When it comes to the least-loved sectors by investors, two wheeler figures pretty much high up on that list. So it would come as a surprise to most people that the top two consistent performers in the Nifty over the last one year have been Bajaj Auto and Hero Motocorp.

Similarly, few would have been willing to bet their money on Adani Ports after the pounding it look in January and February last year over the Hindenburg report. Here too the street is in for a surprise: Adani Ports figures at number three for consistency.

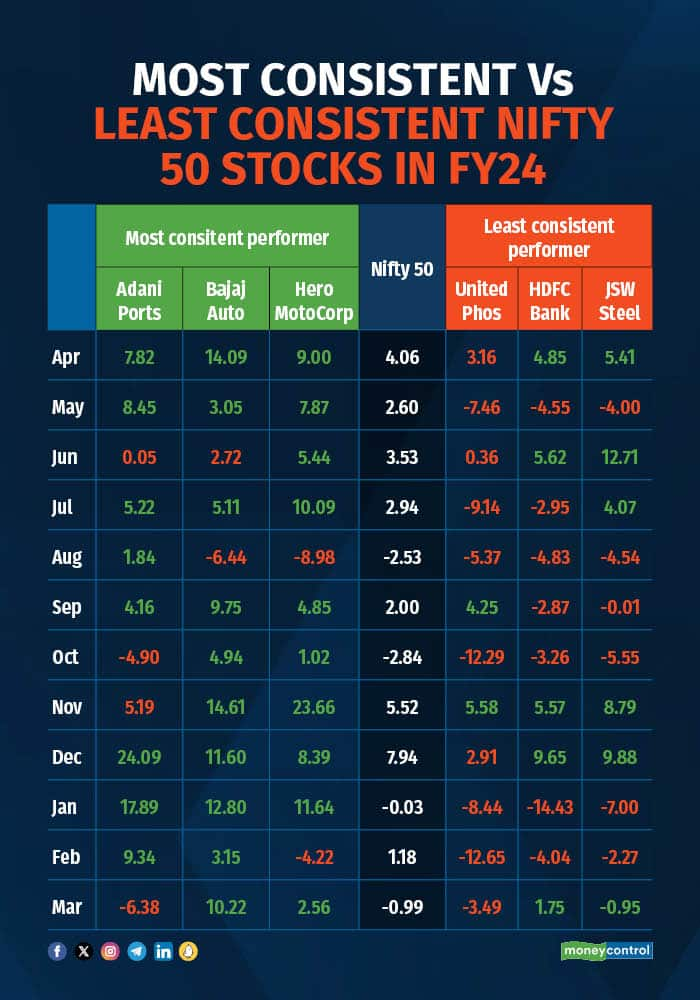

Follow our market blog for live updatesTo test the consistency of performance of Nifty 50 stocks in FY24 we observed the monthly returns of Nifty 50 constituents and compared it with Nifty 50 returns.

Nifty 50 has delivered positive returns in 8 of the 12 months since April 2024 and only on 4 instances it has generated negative returns. However there are at least 16 Nifty stocks that gave positive returns on more occasions, reflecting better consistency in performance in FY24. And Adani Ports, Hero MotoCorp, and Bajaj Auto have given the maximum positive returns among the 16 contesters. Better consistency also indicates momentum in the underlying security.

Bajaj Auto gave positive returns in 11 months of the past 12 months and outperformed the index in 10 out of 12 months.

The company’s newly launched Triumph has presence in Bangalore and Kerala and its market share has reached 20 percent in the category. It plans to grow its footprint beyond 100 cities, covering 50 percent of the market “We expect Bajaj Auto to benefit from market share gains over the long term, driven by the premiumization trend, an opportunity in exports, and a sizeable position in the scooter EV market,” said Amber Shukla and Ankit Desai of Motilal Oswal.

As of March 20, Bajaj Auto has 21 buy calls, 12 hold calls, and 12 sell calls.

The other consistent Nifty 50 outperformer has been Hero MotoCorp. The shares of company have outperformed Nifty 50 in 10 out of 12 months indicating consistency.

On the back of the resilient Indian economy, Hero MotoCorp’s management expects to grow in double digits with new premium product launches, ramp-up of the EV product portfolio, introducing new Premia stores, Vida Hubs and upgrading existing stores to Hero 2.0, said Axis Securities in a report. The brokerage firm further said that reduced inventory levels and higher enquiries from rural geographies with higher demand for 125+ cc vehicles gives management the confidence to beat average industry growth in FY25.

As of March 20, Hero MotoCorp has 26 buy calls, eight hold calls, and 10 sell calls.

Adani Ports has given positive returns in 8 of the 12 months and outperformed the Nifty 50 in 8 of the 12 months. Adani Ports has one buy call, and zero hold and sell calls.

The lagging onesHDFC Bank, JSW Steel and United Phosphorous underperformed Nifty 50 in the past 12 months on regular basis. All these three stocks gave positive returns in only 5 out of 12 months while United Phosphorous managed to outperform Nifty 50 only in 2 months while delivering lesser returns than Nifty in 10 out of 12 months, reflecting lack of momentum and buying.

As of March 20, HDFC Bank had 45 buy calls, five hold calls, and zero sell calls. JSW Steel had 12 buy calls, nine hold calls, and eight sell calls. United Phosphorous had 17 buy calls, eight hold calls, and seven sell calls.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.