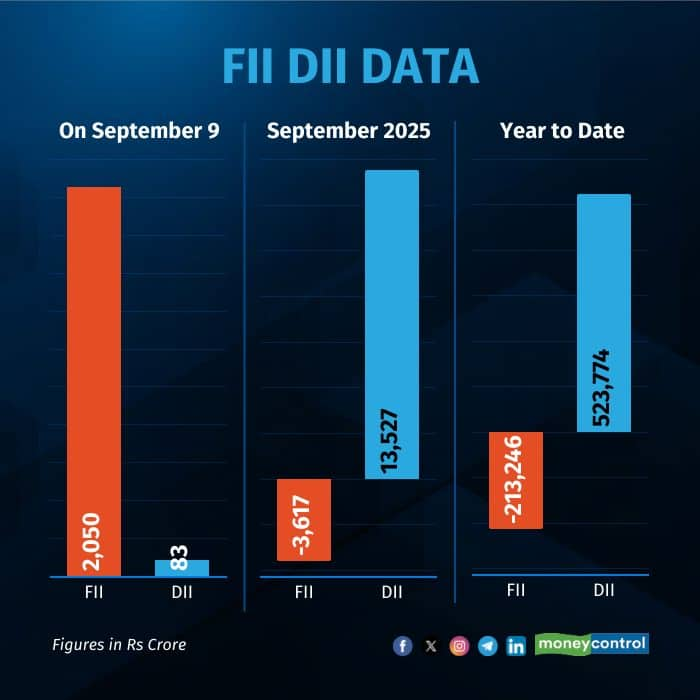

On Tuesday, September 9, Foreign Institutional Investors (FIIs/FPI) net bought Indian equities worth Rs 2050 crore, while Domestic Institutional Investors showed less activity with net buying of Rs 83 crore-worth equities, as per provisional data on NSE. The last time FII/FPIs showed such strength in buying higher than DIIs, was June 26. Also to be noted is that today marks NSE's first Tuesday expiry.

During the trading session, DIIs bought Rs 10,423 crore worth equities and sold Rs 10,340 crore. On the other hand, FII/FPIs bought Rs 11,897 crore and sold Rs 9,846 crore.

For the year so far, FPI/FIIs have net sold equities worth Rs 2.13 lakh crore equities while DIIs have net bought worth Rs 5.23 lakh crore.

Market Performance

Indian equity markets ended higher on Tuesday, On Tuesday, the Nifty moved higher and closed with a gain of 95 points at 24,869, supported by strength in IT and pharma stocks. Although auto and realty sectors saw some selling pressure. Market sentiment improved after Infosys announced a share buyback proposal, sparking strong buying in IT names and lifting overall mood. The Sensex rose 314 points to close at 81,101, while the Nifty gained 95 points to end at 24,869.

The broader markets also moved up, with the BSE Midcap and Smallcap indices rising 0.2% each, showing steady interest beyond large-cap stocks.

As per Amruta Shinde, Technical & Derivative Analyst at Choice Equity Broking, "Volatility remained contained, with India VIX steady around 10.8, reflecting a stable trading environment despite intraday swings."

She added that the index formed a bullish candle on the daily chart, reflecting positive sentiment after Infosys’s buyback news. Strong buying interest was visible at lower levels, though the zone of 24,900–25,000 continues to act as a stiff resistance. On the positive side, Nifty managed to stay above its 10- and 20-day EMAs near 24,730, keeping the short-term trend intact. "However, unless the index sustains above 25,000, some consolidation or mild profit booking cannot be ruled out. Immediate support is placed near 24,620," she said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.