Equity market benchmarks Sensex and Nifty have extended their rally for the seventh straight session, driven by consistent buying by foreign institutional investors and a decline in crude oil prices. On Tuesday, FIIs made substantial purchase of shares amounting to Rs 5,223.51 crore.

Among sectors, the power index was up 2.5 percent, while the FMCG and Oil & Gas indices were up 1 percent each, while selling is seen in realty, metals and bank.

At 11am, the Sensex was up 299.19 points or 0.43 percent to 69,595.33, and the Nifty was up 82.30 points or 0.39 percent at 20,937.40. About 1,697 shares advanced, 1,398 declined, and 99 traded unchanged.

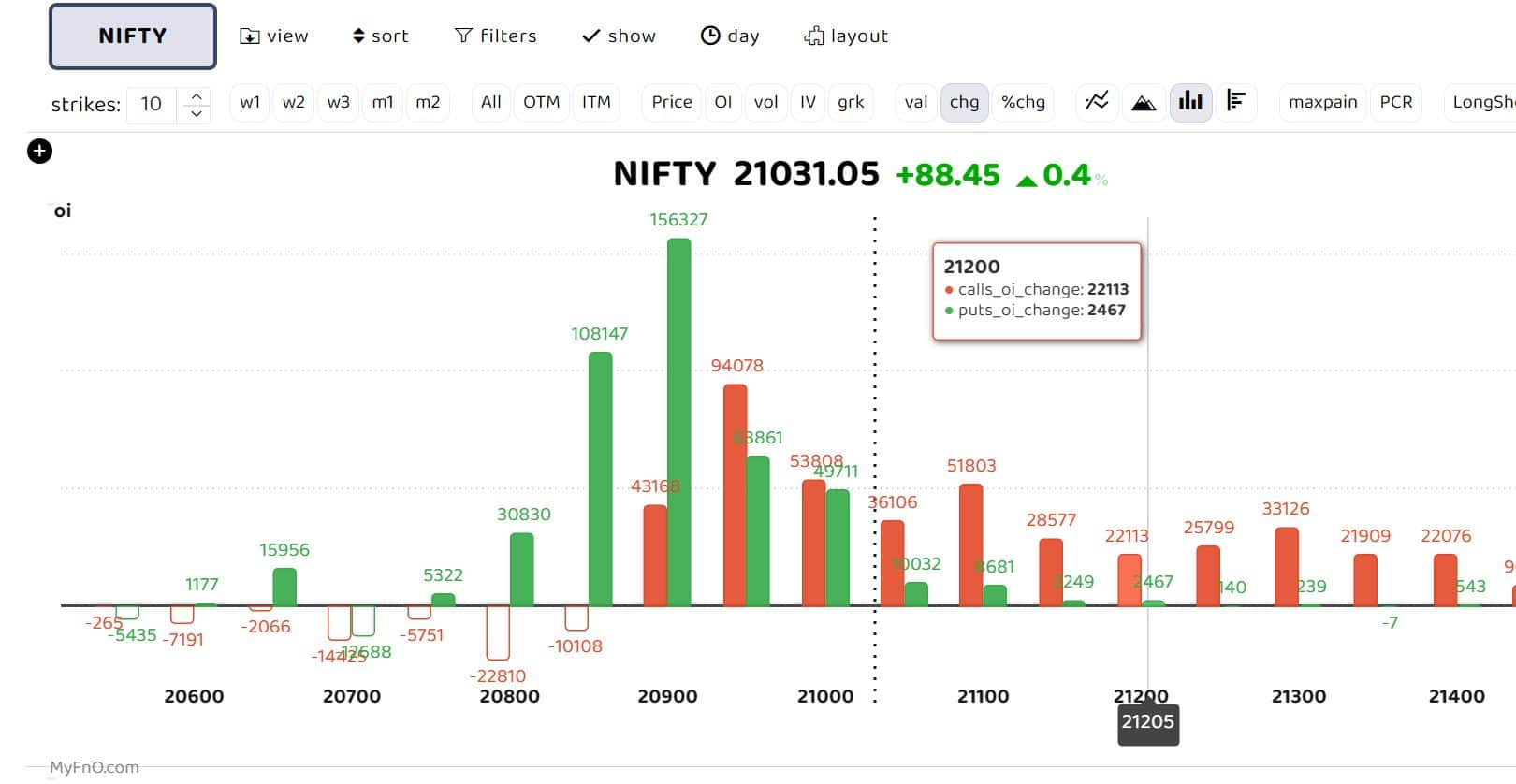

Options data suggests that significant put writing buildup is seen at 20,850 and 20,900 strikes, while on the calls front, 21,100-21,400 saw considerable open interest additions. "Going forward, 20,700-20,740 will act as a strong support, and as long as this zone holds, the index could extend its rally towards 20,930-21,000. Above 20,960, it may test the 161.8 percent Fibonacci extension of 21,077 levels, derived from the Fibonacci sequence applied to the move seen from September 15 to October 26," Sudeep Shah, head of technicals and derivatives research at SBI Securities, said.

"The advance-decline ratio is currently at 90 percent. This parameter typically tops out over 80. While this may signal caution on the long side, it is not necessarily a shorting signal. Additionally, the RSI indicator is above 83-84 levels, indicating the overbought nature of the Index. This implies that indices could consolidate in the coming few sessions," Shah said.

Bank Nifty expiry day view

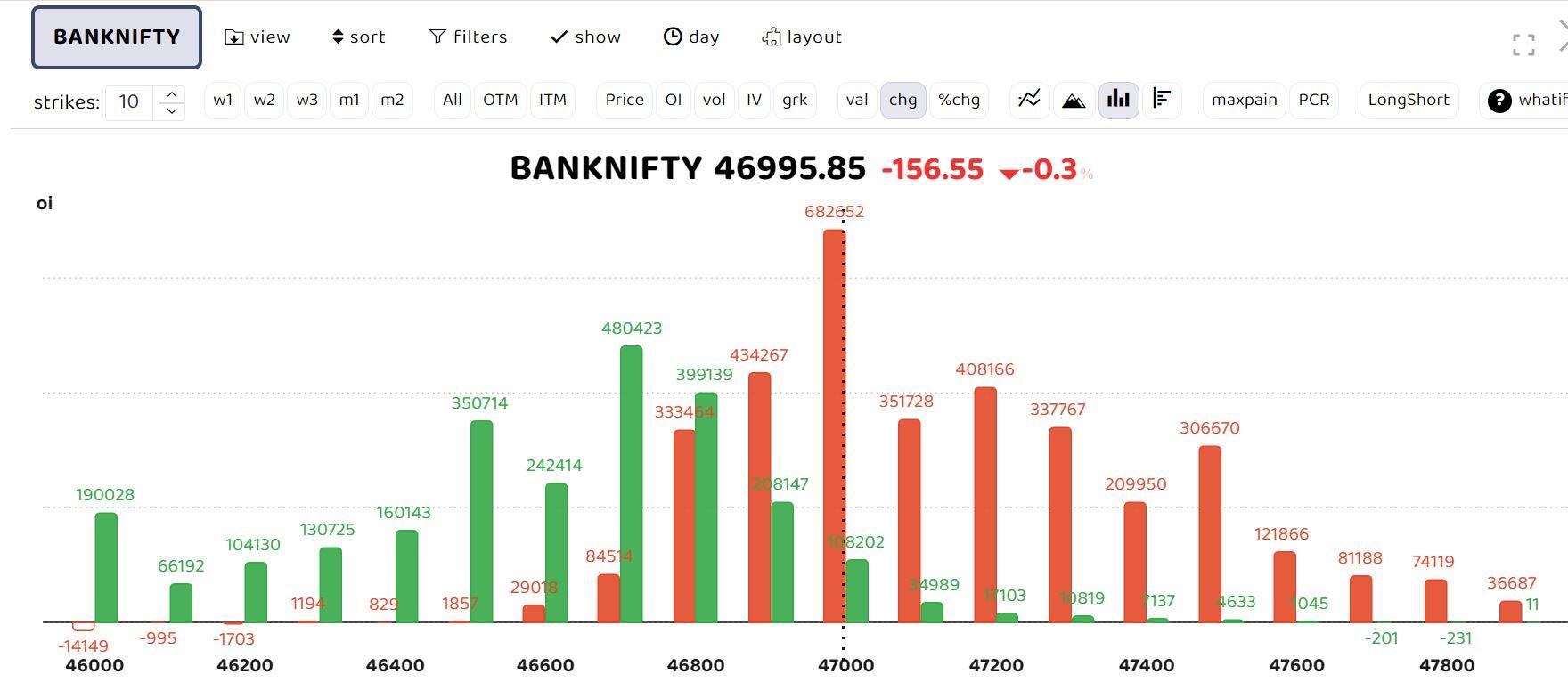

Option data reveals a robust concentration in 47,000 CE and 47,200 CE, with 46,700 PE acting as critical levels. The current data shows writing in 47,000 PE, exposing a sentiment in favour of longs.

"The Banking index possesses resilient support near the previous spot accumulation range of 46,750 – 46,650. A stability over 47,000 could trigger a positive rally on the expiry day. We anticipate a bullish bias over the 47,000 level, with aggressive traders taking longs once 47,000 is maintained for 5-10 minutes," Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.