The markets started the week gone by on a miserable note on unfavourable global cues and the Nifty ended April 18 down over 1.7 percent, a tad below the 17,200 mark.

The next session was better but a massive selloff in the last hour saw the Nifty close below the psychologically vital 17,000-mark. Midweek saw a good recovery but April 22 was a complete dampener and Nifty ended the week below 17,200.

It was a roller-coaster ride but the market was largely timid and the way banking space ended the week, it does not bode well for the bulls. The week's movement indicates a clueless market and so are we.

Though we remain hopeful till the time 17,000–16,800 is defended, the overall positioning is not so convincing. So, the first couple of days of this week remain crucial for the market.

One must keep a close tab on global markets. As far as levels are concerned, 17,300–17,450 is to be treated as the immediate hurdle, while support remains at 17,000–16,800.

Traders are advised not to trade aggressively till the time trend becomes clear and also, unlike previous weeks, we are not left with any convincing idea for individual stocks.

One needs to be very selective in the stock-centric approach and should follow strict stop losses for momentum bets.

Here are two buy calls for the week:

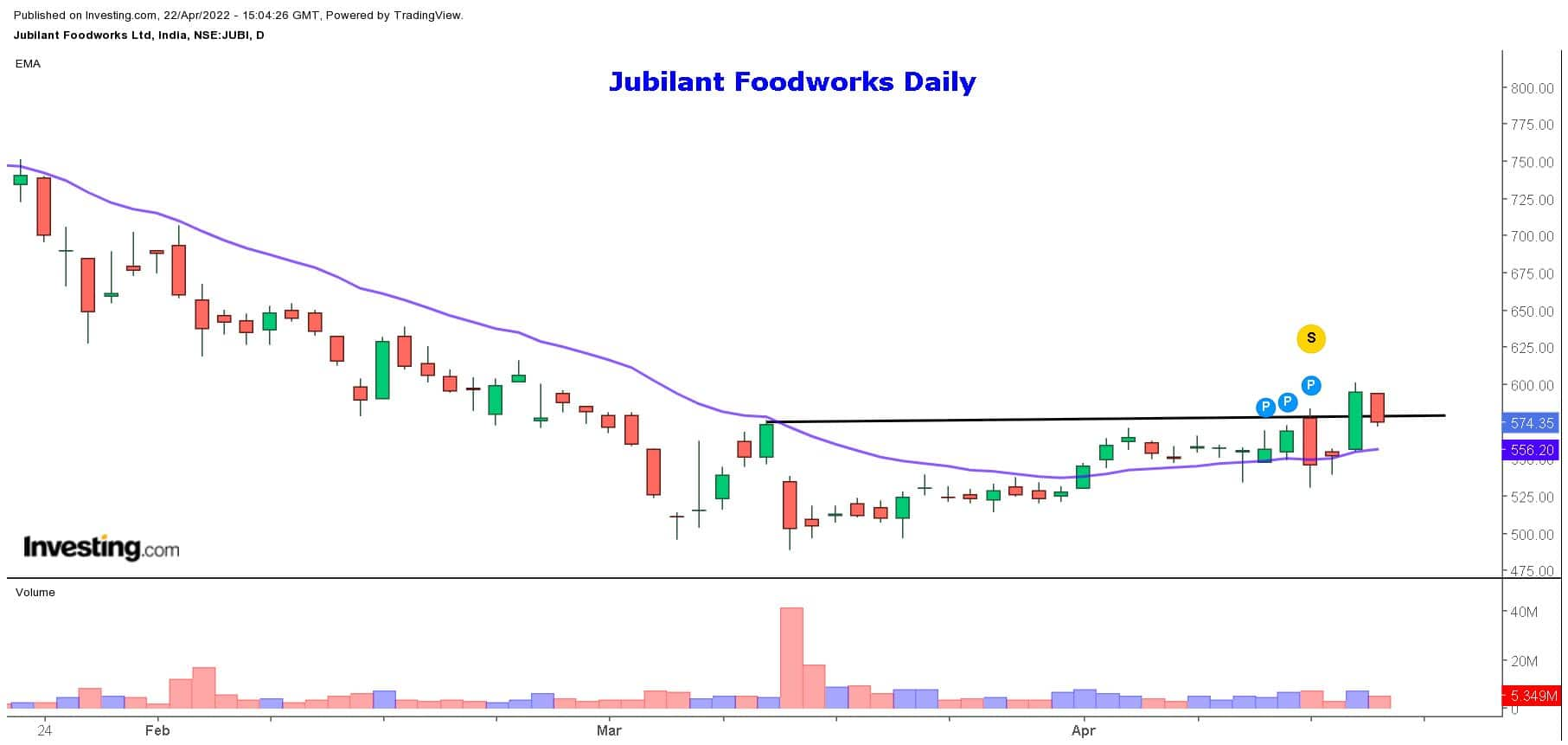

Jubilant FoodWorks: Buy | LTP: Rs 574.35 | Stop-Loss: Rs 554 | Target: Rs 612 | Return: 6.5 percent

One of the top performing quick service restaurant (QSR) stocks in the calendar year 2021, Jubilant FoodWorks peaked in the latter half of October around the Rs 920-mark. In six months, the prices fell more than 40 percent to enter the sub-500 terrain.

Now over the past month and a half, we witnessed some base building in the stock and on April 21, prices burst through the congestion zone.

Since the breakout has happened on higher volumes, profit booking on April 22 can be construed as a pull back and hence, we recommend buying this stock for a trading target of Rs 612. The stop-loss can be placed at Rs 554.

Piramal Enterprises: Sell | LTP: Rs 2,173.35 | Stop-Loss: Rs 2,248 | Target: Rs 2,060 | Return: 5.2 percent

Recently, the stock performed well as recovered nearly 25 percent from the March lows. The stock was in a strong upward momentum and looked set to extend the move further but last week's underperformance in the NBFC space had a rub-off effect on Piramal Enterprises as well. In this course of action, stock prices confirmed a breakdown from recent multiple supports.

Thus, we recommend selling this stock below Rs 2,160 for a near-term target of Rs 2,060. A strict stop-loss needs to be placed at Rs 2,248.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.