Foreign investors continue to significantly influence the direction of Indian markets. During the past week, foreign institutional investors (FIIs) sold equities worth Rs 9,683.64 crore, bringing their total sales for November to Rs 29,533.17 crore. This selling pressure contributed to the Indian rupee reaching a record low of 84.41 against the US dollar.

As a result of these sales, benchmark indices experienced a decline of approximately 2.5 percent over the week. The BSE Sensex fell by 1,906.01 points, while the Nifty50 index decreased by 615.5 points, reflecting a 2.5 percent drop. The broader market was even more adversely affected; the Mid-cap Index lost 3.9 percent, and the Small-cap Index dropped by 4.6 percent.

Sector-wise, both Metals and Public Sector Banks (PSUs) suffered losses exceeding 5 percent. Additionally, indices for Fast-Moving Consumer Goods (FMCG), Healthcare, Auto, and Oil & Gas sectors all saw declines of nearly 4 percent. The only sector that showed gains during this period was Information Technology, which managed a modest increase of one percent.

Selling in the Indian markets has coincided with rising 10-year bond yields in the US, which reached a five-month high of 4.51 percent during the week.

The equity markets in the US are also beginning to feel the impact of increasing interest rates and growing uncertainty regarding potential policies from the Trump administration. Healthcare stocks have particularly suffered following the announcement of Robert F. Kennedy Jr. as the head of the Health and Human Services Department (HHS). Kennedy has been a vocal critic of the pharmaceutical industry and existing public health programs, especially vaccine initiatives.

In contrast, cryptocurrencies are one asset class that has thrived since Donald Trump's victory. Bitcoin, often seen as the flagship cryptocurrency, has surged by 32.46 percent since the day before the election.

Federal Reserve Chair Jerome Powell's statement that "the economy is not sending any signals that we need to be in a hurry to lower rates" has contributed to subdued market sentiment. Expectations for a full percentage point reduction in interest rates by the end of next year have dropped from 41.3 percent to 32.6 percent.

European markets declined for the fourth consecutive week, with the STOXX 600 closing 0.69 percent lower. Concerns regarding the protectionist policies of the Trump administration have negatively impacted market performance. France's CAC 40 fell by 0.94 percent, while Germany's DAX remained largely unchanged. Italy's FTSE MIB, however, saw a modest increase of 1.11 percent, and the UK's FTSE 100 experienced a slight decline.

In the UK, economic growth slowed unexpectedly during the September quarter, with GDP rising only 0.1 percent, down from 0.5 percent in the previous quarter.

Japan's Nikkei 225 index fell by 2.2 percent as the markets assessed the impact of Trump's tariffs on its exporters. Similar to the UK, Japan's GDP also slowed to 0.2 percent in September, down from 0.5 percent in the previous quarter. On an annualized basis, the economy grew by 0.9 percent, a decrease from 2.2 percent.

Trump's tariff policies are expected to hit China hardest, a fact reflected in the country's market performance. The Shanghai Composite Index dropped by 3.52 percent, while the heavily traded Hang Seng Index plunged by 6.28 percent. Declining property prices and an unclear stimulus policy added to the selling pressure in these markets.

Nearing extreme oversold zoneThe Nifty index closed lower for the third consecutive week, marking its longest losing streak in over a year, as most corrections typically last only 1 to 2 weeks. However, this extended decline was primarily limited to the Nifty, while other indices, such as the Bank Nifty, ended the week in positive territory.

Overall, the strength of the broader market suggests a bullish outlook despite the weakness observed in the Nifty. Additionally, oversold conditions have intensified, with the Nifty Put-Call Ratio (PCR) at 0.65, its lowest level since it reached 0.60 in June 2022.

Interestingly, our daily swing short-term sentiment indicator did not register a lower low even as the Nifty closed lower on daily charts, resulting in a positive divergence in the indicator over the past ten days. The Relative Strength Index (RSI) also presents a similar positive divergence.

Source: web.strike.money

The overall market's Put/Call ratio, based on a 9-day moving average, has remained in oversold territory for some time. These readings suggest that the market is bottoming out rather than experiencing a free fall.

Source: web.strike.money

Client positioning in the index futures segment indicates increased long positions at lower levels. The net position is long and above the red line, typically representing market bottoms where buyers enter in substantial quantities. Clients, as a category, tend to hold significant long positions during most market lows, contrasting sharply with Foreign Institutional Investors (FIIs), who are currently holding short positions.

Source: web.strike.money

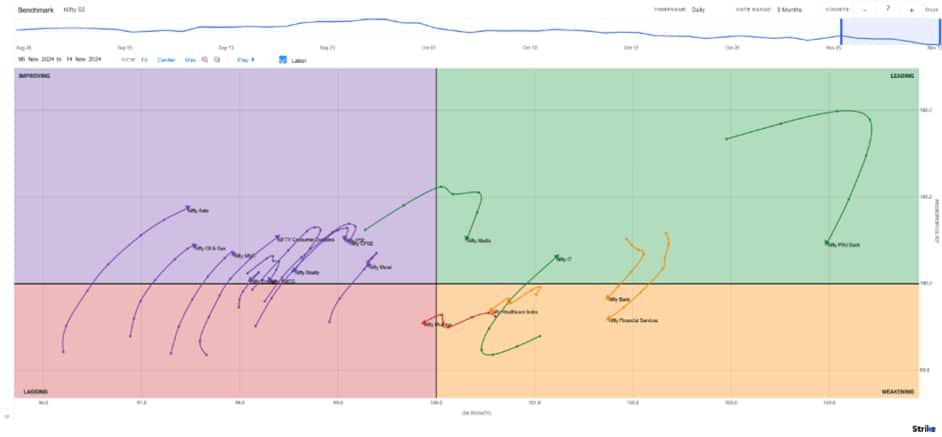

Sector RotationThe Weekly Relative Rotation Graph (RRG) from India Charts shows no major changes except that Nifty Financial Services is placed well in the leading quadrant.

Weekly RRG

Source: web.strike.money

On the daily RRG, all indices except Nifty IT closed lower. Nifty Bank, Financial Services and PSU Banks saw a dip in relative momentum, while Nifty Pharma slipped into the lagging quadrant due to a loss of relative strength.

Nifty IT has made a strong comeback into the leading quadrant with a rise in the relative momentum. Rest of the indices are trying to gain momentum but still lack in terms of the relative strength.

Daily RRG

Source: web.strike.money

Stocks to watchAmong the stocks expected to perform better during the week are Indian Hotels, Coforge, Persistent, Wipro, Tech Mahindra, Eicher Motors and Coromandel.

Among the stocks that can witness further weakness are Astral, Asian Paint, Bandhan Bank, India Mart, Tata Consumer, Shree Cements, Aarti Industries, Bata India, and AU Bank.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.