With a 5 percent gain on a year-to-date basis, the Nifty MNC index is trading at its all-time highs and has emerged as one of the top performers by easily beating the Nifty returns of 1.63 percent. Only infrastructure, realty, healthcare and commodity indices are ahead of Nifty MNC index so far in 2024.

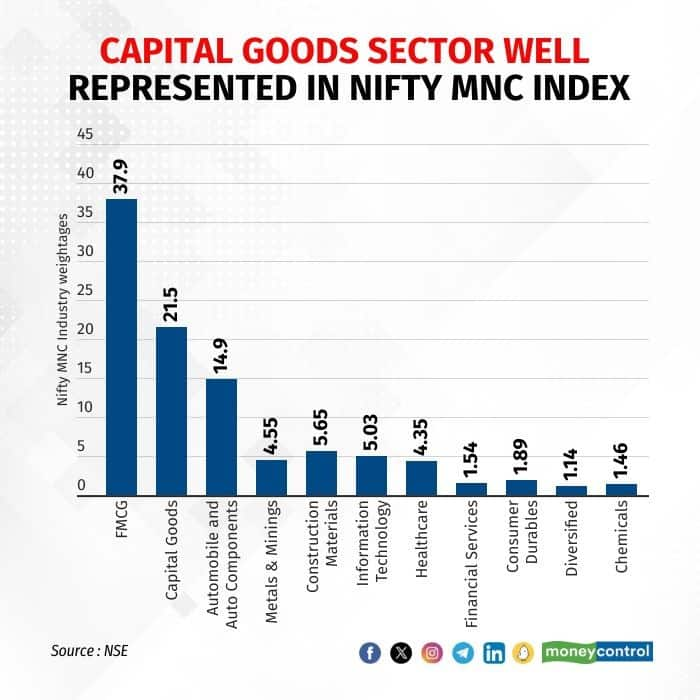

When we look at the composition of the Nifty MNC index, we find that after the FMCG sector which has a total weightage of over 31.5 percent in the index, it is the capital goods sector that constitutes over 21.5 percent weightage of the index.

Also read: Investors get the whiff of higher value in high dividend yielding small-cap stocks

Capital goods constituents of Nifty MNC index such as Bosch, Cummins India, Siemens and ABB have contributed handsomely to the gains of the Nifty MNC index so far this year.

Cummins India, which carries a weightage of 2.74 percent in the Nifty MNC index, is up nearly 50 percent on a year-to-date basis, underperforming only the top index gainer Oracle Financials, which surged 99 percent in the same period. Bosch, with a weightage of 3.16 percent in the index, is up around 36 percent, ABB India 27 percent with 4.49 percent weightage in the index, and Siemens with weightage of 6.3 percent is up by 24 percent.

Another common feature that links these capital goods multinational stocks is that they are almost zero-debt companies. We find that the debt-free capital goods MNCs have largely outperformed the Nifty returns.

Capital goods outperformance

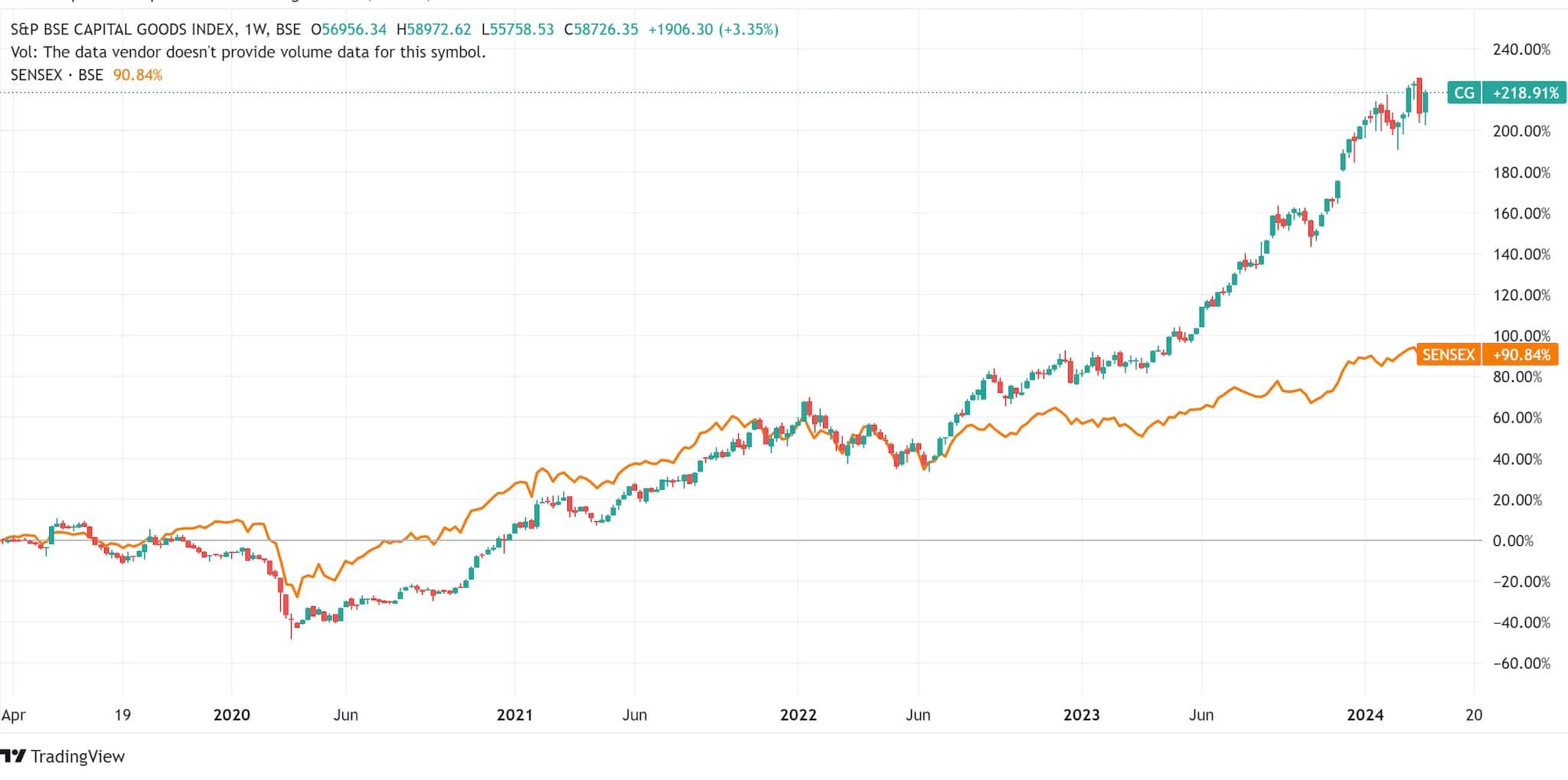

The capital goods sector has been doing well because of the various government initiatives towards incremental capex spending.

The chart below explains the outperformance of BSE Capital Goods Index over BSE Sensex in the previous five years. The BSE Capital Goods index has delivered almost double the returns of the BSE Sensex in this period.

Also read: Bajaj Auto turns the Hero of Nifty pack over last one year for consistency

Experts take on capital goods sector

The important question from the investor’s point of view is whether the growth is behind the capital goods sector or the momentum is not over yet.

Anand Rathi believes that private capex will drive the next leg of growth for the capital goods sector. The brokerage house in its research report published on March 22, picked Cummins for a 'buy' tag, while Siemens and ABB enjoy a 'hold' status.

The brokerage house is bullish on the power generation business of Cummins India because of its superior technology and reach that outsmart its peers. The report highlights that the demand is robust in data centres, commercial and residential realty, infrastructure and manufacturing, allowing it to build in a 23 percent CAGR expectation over FY23-26 for its powergen business.

On Siemens, Anand Rathi believes the company is a key beneficiary of the many macro themes currently unfolding in India. These include digitisation, sustainability, infra upgrade and modernisation. ABB, according to the brokerage firm, like Siemens, is a key beneficiary of the unfolding macro themes and ongoing capex. ABB’s strength lies in electrification and automation and hence the stock carries a 'hold' recommendation.

Given the underlying strength of the capital goods sector in India and the high quality of the MNC businesses, debt-free multinationals will be on long-term watch lists of investors.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.