| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

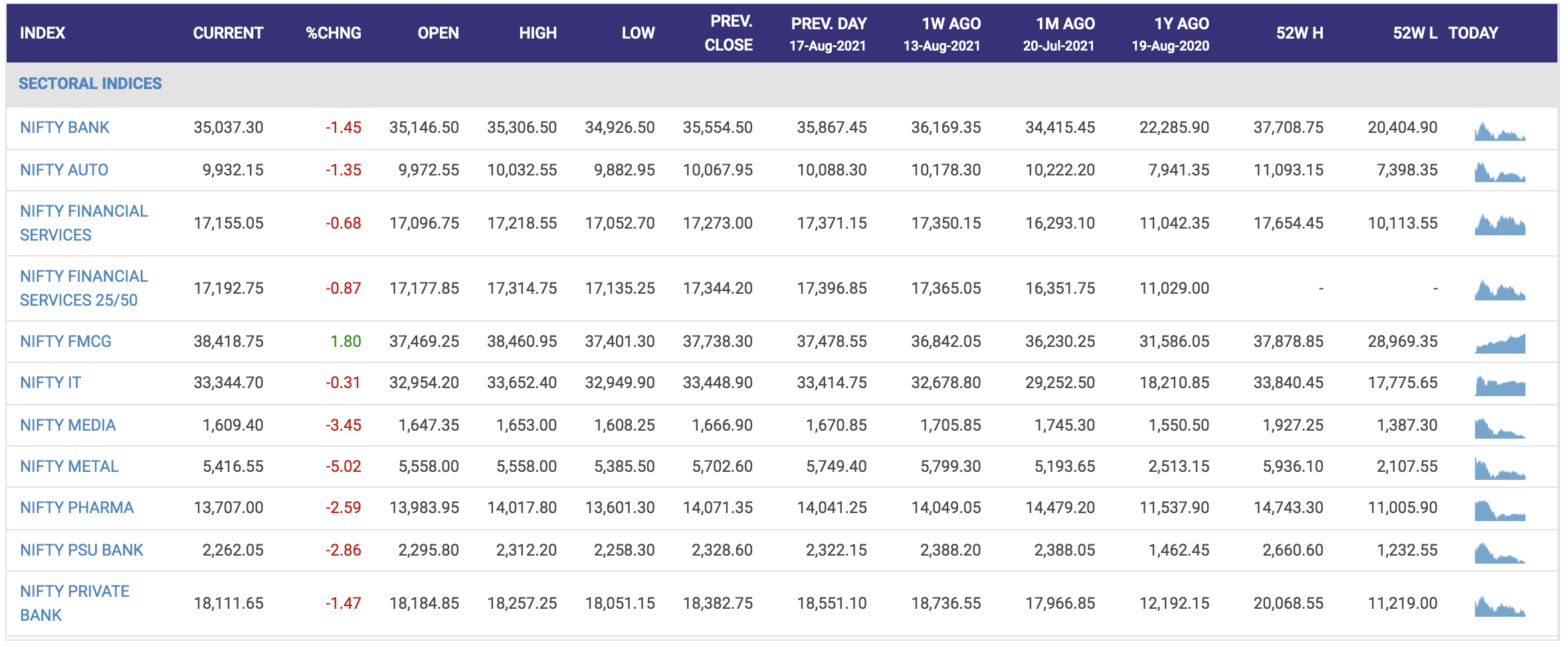

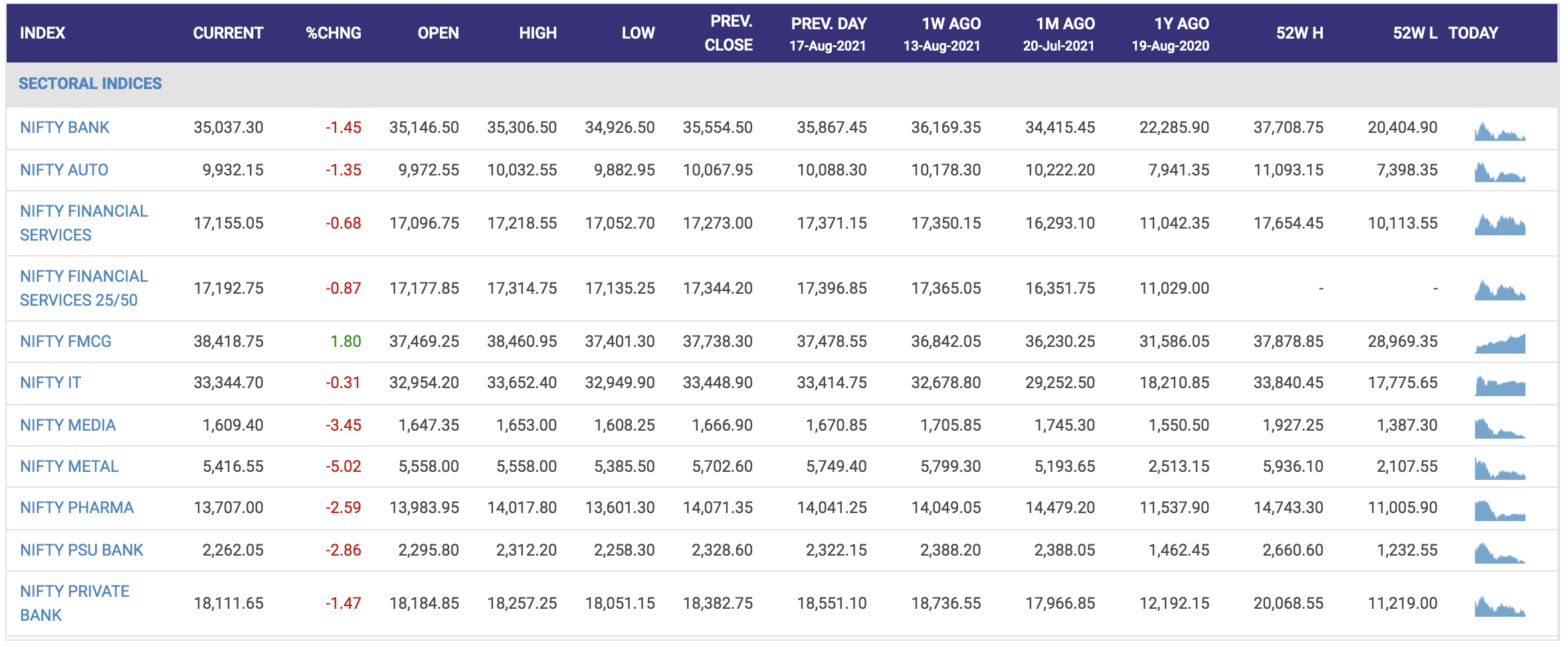

Benchmark indices ended deep in the red on August 20 but Nifty managed to defend16,400

At close, Sensex was down 300.17 points or 0.54% at 55329.32, and the Nifty down 118.30 points or 0.71% at 16450.50. About 728 shares have advanced, 2407 shares declined, and 117 shares are unchanged.

HUL, Asian Paints, Nestle,Bajaj Finance and HDFC were the top gainers in Sensex. Tata Steel, SBI,Dr Reddys LabsSun Pharma and Bajaj Autowere among the top losers.

All sectoral indices barring BSE FMCG ended in the red. BSE Metals was the biggest drag falling 6.9%

Natural gas futures climbed on August 20 as participants rolled over their bullish bets as seen by the open interest. The gas prices had fallen 0.57 percent yesterday on the NYMEX.

The energy commodity extended gained after a gap-up start in the afternoon session, tracking the firm global trend.

On the MCX, natural gas delivery for August rose Rs 7, or 2.46 percent, to Rs 291.50 per mmBtu at 14:38 hours with a business turnover of 7,018 lots.

A Wall Street brokerage has warned of a 9 percent near-term correction for the equity market, saying the “street has only limited runway to continue the rally” that began in the second half of last year.

The benchmark index Sensex has added a whopping 6,000 points since January and touched 56,000 on Wednesday.

Following the pandemic mayhem, the stock market tanked over 35 percent in March 2020. It has rallied over 118 percent since then and after scaling 50,000 in January, the Sensex has peaked the 56,000-mount earlier this week.

"We expect the markets to correct near-term to the tune of 9 percent. Our Nifty target is 15,000 by December implying a 9 percent potential downside near-term," analysts at Bank of America Securities India said in a note on Friday, adding an analysis of the past market rallies that suggests the current rally has limited runway. READ MORE

Benchmark indices are in the red on August 20 with Nifty below 16,500 and Sensex down over 200pts.

At 15:01 hrs IST, the Sensex is down 201.37 points or 0.36% at 55428.12, and the Nifty down 90.50 points or 0.55% at 16478.30.

HUL, Asian Paints,Bajaj Finance, Nestle and ITC are the top gainers in Sensex. Tata Steel, Kotak Mahindra, SBI Sun Pharma andDr Reddys Labsare among the top losers.

All sectoral indices barring BSE FMCG are in red. BSE Metals is the biggest drag

On August 16, Moneycontrol unveiled the first edition of MC30 – a curated basked of 30 mutual fund (MF) schemes. MC30 has been devised to make your investment choices simpler. Five schemes in the MC30 basket are passively managed. What is the role of passively-managed schemes in your portfolio?

Shares of Hindustan Unilever hit a record high of Rs 2630 on August 20 in intraday trading. The company has surpassed the market capitalisation ofRs 6 lakh crore,

At 14:27 hrs Hindustan Unilever was quoting at Rs 2,619.35, up Rs 135.25, or 5.44 percent. Year-to-date the stock is up about 9 percent.

The Indian drug regulator’s subject expert committee (SEC) has recommended emergency approval to Zydus Cadila's three-dose COVID-19 vaccine ‘ZyCoV-D’, CNBC TV-18 reported on August 20, citing sources.

The vaccine demonstrated 66.6 percent efficacy against symptomatic RT-PCR positive cases in the interim analysis. The company had filed the application with the Drug Controller General of India (DCGI) for an emergency use authorisation (EUA) for ZyCoV-D. READ MORE

Experts say investors with long-term portfolios can look at increasing allocation towards large-caps as outperformance in the small and midcap space will now be a factor of earnings growth