IIFL Securities, one of the largest independent full-service retail and institutional broking houses, has acquired 1.76 percent equity stake of itself via an open market transaction on January 14.

The promoter and promoter group already had 29.77 percent shareholding in IIFL as of September 2020. The December quarter shareholding pattern is yet to be announced.

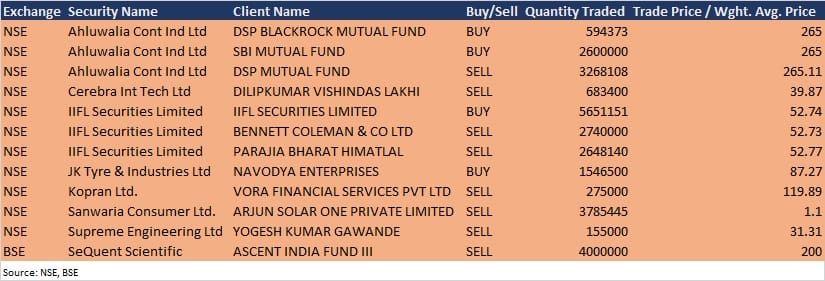

IIFL Securities has bought 56,51,151 equity shares of the company itself (representing 1.76 percent of the total paid-up equity) at Rs 52.74 per share, the bulk deals data available on the NSE showed.

However, Bennett Coleman & Co sold 27,40,000 shares in IIFL Securities at Rs 52.73 per share and Parajia Bharat Himatlal sold 26,48,140 shares at Rs 52.77 per share. Parajia Bharat Himatlal held 4.76 percent (or 1.52 crore shares) stake in the company as of September 2020.

Among other deals, SBI Mutual Fund acquired additional 26 lakh shares in Ahluwalia Contracts (representing 3.88 percent of the total paid-up equity) at Rs 265 per share on the NSE. SBI Large & Midcap Fund already held 1.85 percent stake in the company as of December 2020.

DSP Blackrock Mutual Fund acquired 5,94,373 equity shares in the company at Rs 265 per share, but DSP Mutual Fund sold 32,68,108 shares at Rs 265.11 per share. Hence the net selling by the fund house was 26,73,735 equity shares in the company via bulk deals on the NSE. DS Equity and Bond Fund already had 9.46 percent shareholding in the company as of December 2020.

Navodya Enterprises bought 15,46,500 shares in JK Tyre & Industries at Rs 87.27 per share on the NSE, while Ascent India Fund III sold 40 lakh shares in SeQuent Scientific at Rs 200 per share on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.