IndusInd Bank on July 20 reported a 60.5 percent year-on-year rise in net profit to Rs 1,631.1 crore for the quarter ended June, which was above analysts' expectations of Rs 1,423.5 crore.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,562.78 | 84.11 | +0.10% |

| Nifty 50 | 25,910.05 | 30.90 | +0.12% |

| Nifty Bank | 58,517.55 | 135.60 | +0.23% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Eternal | 303.75 | 6.00 | +2.02% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Infosys | 1,502.80 | -39.00 | -2.53% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8399.90 | 96.85 | +1.17% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36301.30 | -378.10 | -1.03% |

IndusInd Bank on July 20 reported a 60.5 percent year-on-year rise in net profit to Rs 1,631.1 crore for the quarter ended June, which was above analysts' expectations of Rs 1,423.5 crore.

:

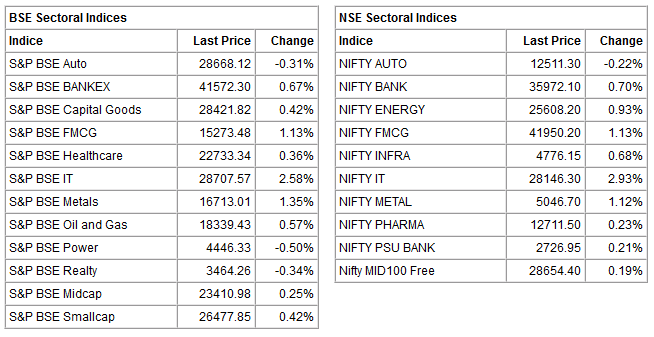

The market is mirroring the mood in global equities and notched up significant gains on strong buying in IT and select media and realty stocks. Basically, the market is hoping that the US Fed may not be aggressive in hiking rates in its next meeting, while falling commodity & crude oil prices too have moderated the bearish trend in recent sessions. On the technical front, the Nifty has formed a small bearish candle near the important resistance level.

Due to markets being in an temporary overbought situation, we could see some profit booking at higher levels. For bulls, 16550 and 16600 would act as an immediate resistance zone. On the flip side, 16450-16400 could be key support levels.

:

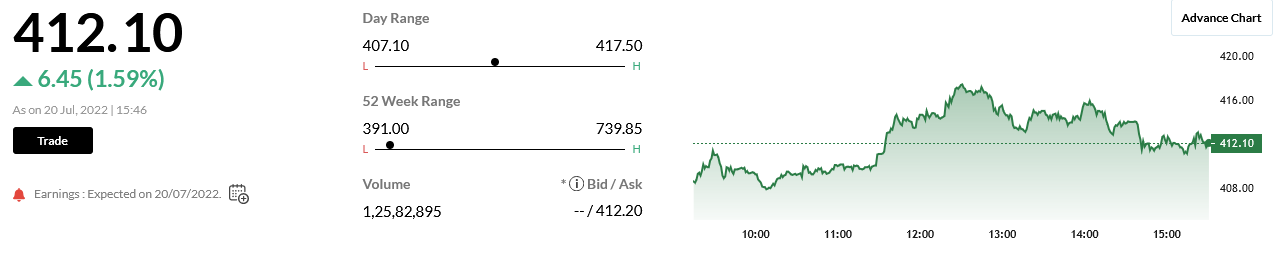

Nifty rose for the fourth consecutive session helped by overnight gains in the US and reduction of windfall tax by the Indian government on fuels. Nifty opened gap up and inched higher till 1245 Hrs and later slipped. At close Nifty was up 1.1% or 180.3 points at 16520.9. Volumes on the NSE were the highest since June 17.

Nifty broke out upwards with an upgap on Wednesday but closed near the intra day lows, suggesting profit taking at highs. While volume expansion is supportive of further upmove, we will have to see whether the upgap made by Nifty at 16359 is filled or not in the next 1-2 days. Nifty could now remain in the 16359-16646 band for the near term.

:

Nifty found resistance at the higher levels as it reached the upper band of the rising channel on the daily chart. Over the near term, the index may consolidate till it gives a breakout above 16600. On the lower end, 16350-16400 may remain crucial support. A buy on dips strategy is likely to work as long as the Nifty holds above 16350.

The Board of Directors of CARE Ratings approved a proposal to buy back of up to 23,68,000 fully paid-up equity shares of face value of Rs 10 each representing 7.99% of the total issued and paid-up equity share capital of the Company) at a price of Rs 515 per equity share.

Rupee ends at 79.99 per US dollar against July 19 close of 79.94 per US dollar.

:

Bank Nifty index faces some profit booking at a higher level but remains in an uptrend with a buy on dip approach. The immediate hurdle on the upside is at the 36,300-36,500 zone which coincides with its 200-DMA. The index might consolidate in the range of 35,500-36,500 with positive bias as long as the mentioned support is held on a closing basis.

:

Indian stocks led a steady climb as a result of encouraging signals from both domestic and international markets. Reduced export duty and windfall taxes improved the mood of oil producers. Strong quarterly results in the US market boosted the rally, while the European market rose as worries over Europe's energy supply eased. If sustained buying from FIIs prevails, it will provide a cushion to the upward rally in the domestic market.

NCLT admits Bank of India petition to initiate insolvency proceedings against Future Retail. However, NCLT dismissed Amazon's intervention application in Future Retail case.Bank of India moved NCLT to seek insolvency proceedings against FRL in April

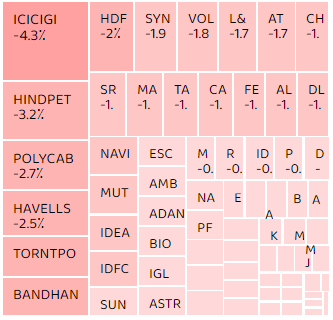

Short build-up was witnessed in ICICI Lombard General Insurance Company, HPCL and Polycab India

Indices trade positive but Realty and Auto lose some growtd; Nifty below 16,550

Sensex is trading higher by 645.49 points or 1.18 percent at 55,413.11; Nifty is up 187.05 points or 1.21 percent at 16,537.60. Of the 3,453 stocks traded on the BSE, there were 1961 advances, 1330 stocks declined while 162 stocks remained unchanged.

Source: BSE