Dear Reader,

The Indian stock market faced a challenging week, marking its sixth consecutive decline as foreign institutional investors (FIIs) continued to offload their holdings following the imposition of a 25 percent tariff and the threat of another 25 percent on account of punitive tariffs by President Donald Trump. This external pressure contributed to the depreciation of the Indian rupee, which fell by 1.2 percent against the US Dollar closing the week at 87.58.

As if the tariffs weren't enough, several broking firms issued downgrades that further compounded the market's woes. On top of this, the Reserve Bank of India's slightly hawkish stance on inflation added another layer of concern for investors. By the week's end, the benchmark Nifty 50 index had dropped by 0.82 percent, while the midcap index fell by 1.14 percent and the smallcap index saw a decline of 1.91 percent. In total, FIIs sold around Rs 12,000 crore worth of stocks in the cash market over the week.

Sector-wise, the IT sector faced significant losses, plummeting by approximately 7.00 percent. The realty sector also struggled, recording a 2.50 percent decline, while pharmaceuticals fell by 2.80 percent. In contrast, metal stocks were the standout performers, rallying by about 5.0 percent over the same period.

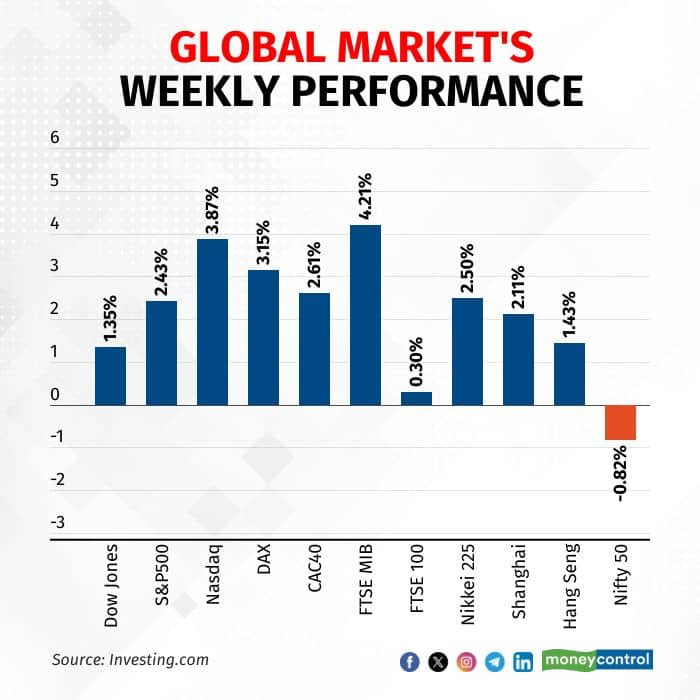

This tumultuous environment is not limited to Indian markets; global markets are similarly grappling with the repercussions of Trump's tariffs and the prevailing uncertainties. However, as the data reveals, the impact of these developments was particularly hurtful to Indian markets last week.

On Friday, US stocks rallied, wrapping up a week of gains fuelled by encouraging technology earnings and indications of a more dovish stance from the Federal Reserve. The Nasdaq Composite surged by 0.8%, achieving a remarkable all-time high—the 18th record close this year—propelled by strong performances from major technology companies.

Contributing to the upward momentum in the US market was the growing expectation that the Federal Reserve might lower interest rates in September. Throughout the week, several Fed officials hinted that rate cuts could be imminent, boosting investor confidence.

In contrast, Indian markets struggled compared to their global counterparts. Downgrades following recent US tariffs hit hard, and lacklustre quarterly results from Indian corporations further dampened market sentiment. Any weakening in the global markets can push the Indian market lower.

Pessimism Looms

The Nifty index has experienced a concerning trend, posting six consecutive negative weekly closes. This streak is significant, as we haven't witnessed such a downturn since the lows reached during the COVID crisis. While a pullback seems inevitable at some point, the critical support zone between 24450 and 24500 has been decisively breached, allowing bears to take control of the situation.

For a reversal of this bearish trend to occur, the index must close above 25000. Until that happens, the bears will likely maintain their dominance, making pullbacks susceptible to selling pressure.

The recent closing below the 24450 level has shifted the trend from bullish to bearish. Consequently, any hopes for an immediate turnaround in the Nifty index from the initial down line of the 20-day A/D ratio are now unrealistic. In a downtrend, this indicator could drop to the second down line, potentially forming a positive divergence before making a meaningful comeback in the short term.

This suggests that the overall market breadth may deteriorate in the near future. Even if a bounce occurs, it is likely to be met with selling pressure unless we observe a significant divergence in the 20-day A/D ratio. With a close below 24450, the downside potential has increased, possibly reaching levels as low as 24000 - 24150 in the upcoming trading sessions.

Source: web.strike.money

The percentage of stocks above the 100 SMA for the Nifty index has been declining over the past few weeks. Breaking below the important support zone of 24450 levels opens up a risk of a further correction. This can lead to the percentage of stocks above the 100 SMA indicator drifting lower to 20 or 10 levels before forming a durable bottom. The current reading is at 40.

Source: web.strike.money

FIIs currently hold a significant position in the market, effectively guiding its direction. Since July 2025, they have been steadily increasing their short positions in index futures, which has coincided with a continuous decline in the Nifty index. The recent breach of a critical support zone, identified as 24450, has likely emboldened them to maintain their bearish stance.

As long as the FIIs continue to hold these short positions without signs of covering, the market is likely to remain under considerable pressure. Back in February 2025, FIIs recorded an unprecedented net short position of -200,890 contracts. Currently, the net short position stands at -182,670 contracts, raising concerns that it could either return to February's low or dip even lower.

Given this scenario, it is essential to closely monitor the FIIs' positioning. A hint of short covering by these investors could signal a potential market turnaround. However, until such signs emerge, attempting to predict a market bottom may prove unwise, especially with the Nifty index having already broken through the crucial support level of 24450.

Source: web.strike.money

Sector Rotation

Nifty 50 – The Benchmark Index ended lower by -0.82% this week and closed at 24363.

Sectors that changed Quadrants on the Weekly RRG

Weakening Quadrant: After showing some sign of improvement in the momentum last week, the Nifty Bank and Nifty Financial Services were hinting towards potential outperformance if this trend were to continue. However, this week the momentum and relative strength have sharply deteriorated. Nifty Oil & Gas has also moved to the weakening quadrant from the leading quadrant due to deteriorating momentum and relative strength.

Lagging Quadrant: Nifty FMCG is the only Nifty index in the lagging quadrant, but it is continuously seeing improvement in momentum as well as relative strength. If this trend continues, it may move towards an improving quadrant in the forthcoming weeks.

Improving Quadrant: Nifty Pharma and Nifty Consumer Durable continue to gain momentum and relative strength. The Nifty IT index’s relative strength is improving, but the momentum continues to weaken, which is not a good sign.

Leading Quadrant: Many nifty indices like Nifty Media, Nifty Realty, Nifty Metal, Nifty Energy, Nifty PSE, Nifty Infrastructure and Nifty PSU banks have seen deterioration in momentum as well as relative strength. Nifty MNC and Nifty Auto have seen some improvement in relative strength, but the momentum is declining, which is not a good sign. We can expect some weakness in these indices if the momentum continues to weaken.

Sectors that changed Quadrants on the Daily RRG

Weakening Quadrant: Many indices, such as Nifty Bank, Nifty Financial Services, Nifty Metal, Nifty Consumer Durable, and Nifty Pharma, are losing momentum and relative strength. Nifty Auto went to the leading quadrant but is back in the weakening quadrant. Nifty MNC is the only index in the weakening quadrant where we are seeing some improvement in the momentum. If we see this trend continuing in Nifty MNC, then we can expect some outperformance from this index in the near term.

Lagging Quadrant: Only the Nifty Realty is the index that is witnessing a loss of momentum as well as relative strength, and there are no signs of turnaround yet, indicating that the underperformance is likely to continue in the near term. However, other nifty indices like Nifty IT, Nifty Media, Nifty Oil and Gas, Nifty PSE, Nifty Energy, Nifty PSU Bank and Nifty Infrastructure are seeing improvement in momentum. Nifty infrastructure and Nifty IT are very close to the improving quadrant, and in the coming week, they can enter the improving quadrant.

Improving Quadrant: There are no indices in the improving quadrant.

Leading Quadrant: The Nifty FMCG is the only index that is in the leading quadrant. It entered the leading quadrant from the weakening quadrant on Friday due to improving momentum and relative strength. This index can be a relative outperformer in the forthcoming trading sessions.

Stocks to watch

Among the stocks expected to perform better during the week are TVS Motor, Delhivery, JSW Steel, HDFC AMC, Indian Bank, AB Capital, Fortis, Indigo and M&M.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.