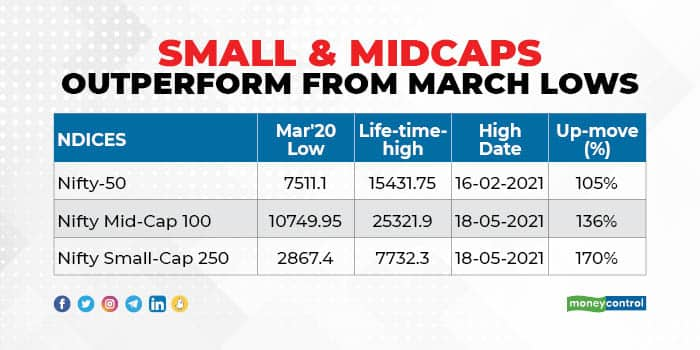

Mid-and-smallcap indices hit fresh all-time highs ahead of the benchmark index on Tuesday. The Nifty50 is still 2 percent shy of hitting fresh highs above their 15,431 it had recorded in February 2021.

The Nifty Midcap 100 index has rallied 136 percent and the Nifty Smallcap 250 has gained 170 percent from respective March 2020 lows compared to a little over 100 percent jump seen in Nifty50.

Many stocks in the small & midcap space have thus given multibagger returns in the same period. One reason for the sharp rise has been that these stocks had largely underperformed over the previous couple of years. The Nifty Midcap 100 index fell over 15 percent in 2018, and over 4 percent in 2019.

Strong growth prospects, a growing risk appetite among investors, and cheaper valuations compared to large-cap peers have also revived the allure of these stocks.

The Nifty Midcap100’s Forward price-earnings (P/E) multiple at 18.1 times is at a 10 percent discount to largecaps. It is also below its historical average, according to a Motilal Oswal report.

How to pick stocks in this space?

Experts see value in those small & midcaps that have a niche business model and are technology-enabled. Stocks in sectors like pharma, telecom, packaged foods, digital, etc. would make the cut.

“The headline valuations for Nifty Midcap 100 suggest that we are in an acceptable zone which can act as a platform for the broader markets to do better from here on,” Rahul Singh, CIO-Equities of Tata Mutual Fund said in a note.

“Midcaps with market leadership and low leverage can be equally attractive investment option compared to any large-cap. Sector performance has so far been led by large caps, but gradually within sectors mid-caps and small caps are emerging as top performers,” he said.

Singh further added that there are opportunities in sectors with post-Covid tailwinds such as pharma, digitization, e-commerce and electronic manufacturing. Some of these sectors are even dominated by midcaps.

What’s the technical view?

Jatin Gohil, a technical analyst at Reliance Securities helped us plot the journey of small & midcaps from March 2020 to May 2021 and had this to say:

From July 2020 mid-Cap and small-cap indices gradually started outperforming the benchmark Nifty.

The Nifty saw a 8.3 percent decline (from 15,431.75 to 14,151.40) after recording a new high, while the mid-cap and small-cap indices continued to maintain their rising trend and kept exploring uncharted territory.

An exponential rise across oil and gas, metal, NBFCs, and chemical & fertilizers sectors supported the rise in mid and small-caps.

The bullish continuation pattern and positively poised technical indicators signal that this rising trend will continue.

This could take the Nifty Mid-Cap 100 index towards 26,000 and the Nifty Small-Cap 250 index towards 8,000, in the next couple of weeks. We believe auto ancillary, electric utilities, packaging, and the transportation space will remain in focus.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!