India seems to be comfortably seated to receive an inflow of $3,595 million as the main US Federal government pension fund gears up to switch its benchmark index for international funds, effectively mobilising around $28 billion (Rs 2.3 lakh crore) across global equities.

Among the emerging markets, India is likely to be one of the biggest beneficiaries of this Federal Retirement Thrift Investment Board (FRTIB) index switch, according to analysts.

This is the first time India will be a recipient of FRITB inflows as it was not a part of the old index and has been included in the new index.

FRTIB decided to switch its benchmark for international stock investment fund to ACWI IMI ex-USA ex-China ex-Hong Kong index from EAFE index. The EAFE index comprises 21 developed markets (DMs) across Europe, Australia, Asia, and the Far East. The new MSCI ACWI IMI ex USA ex-China ex=Hong Kong index will have a mix of both DMs and emerging markets (EMs).

Also read: Risk-on environment to help India markets as bonds, US dollar ease from peak

With around $68 billion invested in the I-Fund (that passively tracks the benchmark index), this benchmark switch will set off churn among constituent stocks in 2024.

The benchmark switch could be implemented in 16 tranches that are executed every five days over a four-month period. One-way trade is around $28 billion with developed markets (DMs) seeing outflows, while emerging markets (EMs) are expected to see inflows.

Apart from India, Taiwan, Korea, Brazil, Saudi Arabia, South Africa, and Mexico will be the largest gainers within the iShares Emerging Markets ETF (see table), showed an analysis done by Brian Freitas of Periscope Analytics who publishes on Smartkarma.

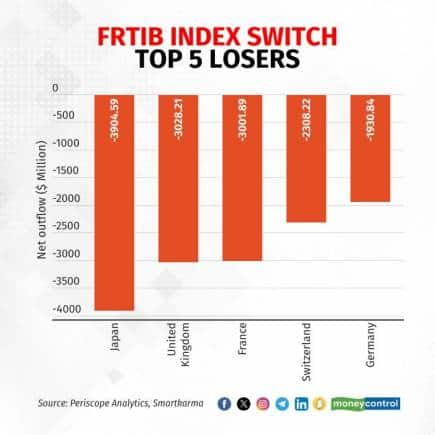

On the contrary, Japan, UK, France, Switzerland, Germany, and Hong Kong would see the largest outflows.

That said, the benchmark switch will not extend its impact on US or Chinese equities since it is not a part of either the old nor new index. Hong Kong index, however, will be one of the worst impacted, showed data as it is a part of old index but not the new one.

Also read: India leads emerging market ETF inflows after $5 billion rout

"FRITB will need to sell around $1.5 billion of Hong Kong stocks. This will increase floating stock for these names between 48-50 basis points (bps) and could create downward pressure during implementation," said Freitas.

On the othe hand, countries like Japan, UK, and France stand out out to be one the biggest losers due to downgrade in their weightage. They are estimated to see outflows of up to $3,904 million, revealed Freitas analysis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.