Rally in the past three-month period was driven by positive global and domestic cues.

The rally in frontline indices was majorly driven by select liquid stocks, which clearly indicated that money chased only quality stocks where investors do not have to be worried about corporate governance, less debt burden, strong fundamentals etc.

"At the cusp of 2020, Indian stock markets look more polarised than its fractious politics! It seems that incremental inflows are mostly chasing less than a dozen stocks. The reasons for this ‘passive flight to safety’ are not difficult to identify," said Dipen Sheth, Head – Institutional Research at HDFC Securities in a note.

Foreign institutional investors and domestic institutional investors poured in more than Rs 41,000 crore in equities during the year despite the economic slowdown.

In fact the rally which the market witnessed and sent benchmark indices to record high levels was despite weak macro environment and mixed earnings performance, but the hope after government's several measures and easing US-China trade tensions raised the bar and indicated more may be coming in the Budget 2020.

"Macro growth has slipped, alarmingly some say, and is not just on a cyclical downtick. High frequency data and core indicators are mostly struggling. Policy reform has been directionally encouraging (GST, RERA, IBC, tax cuts, the push for formalisation and financialisation) but messy and inadequate. Government's efforts to spur capex are sputtering. Modi 2.0 looks like a tougher grind than Modi 1.0, say the detractors," he said.

"An under-estimated factor is the slowly healing global economy, post some concrete steps by the two largest economies in the world (US and China) to end their looming trade stalemate. Government policy action, as we well know from history, has been boldest when it is cornered. Our intuition is that the upcoming budget may well see the government springing a surprise on its naysayers," he added.

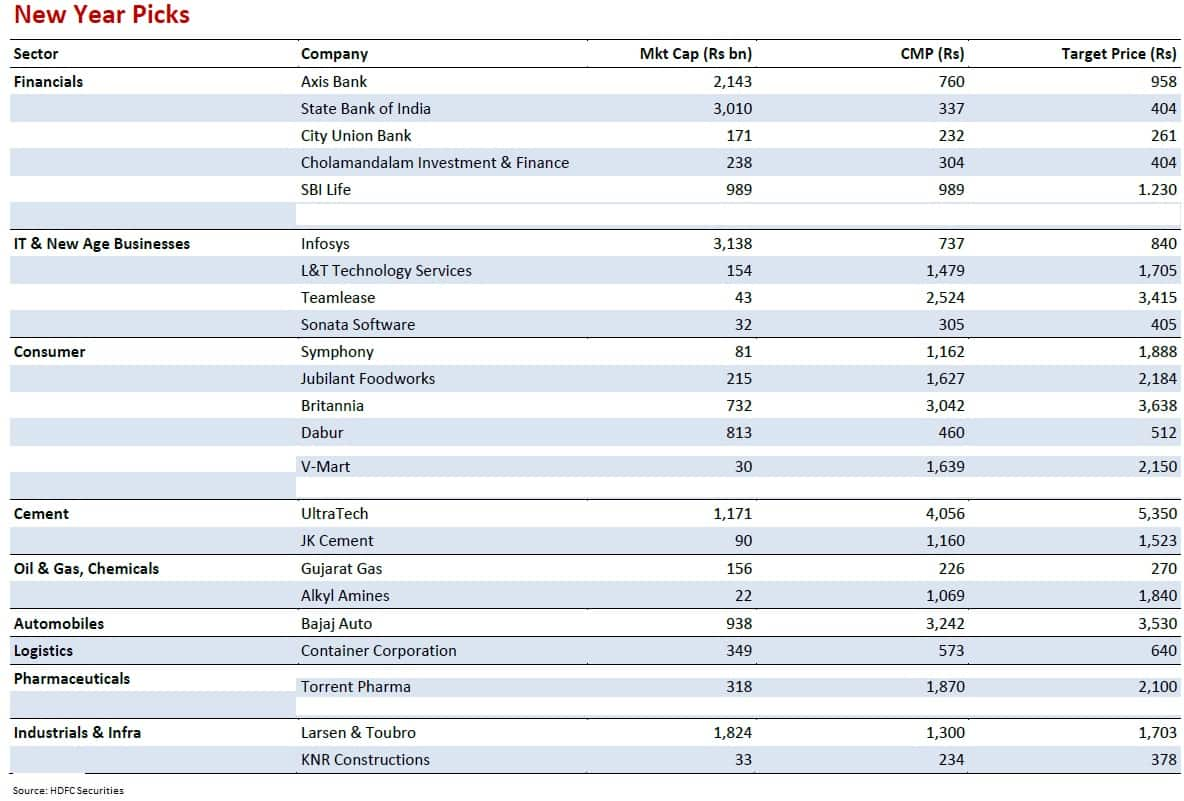

HDFC Securities listed 23 stock picks for 2020 and most of which are hardly different from the compilation it made a few months ago at the turn of the Samvat.

It selected stocks across major sectors financials, consumer, pharma, industrials, oil, automobile, cement and technology.

In the financials space, the brokerage selected Axis Bank, SBI, City Union Bank and Cholamandalam Investment as the healing cycle is set to play out further at stressed lenders, despite a slowing economy.

"In the non-lending pack, SBI Life is set for sustainable growth," Sheth said.

Among consumer stocks, Symphony, Jubilant Foodworks, Britannia Industries, Dabur India and V-Mart are its buying ideas.

"Consumer companies are sitting on very high valuations, even as sentiment (as seen in volume growth) has struggled considerably of late. New age businesses like QSR face long growth runways and (justifiably) command high valuations. Durables/appliances players with niche strengths are similar. The category expansion play at Britannia is not fully priced in, even after the run up over the last few years," Dipen Sheth said.

"Dabur's focus and rising distribution penetration drive our optimism, while Jubilant’s multi-year growth story is yet to play out. Among retailers, V-Mart offers an interesting growth proposition, driven by strategic focus on value retailing," he added.

He feels technology companies, with all their enticing talent, free cash flows and payout yields, are going for under 15x FY22E EPS (top 5 average). "Value is emerging at Infosys. Staffing leader Teamlease is relatively affordable now, while the growth/valuation bargains at L&T Tech and Sonata seem sensible at CMP," he said.

According to him, cement may not enjoy the twin benefits of higher pricing and softer coal prices for another year.

HDFC Securities' preferred stocks here include market leader UltraTech Cement and the fast growing and (now) reasonably profitable JK Cement.

In the auto space, it picked Bajaj Auto due to global sales footprint, while in the logistic space, Container Corporation can capture freight from truckers in the congested Delhi-Mumbai route as the Dedicated Freight Corridor takes off, Sheth said.

He feels oil companies will find it a hard ask to recover from a value destructive regulatory environment. The unfettered-by-regulation city gas distributors thus make sense, he said, adding Gujarat Gas will (as its product mix tilts towards CNG) tread the path of Indraprastha Gas.

Meanwhile, the exceptionally talented and prudent Alkyl Amines is the speciality chemicals pick, he said.

Industrials never really recovered from the slowdown in corporate capex after the fairy-tale pre-GFC years, he feels. Hence barring L&T, infra stocks have gone through a ride to heaven and back, he said, adding KNR Constructions is the other consistent performer in this space.

According to Sheth, pharma may well emerge in 2020, from its multi-year slump. "But we are betting here on the more domestic-focussed Torrent Pharma, that also have interesting US pipeline and look set to improve capital efficiency and cash flows in the foreseeable future," he said.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.