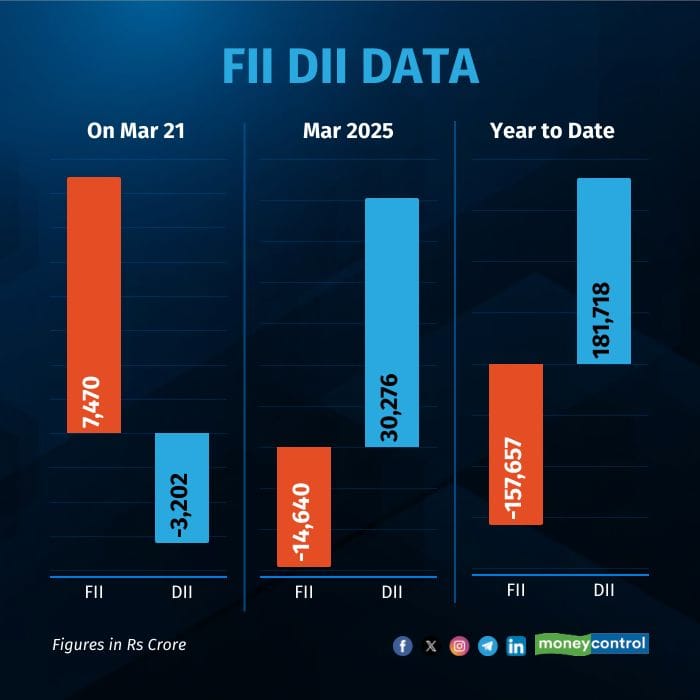

Foreign institutional investors (FII/FPI) turned net buyers again on March 21, purchasing shares worth Rs 7,470 crore while domestic institutional investors (DII) were net sellers of shares worth Rs 3,202 crore, provisional data showed.

During the trading session of March 21, FIIs net bought shares worth Rs 49,892 crore and sold shares worth Rs 42,422 crore. DIIs purchased shares worth Rs 18,878 crore and sold shares worth Rs 22,081 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.57 lakh crore, while DIIs have net bought Rs 1.81 lakh crore worth of shares.

Market Performance

In today's session, the market’s fiery run continued, with the Nifty locking in its best weekly performance in four years, soaring 4.27 percent — the highest since February 2021, when it had surged 9.46 percent in a week. The Sensex wasn’t far behind, posting its best week since July 2022, with a 4.2 percent gain that underscored the market’s unrelenting momentum.

The Nifty breached 23,400 intra-day for the first time in two months before closing at 23,350, up 160 points. The Sensex roared 557 points higher to 76,906, while the Nifty Bank surged 531 points to 50,594. Broader markets kept pace, with the Midcap index jumping 706 points to 51,851 as investors chased opportunities beyond blue chips.

"Following a remarkable recovery, Nifty has now approached its critical resistance around the moving averages ribbon at 23,400. A decisive breakout above this level could further fuel momentum, potentially driving the index towards the 23,800-24,100 range. On the downside, the 22,750-23,000 zone is expected to serve as crucial support. Given the recent surge, traders should focus on selective stock-picking with a favorable risk-reward ratio rather than chasing momentum," Ajit Mishra, Senior Vice President at Religare Broking said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!