The last six months were nothing short of a roller-coaster ride for traders and investors. At a time when most investors are sitting on double-digit loss in their portfolio, little known companies with a market-cap of less than Rs 100 crore made it big on D-Street as they rose 100-1300 percent in the same period.

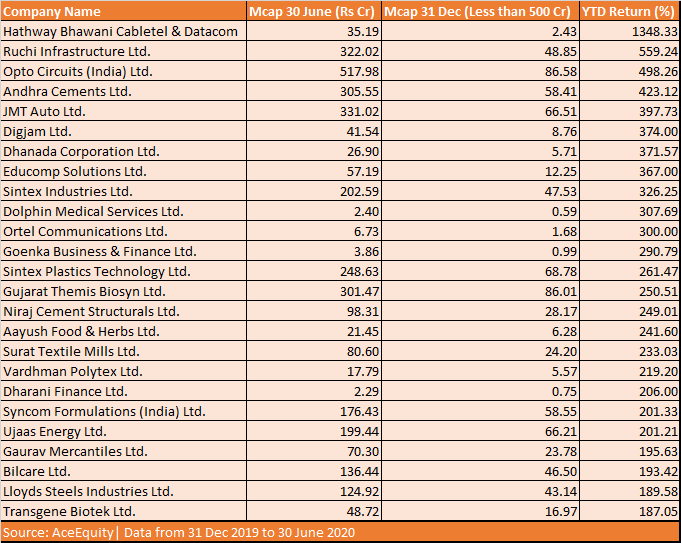

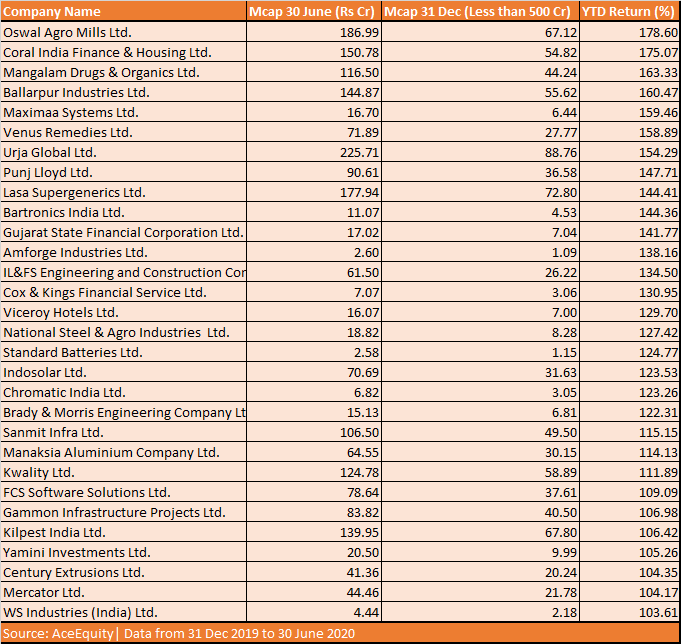

As many as 55 companies rose up to 1300 percent in the last six months. These include Ruchi Infrastructure, Hathway Bhawani, JMT Auto, Sintex Industries, Sintex Plastics, Sintex Industries and Ujaas Energy, shows data from AceEquity.

Both Sensex and Nifty went from lifetime highs recorded on January 20 to enter a bear market in March. The Nifty50 fell by about 40 percent to hit a low of 7500 on March 24, but value buying was happening in the broader markets.

If we look at the data for the last 6 months, both Sensex and Nifty were down by about 15 percent each, compared to 11 percent fall seen in the S&P BSE Midcap index, and nearly 8 percent decline seen in the S&P BSE Smallcap index.

One possible reason for the outperformance is valuation. Small & Mid-caps space entered bear markets back in 2018 and since then value erosion was happening. Investors took the fall as an opportunity to get into some of the stocks, suggest experts.

However, investors should not feel disappointed because not everyone would want to or willingly invest in stocks with a low market-cap due to liquidity concerns.

“In six months from Jan 1 to June 30, Sensex and Nifty slipped almost 15%, while BSE small cap Indices went down by 9%. Some penny stocks with Market cap below 100 cr have given positive returns rallied 100-500% in the same period.

"One should invest in penny stock according to the risk appetite,” Palka Chopra, Senior Vice President Master Capital Services told Moneycontrol.“It is to be kept in mind that penny stocks are very volatile because of the low liquidity and hence are very risky. These stocks are prone to any unfavorable news in the market and, therefore, a risky bet for an investor,” she said.

Note: The above list is for reference and not buy or sell ideas

Should you invest? What is the ideal portfolio composition?

Well, most investors prefer to stay on the sidelines when it comes to penny stocks while for the rest who are risk-takers can include them in their portfolio but it should not be more than 5-10 percent.

“The markets were beaten down due to the COVID crisis and therefore there is an opportunity for value buying in these stocks. However, only those who can stomach the exposure in it should consider putting any sizeable chunk in this space, for normal retail investors, it would be advisable to not place more than 5-10% of the total portfolio into penny stocks,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“Time frame in these stocks should be medium to long term. The volume in the stock must be taken into consideration whether enough buyers and sellers exist or not. While looking at its fundamentals main focus must be on the operating profit and cash flows along with its growth over a period,” he said.

Factors which one should keep in mind while investing:

Penny stocks are traded at low prices and is a risky investment. It is characterized by more limited disclosure and relatively large ask and bid spreads, suggest experts.

Liquidity is an issue in penny stocks as there are limited buyers and sellers. On the technical front, one must track the price behavior of the stock. A stock locked in continuous downtrend or uptrend circuit levels gives an idea about the trend.

These stocks heavily rely on the market conditions for growth in their value. Palka Chopra, Senior Vice President Master Capital Services recommends these 4 factors which one should keep in mind following risk associated with Penny stock investment:

Limited information

Generally, the companies issuing penny stocks are mostly start-ups, therefore the information related to their financial soundness, past performance, growth prospects, etc. is limited.

Investors might end up investing in penny stocks with half knowledge. Therefore, thorough research has to be conducted for the list of penny stocks in India before investing.

Low liquidity

Liquidity of the penny stocks are low, as many are traded over-the-counter. An investor may not always be able to sell the shares at the right time.

Also, the low liquidity results in low trading volumes. Thus, relatively small transactions can cause large swings in the price of the stocks.

Limited historical information

Most of the stocks are of start-up companies with limited historical information. The companies generally lack a proven track record regarding products, operations, assets, or revenues.

Therefore, investing in such companies is extremely risky. Potential investors may not find sufficient resources to make an informed investment decision.

Scams

Penny stock scams are commonplace in international financial history. Pumping and dumping is a form of fraud associated with microcap stocks and penny stocks.

Companies and scammers purchase a considerable amount of penny stocks resulting in value inflation which attracts other investors to follow the hype.

After that fraudsters sell their shares and make huge profits, and retail inexperienced investors are left stuck in these stocks.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.