“Main uthega nahi,” declared a widely shared meme on Zomato in 2022, borrowing a scene from the blockbuster Pushpa.

There were several others. Last year was hard for the stock. Thankfully, 2023 has started on a better note. The December-quarter numbers were better than analyst expectations, demonstrating the company’s intention to move towards profitability.

The question now is how quickly can it rebuild its business to meet two competing demands--start generating profits while meeting investors’ growth expectations.

First, let’s take a closer look at the last quarter’s numbers.

Zomato's consolidated net loss for the third quarter of FY23 widened to Rs 347 crore from Rs 63 crore in the same quarter of the previous year. Adjusted Earnings Before Interest Tax, Depreciation and Amortisation (EBITDA) loss increased 38 percent sequentially to Rs 265 crore but narrowed by 3 percent from the year-ago quarter.

“You can make all kinds of adjustments, but ultimately markets look at consolidated numbers,” says Amit Jeswani, Founder, Stallion Asset. “If anything, the Blinkit acquisition has delayed the road to profitability considerably.” Zomato acquired the quick-commerce start-up Blinkit in August 2022.

Blinkit, which earns from commissions taken from local shop owners and merchants Zomato has tied up with, and from a delivery fee charged from customers if the order amount is below a minimum purchase floor—is today one of Zomato’s major offerings.

The other major offering is Hyperpure, which supplies everything from meat and seafood to fruits and vegetables to restaurants.

The company’s original proposition—of food delivery—remains the highest contributor to revenue. This vertical generates revenue through commissions from restaurant partners using the platform and from restaurants advertising on the platform.

Besides, Zomato also has a minor dining-out segment across India and the United Arab Emirates, which can tell a user where to get the best Belgian beer or go for a chaat fix even in Dubai Festival City, and which is monetised through advertisements that restaurant partners pay for better visibility.

The positive surprise in Zomato’s December-quarter numbers came from the food-delivery business in the form of rising profitability. The negative came from Blinkit, which earned the company losses in the first full quarter after its acquisition.

Excluding the quick-commerce business, which is expected to continue to bleed, the management is confident about reaching adjusted EBITDA break-even for the food-delivery business by the second quarter of FY24.

This confidence found favour with investors and, after the results announcement in February, the stock moved up by 10 percent over the next few days. But the buoyancy didn’t last.

Now, how does the arithmetic look piece-by-piece for Zomato?

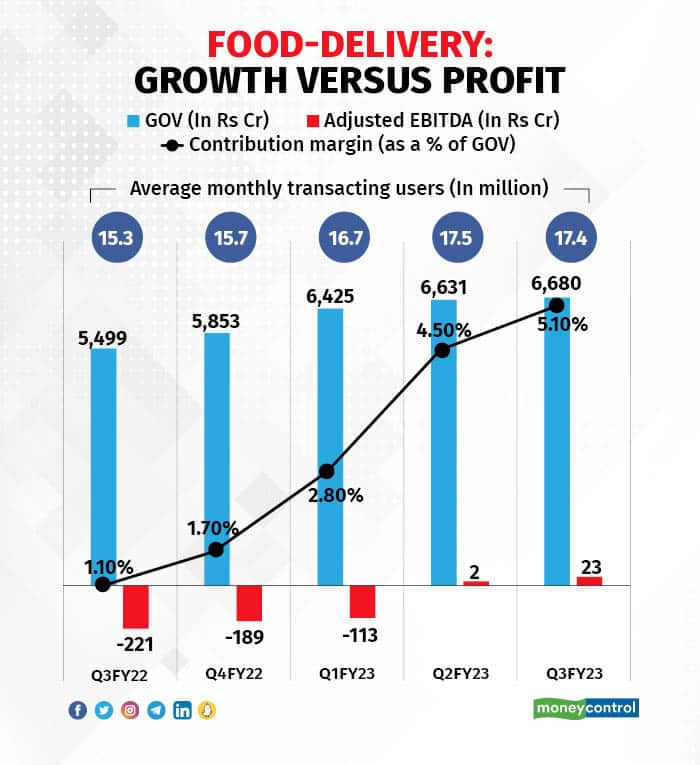

Food-delivery —what about growth?The food-delivery business, which is the company’s mainstay, is clearly showing improving profitability from Q3FY23. Contribution, which refers to the additional revenue generated by selling each additional unit after the company achieved break-even, is on the rise. This segment’s adjusted EBITDA also grew significantly from Rs 2 crore in the second quarter of FY23 to Rs 23 crore in the third.

“Improvement in profitability was driven by optimisation of cost, shutdown in non-performing markets and employee layoffs,” noted JPMorgan in its report.

The flip side: there are concerns about growth. Last quarter, adjusted revenue as well as order volumes declined, while gross order value (GOV) and average monthly transacting customers remained flat, sequentially.

The management attributed the numbers to an industry-wide slowdown in the food delivery business since late October after Diwali.

In its quarterly note, it said, “We believe that the long-term opportunity remains large and exciting. We think that the current slowdown is a result of a few temporary factors – a) macro slowdown for the mid-market segment, b) boom in dining out for the premium-end, and c) boom in travel at the premium-end.”

But was there more?

Does this slowdown hint at a permanent reset to lower growth rates, or is it an inevitable outcome of a deliberate attempt by the management to steer its business towards profitability?

It’s hard to say if the recent moderation in the topline is an “aberration”, as the management put it, or if the growth that preceded was unsustainable.

Analysts attribute the decline to Zomato’s decision to exit the loyalty programme and push ahead with delivery charges. Amit Khurana, Head of Research, Dolat Capital calls it a “blunder”.

“You can’t expect customers to suddenly pay Rs 40 delivery charge on a Rs 300 order, especially since it costs nothing for customers to switch to Swiggy,” he says.

Jeswani says push-back from the customers is inevitable. “Profitability will come at the cost of growth,” he adds. But it’s not a bad strategy. “You have to survive the next 10 months and 10 quarters before you ride growth over next 10 years,” says Khurana. “It’s thus better to focus on just top cities, grab market-share and build customer stickiness.”

If the last quarter’s trend continues, there will be multiple reasons to question stock valuations; mainly, what is the right point of trade-off. “Profitability is necessary, but 1 percent growth? Who would want to buy Zomato if the growth is in single digits?” asks Jeswani. “If you are paying a high price, you want to see high growth.”

Besides, with the cut-back from new markets, the math around the scaling-up, and the huge total addressable market around which the valuation thesis has been built also got to be scaled down.

“We believe cut back on growth to focus on profit would better short-term profitability, but impact both scalability and long-term profitability,” said Khurana.

Quick-commerce, a game of lossesStill, food delivery is the best of Zomato’s businesses. The business that is more difficult to digest (read turn profitable) is its quick-commerce business Blinkit, which Zomato bought amid much controversy over the valuation and the fact that the management did not disclose that the business had been co-founded by Albinder Dhindsa, who is married to Zomato’s co-founder and chief people officer Akriti Chopra.

“The management wants to invest big time in Blinkit, which is not an easy business to carry. It’s cash-guzzling. There is a real concern on Zomato’s capital-allocation decision,” says Khurana.

Blinkit operates through a network of warehouses and dark stores, which store inventory, and is owned by a third-party distributor or retailer. A dark store or a small-scale fulfilment centre is a retail warehouse serving a small area and caters to people shopping online. After an online order is placed, a Blinkit application connects it to the dark store where the employees then pack and ship the order. The company currently has over 400 dark stores.

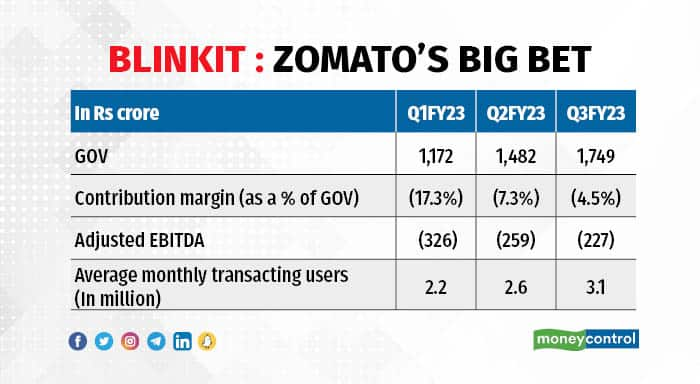

Last quarter, Blinkit managed a sturdy growth in GOV to Rs 1,749 crore, thanks to a 21 percent sequential growth in order volume, though average order value (AOV) declined. Average monthly transacting customers increased 19 percent, and revenue growth was robust at 28 percent.

This despite the company operating fewer dark stores (the company said this was because of lease expiries), which helped cut loss margin – contribution margin stood at -4.5 percent compared with -7.3 percent in the September quarter. But considering the robust growth, in absolute terms, Blinkit reported an adjusted EBITDA loss of Rs 227 crore for its first full quarter in December compared to Rs 132 crore in the September quarter.

The management talked about revenue potential in Blinkit through advertising, which is a positive, but analysts still feel there is a need for a far more credible path to profitability. “Small ticket deliveries will require massive volumes which is where Blinkit is a lot more challenging business than food delivery,” says Khurana.

Over the next 12 months, the company plans to expand its dark-store count by 30-40 percent. This, if accompanied by a fall in AOV, won’t add up to better profitability.

“Path to profitability requires right functioning of multiple moving parts, as this is a relatively niche retail business with low AOV and facing rising inflationary pressure. Both AOV as well as volumes need to grow to better profitability,” wrote analysts at Dolat Capital in a recent report.

The challenge here is not market potential. “Quick-commerce market is huge but the problem here is the competition. Zomato is one among the five players here with no real advantage – at least it is not clear yet,” says Jeswani.

“There are big players with deep pockets and natural synergies competing in this space,” seconds Khurana. There are at least four players as of now: Big Basket, Zepto, Swiggy’s Instamart and Blinkit. “But how do you become profitable and at what cost? Ultimately, there will be consolidation,” says Jeswani.

The question then is who is better placed to win? This is where there is a lot of ambiguity about whether Zomato has the right to win here. “What are the synergies between food-delivery and grocery is really not clear,” says Jeswani. “Big Basket now has Big Basket daily. Given the kind of backward integration they have by now, they are not going to be easy to beat,” says Khurana.

Delivery on track, but value for money?Apart from business concerns what has kept the stock under check is the large sell-off by pre-IPO investors. Info Edge, Antfin, Alipay, and Uber include some of the early investors in the company, while pre-IPO anchor investors who subscribed to 44 percent of the total IPO size included Tiger Global, Fidelity, Blackrock, JPMorgan among others.

Following the end of the lock-in period in July 2022, investors such as Moore Strategic Ventures and Uber made a complete exit, while Sequoia, Tiger Global and Alipay reduced their stakes in the company. Considering the stock price is still 35 percent down from the IPO price, there is likely to be selling pressure at every step of the way.

Coming back to business, Zomato seems to be treading on the path it had laid out for itself. But the intention to get to profitability is one thing and getting there is quite another. “You cannot think or evaluate these stocks beyond the next four quarters because the market dynamic keeps evolving. Even that’s a big ask,” says Khurana.

Unfortunately, that is not what stock valuations suggest. Despite a steep cut since listing, the market capitalisation is Rs 43,000 crore, which means markets are counting on profits “at some point” in the future.

The problem for now though is, with no earnings to show, Zomato is still far from being evaluated on traditional investment metrics such as a price-to earnings multiple. Yet, Zomato has 19 buy, three hold and three sell ratings compared to a year ago, when it had 16 buy, two hold and one sell rating, according to Bloomberg Data.

Analyst recommendations have hardly changed in the past year. And the common method analysts use to value the stock is discounted cash flow. Analysts at HSBC Global Research have valued Zomato at Rs 87 assuming a revenue growth of 11 percent for 15 years (FY21-35), an average EBITDA margin of 7.5 percent during the period, and a 6 percent terminal growth rate.

Not just HSBC, analysts are overwhelmingly bullish on the stock. Therein lies the dichotomy: while there is still haziness around sustainable growth and the evolving competitive landscape, analysts are merrily valuing the company based on high growth projections over long periods. It should be clear to investors that be it 12 months or the long term, stocks are not duty-bound to deliver returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.