A quiet revolution is underway in global healthcare - one that’s transforming how we treat diabetes, obesity, and perhaps even addiction. It doesn’t come from a new diet fad or fitness trend, but from a simple weekly injection. I will explain here in detail, how this revolution will create a new Gold Rush for the Indian Pharmaceutical Industry going forward.

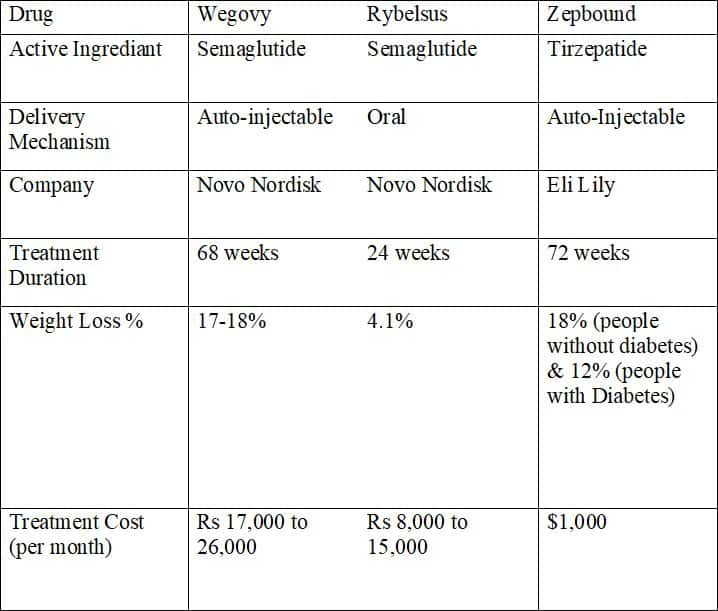

The new class of drugs called GLP-1 (Glucagon – like – peptide) agonists, led by Novo Nordisk’s Ozempic and Wegovy and Eli Lilly’s Mounjaro have become nothing short of a phenomenon. They not only regulate blood sugar but also trigger meaningful weight loss, often up to 15 - 20 percent of body weight. In a world battling obesity and metabolic disorders, this isn’t just medicine, it’s a megatrend.

The Science Behind the Breakthrough: How GLP-1 Drugs Work

GLP-1 drugs mimic the body’s natural GLP-1 hormone, enhancing insulin release when blood sugar rises and delaying gastric emptying, which prolongs fullness. They also act on the brain’s appetite control centers, reducing cravings. By maintaining lower blood sugar levels and suppressing hunger, these drugs create a sustained calorie deficit - leading to a gradual yet significant weight loss without extreme dieting or constant hunger pangs.

India at the Heart of the Transformation

India, which accounts for over 100 million obese adults, is at the heart of this global transformation. The local GLP-1 drug market, valued at Rs 700 crore, is projected to soar to Rs 8,000 - 10,000 crore growing at a 34 percent CAGR at double the global pace. The growth is inevitable, India is the diabetes capital of the world and obesity among children (now 29 percent) is an alarming red flag for the future.

The Coming Patent Cliff — and India’s Big Opportunity

At present, Novo Nordisk controls 62 percent of the global market with Eli Lilly holding 32 percent, but both face an impending challenge—the expiry of patents in 2026 in India and in Europe and USA from 2029 to 2033. This opens a golden window for Indian pharmaceutical giants. Indian companies are planning to launch Wegovy generics, building manufacturing capacity for semaglutide and developing a new investigational molecule in the Semaglutide space.

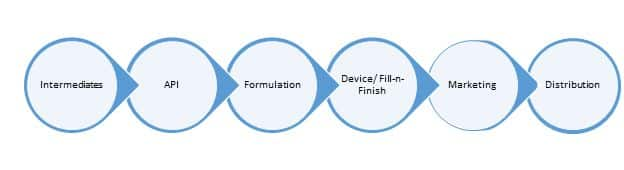

How India can Benefit Through GLP-1 Value Chain

To understand how India can benefit, it’s important to look at the GLP-1 value chain - it begins with intermediates (chemical building blocks), progresses through Active Pharmaceutical Ingredient (API) synthesis, formulation development which consists of drug device manufacturing and fill-n-finish models and then marketing and distribution of products. Mastery across this chain gives Indian firms a cost advantage with the potential to undercut global prices by 70 - 80 percent through launching generics, expanding affordability and access.

The Road Ahead for The Indian Pharma Companies

Globally, this market is estimated at $56 billion in 2024 and expected to hit $150 billion by 2030. If Indian players succeed in scaling production and biosimilar innovation, even a small slice of this pie could translate into multi-billion-dollar export opportunities. With their established expertise in generics, biologics and peptide chemistry, Indian firms are strategically positioned to replicate the biologic revolution much like they did with vaccines and insulin in the past decade.

Rewards Far Outweigh the Risk

However, this isn’t a risk-free pursuit. Peptide synthesis demands high precision and purity, requiring advanced infrastructure and regulatory rigor, process complexity and potential counterfeiting remain significant challenges. Furthermore, these are biologics, not simple chemical compounds which means creating biosimilars requires both scientific depth and manufacturing finesse.

That said, the potential reward far outweighs the risk. As semaglutide loses its exclusivity in India in 2026, the stage is set for a massive price disruption and access expansion. Just as India transformed global vaccine affordability, it can now democratize access to GLP-1 therapies for diabetes and obesity management.

The Long Game

In the short term, Eli Lilly and Novo Nordisk will continue to dominate due to strong branding and doctor trust. But in the medium to long term, expect Indian pharma to emerge as a major competitive force bringing innovation, affordability, and scale to one of the fastest-growing drug segments in history.

The Bottom Line

If I were to make one bold prediction for the next decade - it’s this: India won’t just consume the GLP-1 revolution; it will manufacture it for the world.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.