The Finance Minister Nirmala Sitharaman recently called a meeting with public-sector lenders, urging them to boost deposit growth. With banking deposit growth slowing and credit offtake on the rise, there's trouble brewing, no doubt.

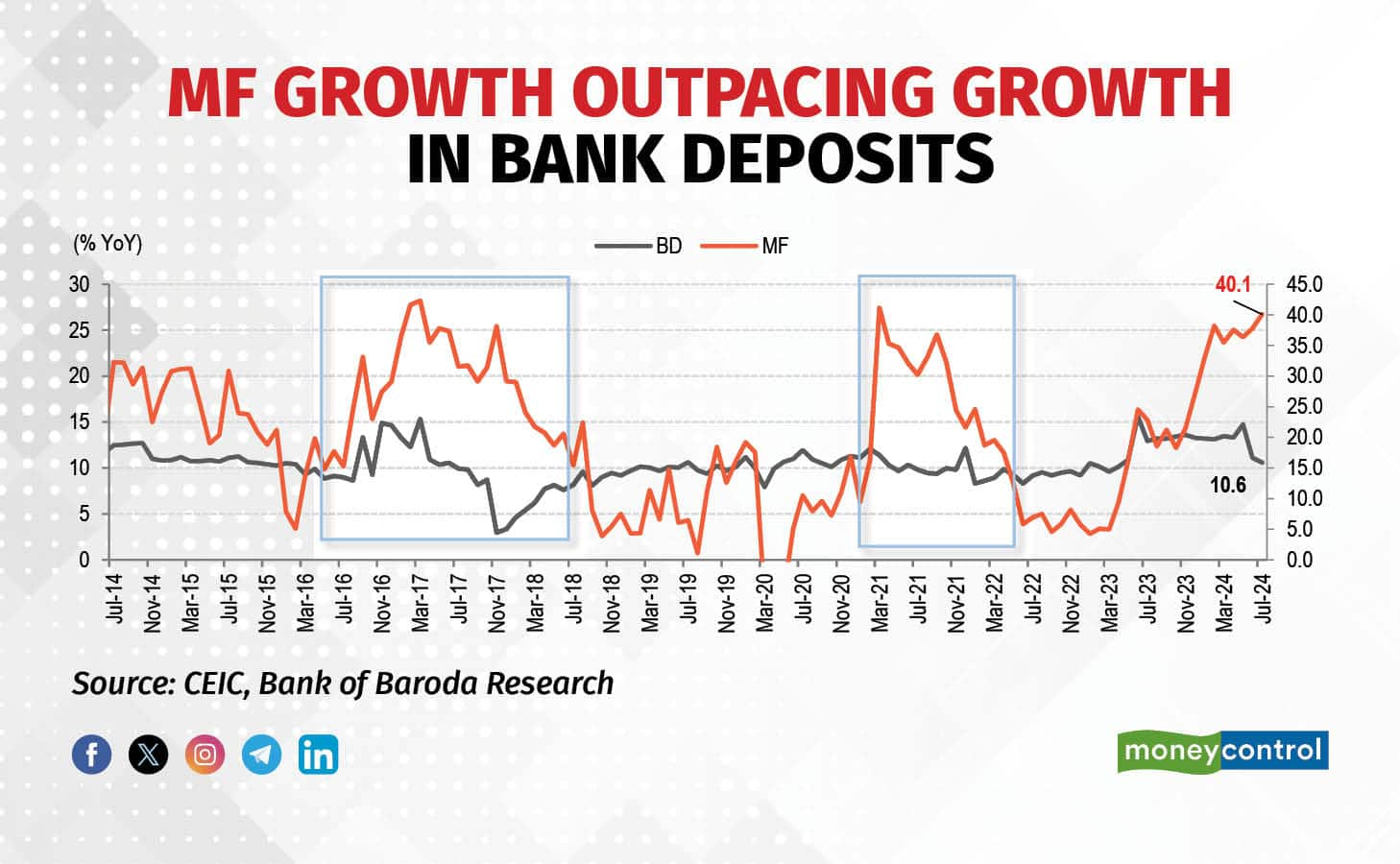

Over the past few months, deposit growth has lagged credit growth by 3-4 percentage points. According to the latest RBI data, as of July 26, bank loans surged 13.7% year-on-year, while deposits only grew by 10.6%. If this mismatch continues, the banking system could face a serious liquidity crunch.

In the blame game of financial crises, guess who's the fall guy this time? Equities. But as usual, while equities is the fall guy, the real villain remains unidentified.

Let’s lay out the facts first. Households are shifting their savings from traditional bank deposits and fixed deposits to higher-yield equity instruments like mutual funds or direct stock investments. RBI Governor Shaktikanta Das pointed to the markets, acknowledging that young Indians are increasingly attracted to equities—a natural, albeit concerning, shift.

"This is the consequence of the larger shift in the behaviour of people, particularly the younger generation, from savers to investors. That’s why the RBI is concerned," explained V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

But are equities really the villain here? Are savings being swapped for investments?

The numbers game: savings vs investmentsLet’s dive into the data. In FY24, the ratio of mutual funds’ AUM to GDP hit a record 18.1%.

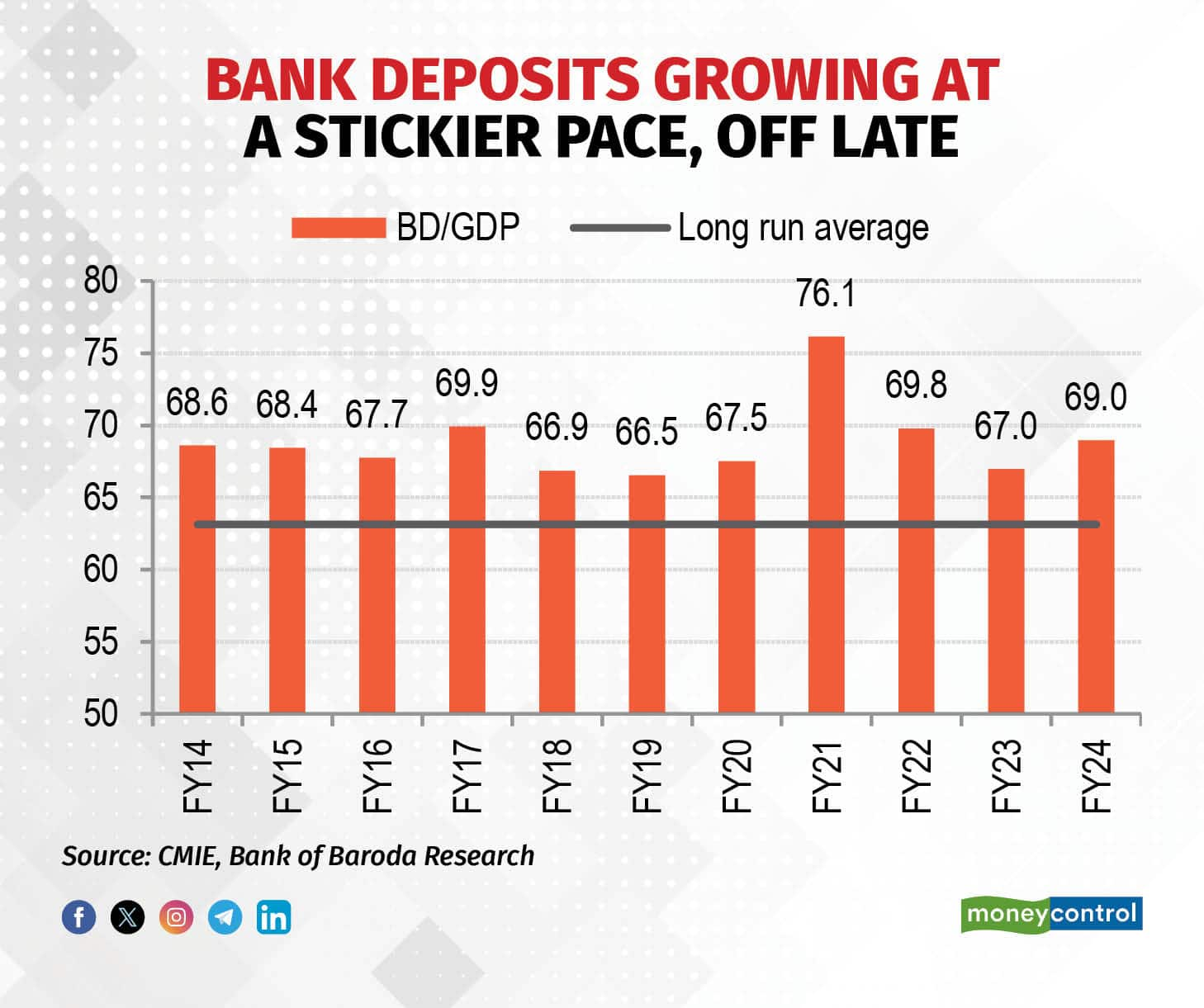

Meanwhile, the bank deposits-to-GDP ratio dropped to 69% from 76.1% in FY21.

In FY22, households clearly favoured mutual funds over deposits, with the share of deposits in gross financial savings dropping to 29.4% from the long-term average of 33%. On the flip side, mutual funds’ share spiked to 6% from the usual 2%.

According to Bank of Baroda economist Dipanwita Mazumdar, "The quantum of the two may not be comparable, but it cannot be denied that some rejigging is happening." The market is buzzing with a growing risk appetite as equities rally and savings become more financialised.

Also Read | Key chemical stocks upbeat on likely anti-dumping duty on a Chinese solvent

What goes around, comes aroundWhen you buy stocks, your brokerage pulls funds from your bank account. Simple, right? But here’s where it gets interesting: after you buy shares, the money doesn't just vanish into thin air—it lands in the seller's bank account. Even with mutual funds, when a fund buys shares, the seller (whether a person or a company) gets the proceeds in their bank account. So, while funds might shift, the overall deposit levels shouldn’t drop—they’re just moving around.

When the seller of a share decides to offload his holdings, once brokerage charges are deducted, the money is deposited into a bank account. Even when you invest money through a mutual fund, the MF might purchase shares from a seller or the company. Once again, the seller, either a person or a company, will receive the proceeds in their account.

To explain further, Nuvama Institutional Equities posited that if the company chooses to spend that money on buying equipment or paying salaries, accordingly, money would be debited from the company’s account and credited to the beneficiary’s account. Thus, Bank of Baroda argued that “deposits can never go down, as any shift will only mean change in nomenclature of deposits in terms of ownership.”

A look at the long-term trends further reinforces the fact that mutual funds are not the villain. Sure, mutual funds are growing faster than bank deposits—CAGR of 20.5% over the past decade, compared to 10.3% for deposits.

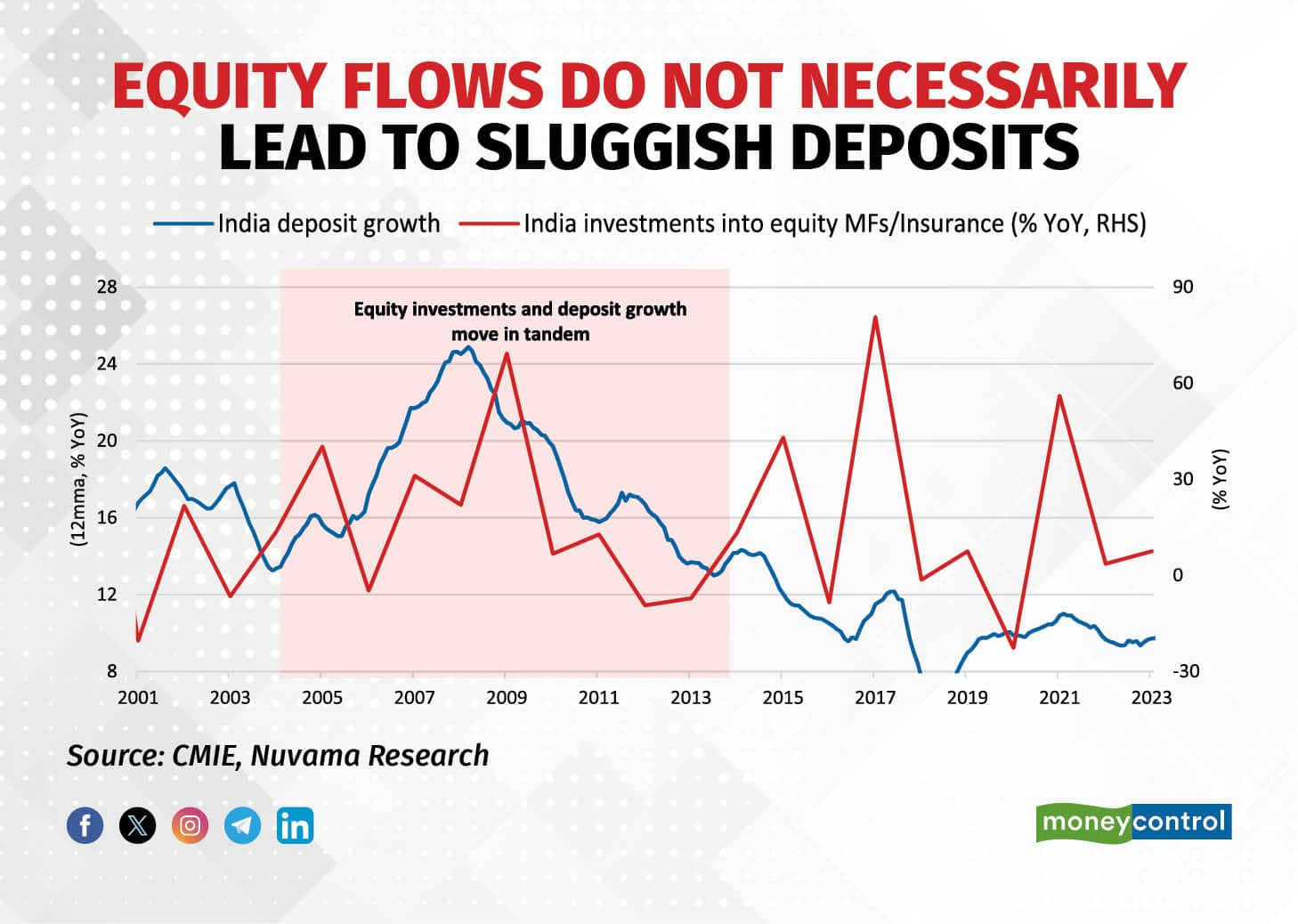

But during the 2000s, strong equity and insurance flows didn’t hurt deposit growth; both grew in tandem. From 2010-2014, as equity flows slowed, so did deposit growth.

But during the 2000s, strong equity and insurance flows didn’t hurt deposit growth; both grew in tandem. From 2010-2014, as equity flows slowed, so did deposit growth.

Only in the last decade, the trends have diverged. Bank of Baroda conducted about a statistical exercise is conducted to show whether some degree of crowding out persists between MF and BD or not. The analysis stated that there was no correlation between the two.

"Being a more recent phenomenon, the long-term time series did not show significant trend for mutual funds in the past and hence this can be a reason for the absence of significant relations between the two," added the BoB report.

So, while the equity boom might be raising eyebrows, it’s not necessarily draining bank deposits. The current trends could be more coincidental than causal.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.