Share buybacks don't always add to the earnings of investors, wrote Michael Mauboussin, in response to an article by the Wall Street Journal.

The article had said that investors like buybacks because they lower the number of shares outstanding and boost the company's per-share earnings.

But Mauboussin, the head of Consilient Research at Counterpoint Global of Morgan Stanley Investment Management and adjunct professor of finance at Columbia Business School, pointed out that there is more to it.

Also read: Want to chat with the famed finance guru Michael Mauboussin? Here's how

He wrote that buybacks' impact on earnings per share (EPS) will depend on the relationship between company's after-tax interest rate and earnings yield.

The after-tax interest rate is either on interest income from cash or interest expense from debt. Earnings yield is EPS divided by price, which is the reciprocal of the P/E multiple.

He wrote, "Buybacks don't always add to the EPS. When interest rate<yield, they add to EPS. When interest rate>yield, they don't."

He also quoted from a paper titled "Stock Repurchases and the EPS Enhancement Fallacy" by Jacob Oded of Tel Aviv University's Coller School of Management and Allen Michel of Boston University's Questrom School of Business.

The paper's authors stated, "A common belief among practitioners and academics is that the increased EPS associated with a stock repurchase creates value for a firm's shareholders. This belief is flawed."

Let's look at the arguments in more detail.

The example of three companies

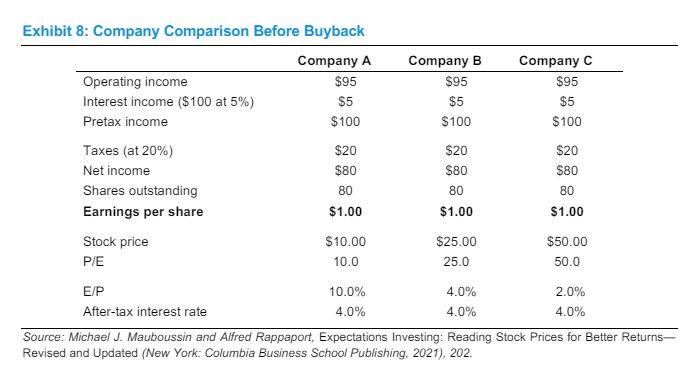

In Morgan Stanley's Counterpoints Global Insights dated February 28, 2024, Mauboussin elaborates on this with examples of three companies.

Also read: Michael Mauboussin believes this simple, fair-value calculation method deserves a book

They are assumed to have the same earnings but trade at different P/E multiples. They are assumed to have operating income of $95, $5 of interest income on $100 of excess cash (that is earning 5 percent from the cash), pay taxes at 20 percent rate and have 80 shares outstanding.

Each are assumed to earn $80 and therefore have an EPS of $1. Their after-tax interest rate comes to 4 percent.

Formula for calculating after tax-rate rate: Interest rate earned from excess cash (1-Tax rate) that is 0.05 * (1-0.20).

Earnings yield is inverse of P/E, therefore Company A's earnings yield is 10 percent (or $1/$10*100); Company B's is 4 ($1/$25*100); and Company C's is 2 ($1/$50*100).

Then the paper shows how the buyback affects the EPS of each of these companies.

Company C, which has earnings yield that is much lower than the after-tax interest rate the company can earn from its excess cash, is shown to have lower EPS after the buyback. Company B, which has earnings yield equal to the interest rate, shows no change in EPS; and Company A, which has earnings yield that is higher than after-tax interest rates, has higher EPS.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.