Select fertiliser stocks are showing bullish structural confirmation in long-term charts, attracting strong attention. The fertiliser sector is in focus today as it witnesses a strong surge accompanied by a long build-up.

The sector, which has exhibited mixed performance in recent years, is currently displaying the first signs of leadership in the high-beta sector, believes Manav Chopra, Director of Institutional Technical Research at Nuvama Institutional Equities.

"There are initial signals indicating base formation observed over the past few months, along with improvement in relative performance and a visible accumulation phase," said Chopra.

Chopra highlights that the basket of stocks has formed higher tops and bottoms on medium-term charts, suggesting a probable trend change and the resumption of the uptrend. The overall outlook appears positive, indicating a major uptrend unfolding in the coming years, with a new sector likely emerging from the PSE space.

Nuvama recommends the following stocks that are expected to benefit from the sector's upside:

Stock specific technical outlook by Chopra:

Chambal Fertiliser Monthly Chart

In the past, Chambal Fertilizer has doubled within 16-18 months of breaking above the 52-week highs. The current setup points to a strong

uptrend with the formation of a reversal candle and momentum indicators confirming a new high for the stock.

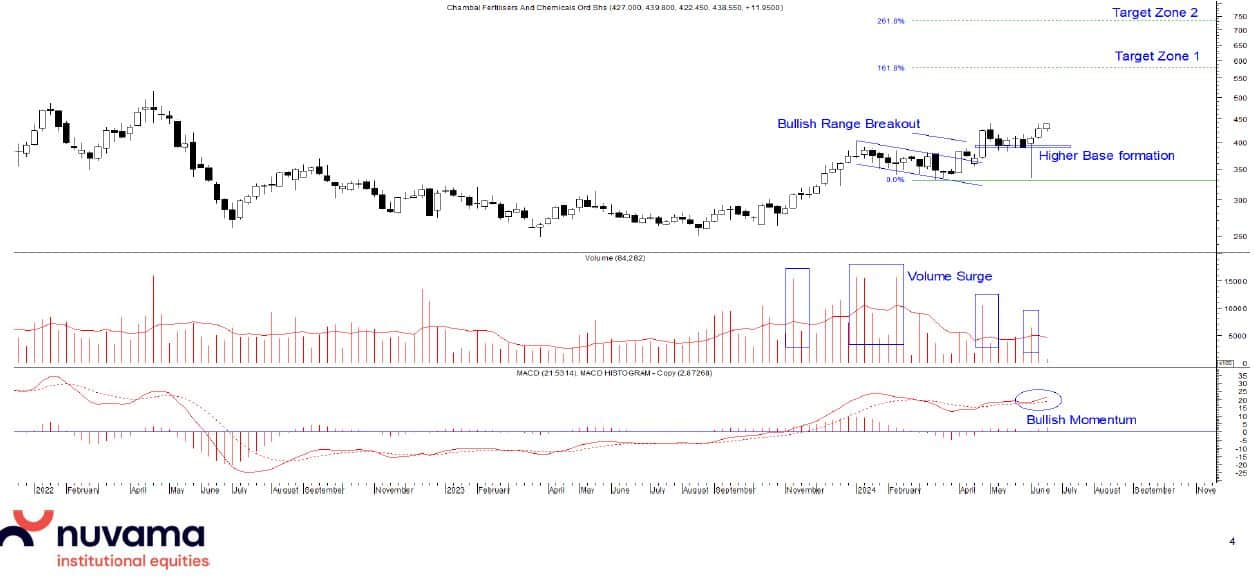

Chambal Fertilizer Weekly Chart

The breakout from the consolidation pattern and the formation of a higher base formation in recent months, which has formed higher lows, indicates an upward shift in demand. The bullish MACD crossover suggests a resumption of the uptrend and strong momentum to unfold.

National Fertilizer (NFL) Monthly Chart

The price has exceeded the falling trendline drawn from the recent peak and the MACD is in a bullish momentum above the 0 line. The price structure confirms a trend reversal as NFL has formed a series of higher highs with higher base formations that signify new bull trend.

National Fertilizer (NFL) Weekly Chart

The stock has been in the consolidation phase for the past few weeks as held support clusters of 110-100 zone above the 50sma and has absorbed the selling pressure in weak markets. The Multi-frame analysis indicates resumption of the uptrend and hints at a new swing high in the making.

Rashtriya Chemicals & Fertilizers (RCF) Monthly Chart

RCF price breakout from the 16-year resistance zone pattern has formed a higher base formation around the 140-130 levels zone that reaffirms the change in polarity ie. previous resistance now acting as a support zone. There is the emergence of multiple bullish candlesticks on the charts that further validate the presence of bulls.

Rashtriya Chemicals & Fertilizers (RCF) Weekly Chart

The stock has held above the 150-140 long term support levels and indicates demand at the lower levels. MACD Bullish crossover formation above the zero line along with the horizontal trendline breakout in price reaffirms the bullish setup in place. The volume spikes indicate a strong undertone and a sustained move above 180 levels will witness fresh momentum.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.