Select equity market segments have widely outperformed the benchmark NSE Nifty 50 in the last one year, but with much higher volatility, exposing investors to a higher degree of risk.

The Nifty PSE and Nifty Defence indices have, for example, delivered a whopping 110 percent and 125 percent returns in the one year to February 2024, which is three times as much as Nifty 50. The Nifty PSE index has been twice as volatile as Nifty 50, and the defence index has been three times as volatile. It is measured in standard deviation for the one year to February 2024.

This is traditional wisdom - higher returns come with greater risks. However, there are a few thematic and strategy indices, which have given better returns than the Nifty 50, with lesser volatility.

Also read: Debt-free capital goods MNCs outperform Nifty on capex boosters

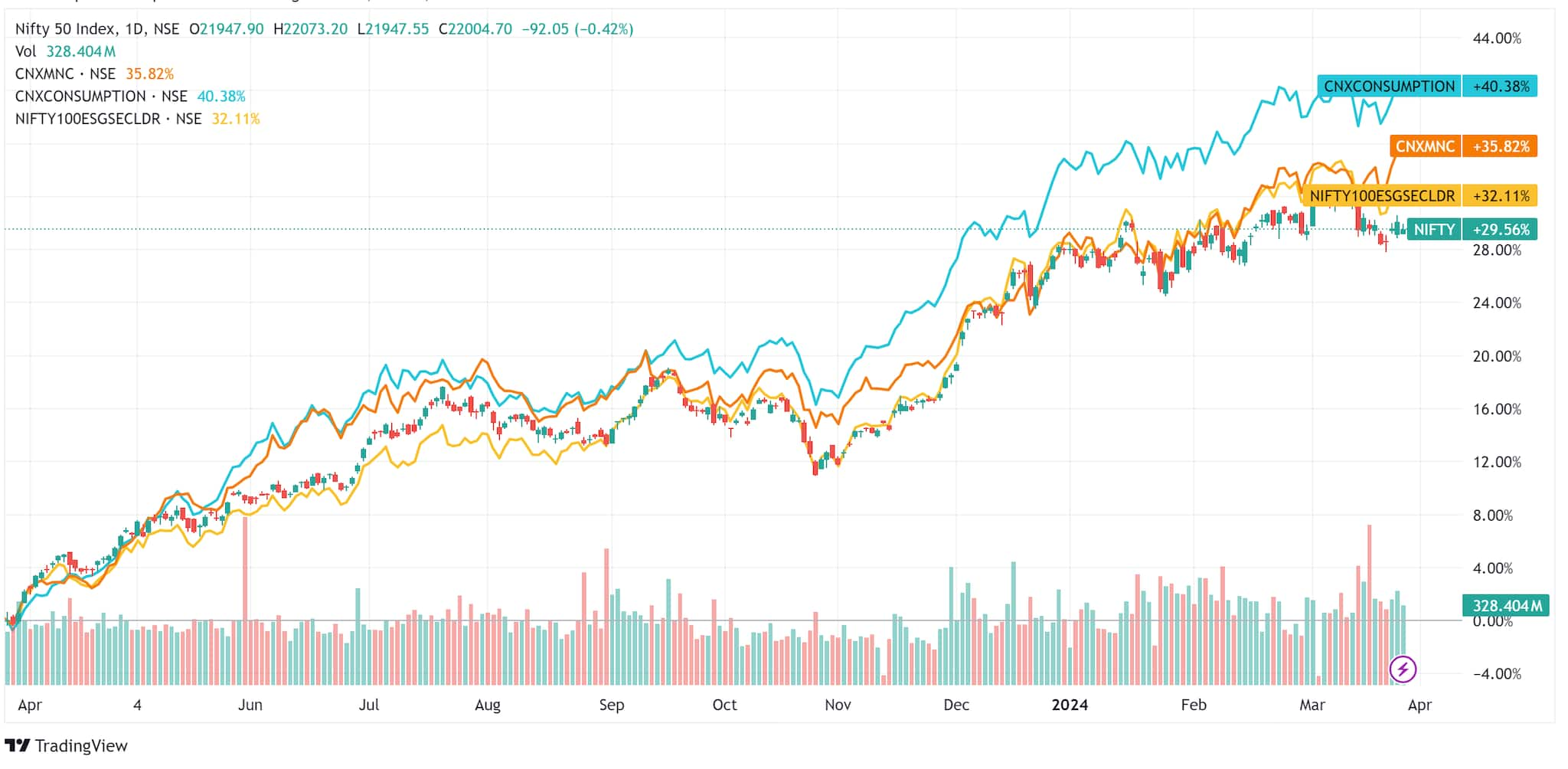

Thematic indices that beat Nifty 50 returns with lower volatilityThe themes that focused on MNC stocks, India (domestic) consumption story, and ESG have delivered excess returns with lower volatility than the key benchmark indices. The Nifty MNC index has risen 38 percent in one year, beating the Nifty 50’s 32 percent rise. It had a volatility reading of 9.72, compared with 9.98 for the Nifty 50.

The ESG index gained 36 percent, with 9.73 volatility, while the consumption index surged 43.81 percent with 9.23 volatility.

The chart below highlights the price performance of thematic indices with reduced volatility:

Nifty Thematic Indices outperformStrategy indices with low volatility and excess returns

Nifty Thematic Indices outperformStrategy indices with low volatility and excess returnsBeyond thematic indices, strategy indices that focus on low volatility have also outperformed Nifty 50 returns. The Nifty 100 Low Volatility Index has gained 41 percent in one year, but its volatility reading was at 8.84.

The chart below highlights the price performance of Nifty 100 low volatility index when compared to Nifty 50.

Nifty 100 Low Volatility index outperforms

Nifty 100 Low Volatility index outperformsAlso read: Indicator flashes 'buy' on 33% Nifty smallcaps as bulls return to broader markets

Risk aversion at play"What is interesting about low volatility stocks is that mutual funds have been buying such stocks since last year. This trend is expected to continue and hence I won't be surprised if large-sized, low-volatility stocks continue to do well,” said Darpan Patil, founder of Rupic Consultancy.

“Basically risk-aversion is at play and hence the low volatility stocks and large-cap mutual fund schemes are in demand even amongst the retail investors."

Siddharth Srivastava, Head – ETF Product and Fund Manager, Mirae Asset Investment Managers explains ," In last one year, Nifty100 low volatility 30 index has performed better than its parent Nifty 100 index due to higher allocation to healthcare which has done well and lower allocation to financial services which has underperformed. The Low volatility strategy tends to perform better when the markets are volatile and/or sentiments are weak. It is suited for investors who want more stability and focus on risk adjusted returns."

The table below details the complete list of thematic and strategy indices that displayed lower volatility when compared to the Nifty and, at the same time, delivered better returns in the one year period ending February 2024.

Higher risk-adjusted returns in low volatility indices and thematic indicesWhat is Nifty 100 Low Volatility 30 Index

Higher risk-adjusted returns in low volatility indices and thematic indicesWhat is Nifty 100 Low Volatility 30 IndexNifty 100 Low Volatility 30 index picks 30 stocks with lowest volatility measured in terms of standard deviation of daily price returns from the top 100 companies in terms of market capitalisation. Thus, all the components are from the Nifty 100 index and should be available for trading in F&O segment.

Sun Pharma, ICICI Bank, RIL, Nestle and BOSCH are among the top index constituents in Nifty 100 Low Volatility 30 index.

Unlike the Nifty 100 Low Volatility index, which ranks stocks based entirely on volatility, the Nifty Alpha Low Volatility 30 index lists stocks based on the combination of Alpha and Low Volatility. The index consists of 30 stocks selected from Nifty 100 and Nifty Midcap 50.

How to take exposure to low volatility strategy indicesSeveral mutual funds have ETFs that replicate the performance of such low volatility indices. For example Kotak MF, ICICI Prudential MF and Mirae Asset MF all offer ETFs that track the performance of Nifty 100 low volatility 30 ETF.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.