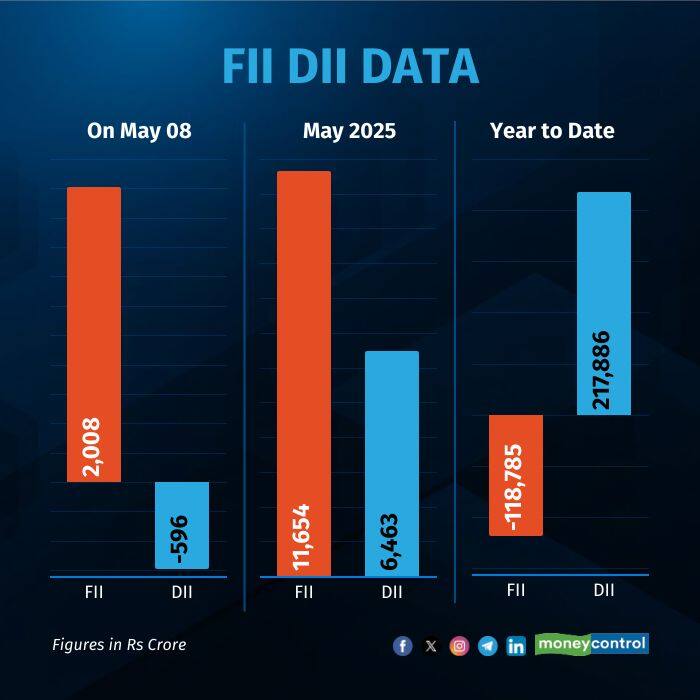

Foreign institutional investors extended their buying spree to the 16th consecutive session, as FIIs bought domestic equities worth Rs 2,008 crore in trade on Thursday, May 8. On the flip side, domestic institutional investors sold their holdings worth Rs 596 crore.

DIIs recorded gross purchases worth Rs 12,682.67 crore and sold Rs 13,278.92 crore, resulting in a net outflow of Rs 596.25 crore. In contrast, FPIs bought equities worth Rs 22,365.53 crore and sold to the tune of Rs 20,357.57 crore, marking a net inflow of Rs 2,007.96 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.19 lakh crore, while DIIs have net bought Rs 2.18 lakh crore worth of shares.

Market performance

After a range-bound session, Nifty 50 and Sensex saw deepening losses towards the closing bell on Thursday, May 8, as investors rushed to offload their equity holdings amid rising geopolitical tensions, while uncertainty spiked as a result of the weekly expiry session.

On the sectoral front, the indices painted a mixed picture. Auto, FMCG, banking and pharma stocks were among the top losers, with the indices slipping nearly two percent. On the flip side, IT and media stocks managed to eke out some gains, despite a turbulent session.

The fear gauge, India VIX, that measures market volatility through options trading soared 10 percent to 21.01, as uncertainty dictated the market sentiment. Further, the weekly index expiry also led to volatility spiking.

"The Indian equity market experienced profit booking by the end of the trading day due to escalating tensions between India and Pakistan, marked by increased cross-border exchanges. The FOMC policy meeting provided little reassurance, as the Fed expressed concerns that aggressive U.S. tariffs could fuel inflation and raise unemployment," said Vinod Nair, Head of Research, Geojit Investments.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!