The coronavirus outbreak has pushed most sectors to their lowest lows but there is one segment that is clocking impressive growth, thanks to healthy underlying demand.

Fertiliser sales were up 47 percent in April, brokerage firm Prabhudas Lilladher has said in a report.

"Total industry volume up 47 percent to 3.7 million tonne, driven by preponement of purchase, healthy underlying demand and low base. Urea/NPK/DAP sales are at 2 million tonne/5.9 million tonne/7 million tonne, up 27 percent/102 percent/95 percent, respectively. SSP volumes up 51 percent to 2.7 million tonne," the brokerage said.

Among the players, Coromandel International’s volumes were up 194 percent YoY, Chambal up 69 percent and GSFC’s volumes were 15 percent higher, the report said.

Demand to remain healthy

The sector is likely to see positive growth due to healthy underlying demand as India's agriculture sector has not been hit as badly as the industry by the coronavirus outbreak.

Besides, both the Centre and state governments have been responding to the challenges in agriculture value chain posed by the COVID-19 outbreak, which is a positive.

The government has taken several steps to ensure that the farm sector remains on track and a good rabi season has resulted in a spike in receivables of most agrochemical players.

The outlook for the Kharif season is also positive with the met department predicting a normal monsoon.

"IMD’s forecast indicates that India’s seasonal monsoon rainfall is likely to be normal (96-104 percent) of the long period average, with a likelihood of above-normal rain in August and September 2020. Rabi harvesting has been encouraging, with nearly 40 percent of the crop already purchased by the government and other private institutions and disbursements being transferred to the farmers," brokerage firm Kotak Institutional Equities said.

The challenges

The biggest challenge for the fertiliser industry is the liquidity crunch in the rural sector.

Timely disbursements are critical to mitigate tight these conditions and enable robust offtake for agri-inputs for Kharif.

"Cash flows of farmers have taken a hit as several mandis remain closed due to the lockdown. Dip in realisation of produce has further worsened woes. However, procurement by the government at MSP rates is likely to ease their liquidity woes," said Edelweiss Securities.

The brokerage expects surplus production to improve farmer’s overall income.

Experts highlight that the fertiliser players may not see a similar magnitude of sales in Rabi season due to stretched working capital.

"The increase in volume in April sales was due to the higher acreage of sowing, especially in paddy and cereals. But the sector has very limited companies that will be able to see a similar level of sales in Rabi season due to stretched working capital," said Sameer Kalra, Founder, Target Investing.

Stocks to buy

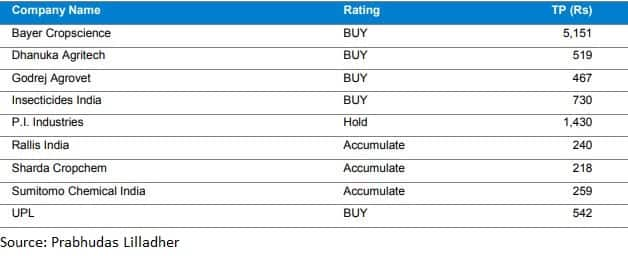

Brokerage firm Prabhudas has buy recommendations on Bayer Cropscience, Dhanuka Agritech, Godrej Agrovet, Insecticides India and UPL.

Brokerage firm Edelweiss Securities has buy recommendations on Dhanuka Agritech and Coromandel International among the agro-chem players.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.