid-cap stocks also declined by more than 4 percent each. However, some sectors closed in positive territory, with IT gaining 3.5 percent, FMCG rising 0.5 percent, and private banks earning a 0.30 percent gain.

FII selling intensified during the week, with cash market sales reaching Rs 22,504.08 crore. This brought the total sales in January 2025 to Rs 66,944.50 crore, marking one of the highest monthly sell-offs on record.

Indian equities continued to underperform compared to most global markets in the first month of the year. Despite uncertainties surrounding President Trump's initial week in office, global markets posted robust returns.

The S&P 500 reached a record high during the week, with smaller stock Russell indexes outperforming the benchmark indices as Trump maintained his "Make America Great Again" rhetoric.

One possible reason for the positive closing in global markets could be Trump's more lenient approach to tariffs. Instead of imposing new tariffs, he requested federal agencies to review US trade policies to assess the impact of future tariffs.

In an interview, he said he would "rather not have to use" tariffs on China. His decision to reverse the ban on TikTok also suggests a potential reconsideration of his protectionist stance. However, Trump did hint at the possibility of imposing 25 percent tariffs on Canada and Mexico as early as February. US benchmark indices closed the week nearly two percent higher.

European markets also saw gains, with the STOXX Europe 600 Index ending 1.23% higher after Trump refrained from announcing new tariffs in his first days in office. The CAC 40 gained 2.83%, while the DAX rose by 2.35%. However, Italy's FTSE MIB fell by 0.18%, and the UK's FTSE 100 remained flat. European markets were further bolstered by statements from ECB policymakers suggesting that the central bank is likely to lower borrowing costs for the fifth time on January 30.

The bullish sentiment continued in Japan, with the Nikkei 225 closing the week up 3.85 percent. Japanese markets remained buoyant despite the Bank of Japan raising interest rates by 25 basis points, reaching the highest level since 2008. Chinese equity markets also saw modest gains of 0.33%, while the Hang Seng celebrated Trump's inaction with a substantial increase of 2.46%. The Chinese central bank maintained its rates unchanged for the third consecutive month.

With the market entering the monthly expiry week and the budget at the end of the week, the chances of traders carrying forward their position are low. Markets can remain subdued during the week.

Are we close to the bottom?

The Nifty index closed lower for the third consecutive week, forming another bearish candlestick pattern. Multiple such patterns suggest a continuation of the downward trend, indicating that lower prices may be expected in the near future unless a clear signal of trend reversal emerges.

Interestingly, sentiment indicators are beginning to show oversold conditions on various fronts, leading some to believe that the worst may be over and that a recovery is overdue. This creates a conflict between the extremely negative market sentiment and the ongoing price action. The price action must confirm this extreme by turning around for a reversal to occur. As this has not yet happened, we must assume that the downward trend is still in effect, albeit potentially in its late stages. It's important to note that significant market declines can still occur even from oversold conditions.

Foreign Institutional Investors (FIIs) continued to increase their short positions during the week. The market has now reached a position near the lower red lines, which can be considered excessive. Any positive catalyst could potentially trigger a short-covering rally. However, as long as the market continues to make lower lows and lower highs, we are likely to see lower prices first. The week concluded with 309,000 contracts net short after reaching a peak of 350,000 contracts.

Source: web.strike.money

The Open Interest Put-Call Ratio (PCR) is a short-term indicator that can become oversold near market bottoms that last for several weeks. In a bullish market, prices can recover quickly from such readings. However, in a bearish market, like the one we are experiencing today, the same indicator can remain oversold and subdued for an extended period. This is the situation we are facing right now. Therefore, the PCR reading alone cannot confirm a market bottom; a price reversal is needed for confirmation.

Source: web.strike.money

Total futures open interest has continued to expand, and, in relation to the index (as shown by the green indicator below), it has reached new all-time highs. We have not yet seen capitulation because the total open interest in the futures market has not fallen below the previous low when adjusted for the index. When markets decline, they typically encourage long positions to capitulate, resulting in lower lows and lower highs in open interest data. However, since the indicator is rising, it suggests that people are actively buying the dip.

Source: web.strike.money

Sector Rotation

This week again, Nifty ended down by just 0.5%.

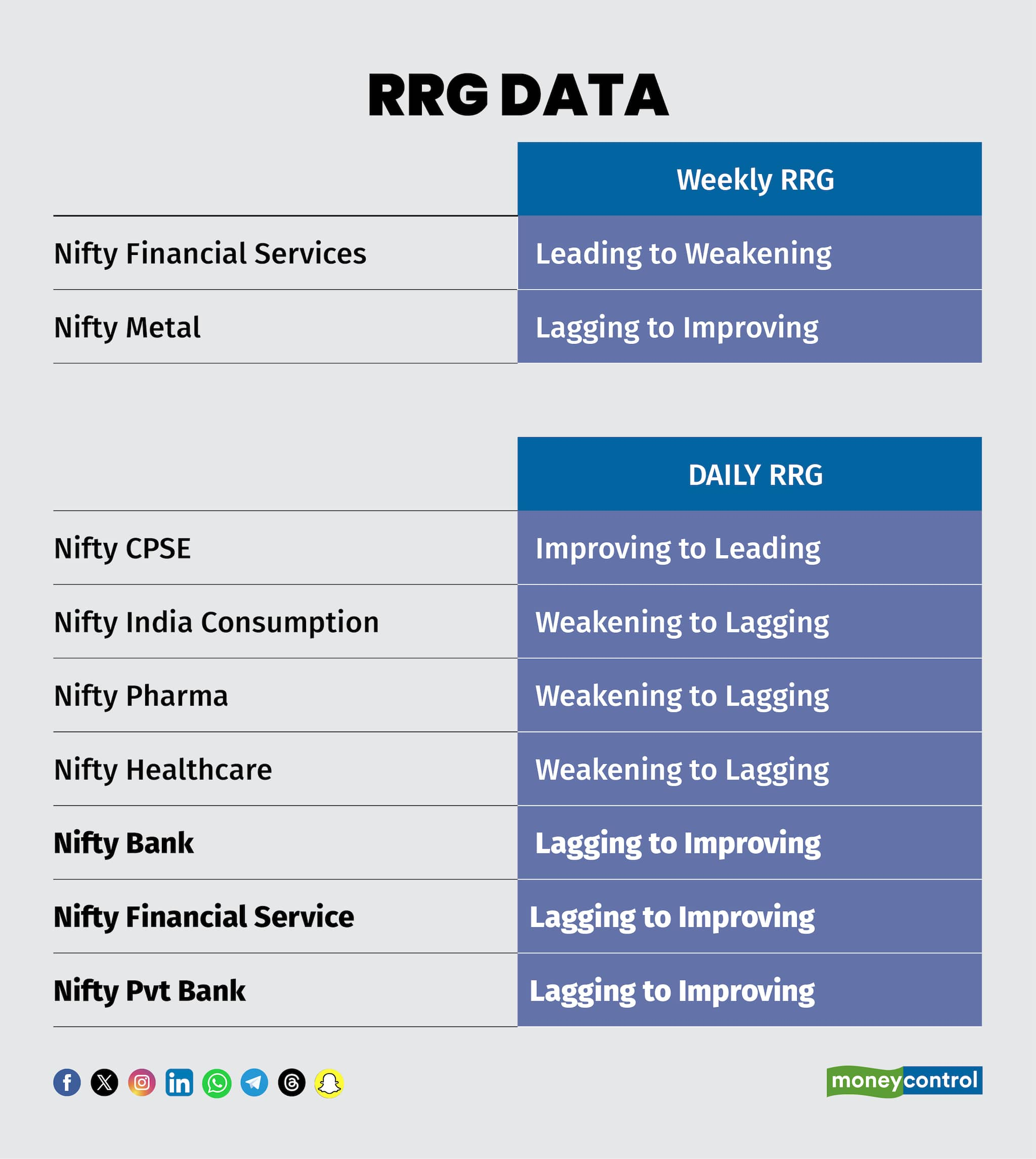

On the weekly RRG, the only index changing its quadrant is Nifty Financial Service, which moved down into Weakening from the Leading quadrant, indicating a loss in momentum. Other momentum losers on the weekly time frames are Nifty Realty, Nifty Pvt Bank, Nifty Bank & Nifty IT. All these Indices are on the Right side quadrant, indicating that, though there is a loss in momentum, they are outperforming the Benchmark.

A notable change is seen in Nifty Metal (weekly), which gained momentum and entered the Improving quadrant again from the Lagging. Other momentum gainers on the weekly chart are Nifty Oil & Gas in the Improving Quadrant, Nifty Energy, Nifty Commodities & Nifty FMCG in the Lagging Quadrant.

Source: web.strike.money

On the Daily RRG, all the banking & financial service Indices, Nifty Metal, Nifty PSE, Nifty Commodities, Nifty CPSE, Nifty Energy & Nifty Infra, all of these Indices are headed toward the Leading quadrant from the Improving, indicating a gain in momentum as well as outperforming the Nifty.

The Nifty Oil & Gas index is losing momentum and can enter the Weakening quadrant from the leading. Nifty FMCG, Nifty Auto & Nifty IT are headed towards the Lagging quadrant from the Weakening, indicating possible underperformance next week. Nifty India Consumption, Nifty Pharma & Healthcare Index, and Nifty Consumer Durables are already underperformers. Nifty Realty, in the Lagging quadrant, is far away from the rest of the indices. It is significantly underperforming the benchmark Index.

Stocks to watch

Among the stocks expected to perform better during the week are Wipro, Laurus Labs, JK Cement, Kotak Bank, Eicher Motors, Biocon, SRF, Zensar Tech, Muthoot Finance and Tech Mahindra.

Among the stocks that can witness further weakness are MRF, India Mart, PVR Inox, DLF, Hero Moto, Bata India, LIC, Tata Motors, Jio Fin, Asian Paints, Tata Chemicals and Astral.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.