At a time when equities globally are facing a lot of headwinds due to a combination of global and domestic factors, majority of experts in India believe that the biggest risk facing the Indian stock market is earnings downgrade, followed by huge outflows by foreign institutional investors (FIIs), as per the findings of the latest Moneycontrol Market Poll.

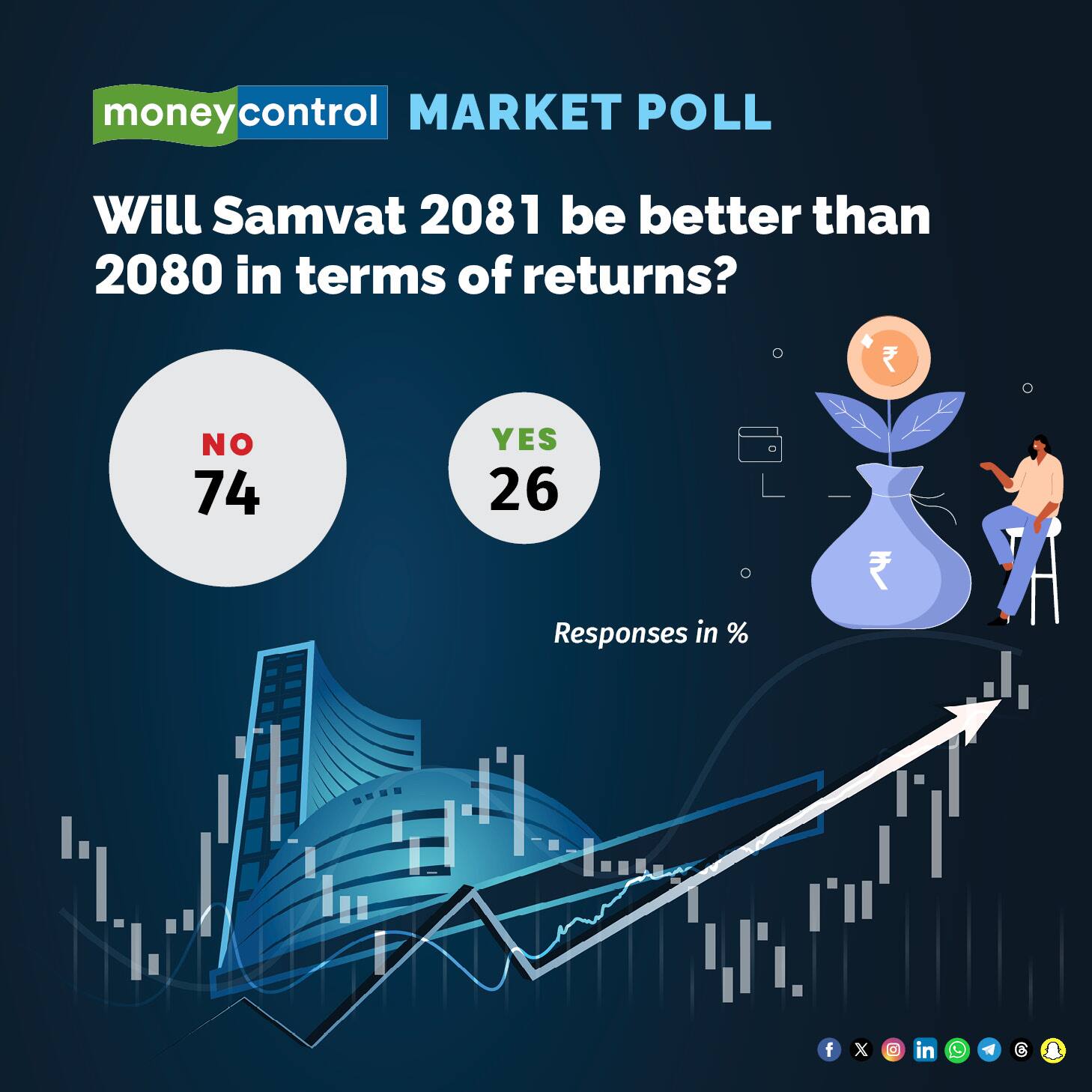

Further, a majority of experts also feel that the coming Samvat 2081 would be rather subdued when compared with the current Samvat’s returns of around 25 percent though they are optimistic in terms of the market movement in the remaining two months of the current calendar year – majority believe that the benchmark Nifty50 will end CY24 between 23000 and 25000 with some even expecting it to end between 25000 and 27000.

Simply put, a vast majority – a high 74 percent -- believes that the Nifty will end CY24 higher than the current levels – Nifty is currently trading around 24,339 levels.

The Moneycontrol Market Poll reached out to market participants across categories – broking firms, mutual funds, AIF/PMS players and independent analysts – and received nearly two dozen responses.

In terms of the key risks, an overwhelming 74 percent of the respondents said that they feel that earnings downgrade is the biggest risk for the Indian stock markets, followed by 22 percent of respondents who felt FII outflows are the biggest risk.

Interestingly, global factors like the ongoing Middle East tensions and the China stimulus factor do not feature high on the list of key risks amongst Indian experts. While a paltry four percent of respondents said that Middle East tensions could be the key risk, none felt that the China factor would play a role in the Indian stock markets.

In fact, when separately asked if the ‘Sell India, Buy China’ is a concern for the Indian markets, a vast majority – 74 percent – answered in the negative.

.

.

On a different note, when asked about their outlook in terms of the relative performance of benchmarks (Sensex and Nifty) and the broader indices (BSE MidCap or BSE SmallCap etc), a significant majority of 78 percent said that they believe that benchmarks would perform better than the broader indices in Samvat 2081.

This assumes significance as the current calendar year has seen the Sensex and Nifty gaining 10.8 percent and 12 percent, respectively, while the BSE MidCap and BSE SmallCap indices have gained around 24 percent.

Similarly, the majority of the experts who participated in the MC Market Poll also said that they would advise investors to stick to large-caps with attractive valuations rather than bet on small-caps showing quick return potential. Around 57 percent of the respondents advised large caps with attractive valuations.

However, a slight majority of experts – 44 percent -- are currently neutral in terms of their near-term outlook on the Indian stock markets with 39 percent saying they are bullish. Only 17 percent of the respondents said that their near-terms outlook is bearish.

Interestingly, this even as 52 percent of the respondents said they view the current valuations of the Indian stock market as ‘expensive’ with another 48 percent saying it is ‘reasonable. None of the experts believe that the current valuations are ‘cheap’.

Meanwhile, even amidst the heightened volatility, a strong majority of experts believe that there will be no slowdown in the inflows coming through systematic investment plans (SIPs), which have been setting new records almost every month. A little over Rs 24,500 crore came through SIP flows in September, as per data from the Association of Mutual Funds in India (AMFI).

A high 65 percent of the respondents also said that they do not expect any kind of slowdown in terms of buying from domestic institutional investors (DIIs) who have invested more than Rs 4 lakh crore in the stock market this year, setting an annual record with two months to spare.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.