The benchmark indices traded in the negative territory around mid-day after opening in the red on January 17 after disappointing results put up by HDFC Bank. The Nifty was down by 300 points and the Sensex plunged 1,100 points.

For the Nifty, the 21,650–21,500 levels constitute a key demand zone. As long as the buy-on-dip sentiment persists, experts anticipate short-term weakness below 21,500, with a potential decline towards the 21,000–20,800 zone.

At 11:54am, the Sensex was down 1,251.66 points or 1.71 percent at 71,877.11, and the Nifty was down 351.10 points or 1.59 percent at 21,681.20. About 1,106 shares advanced, 2,057 declined, and 62 stayed unchanged.

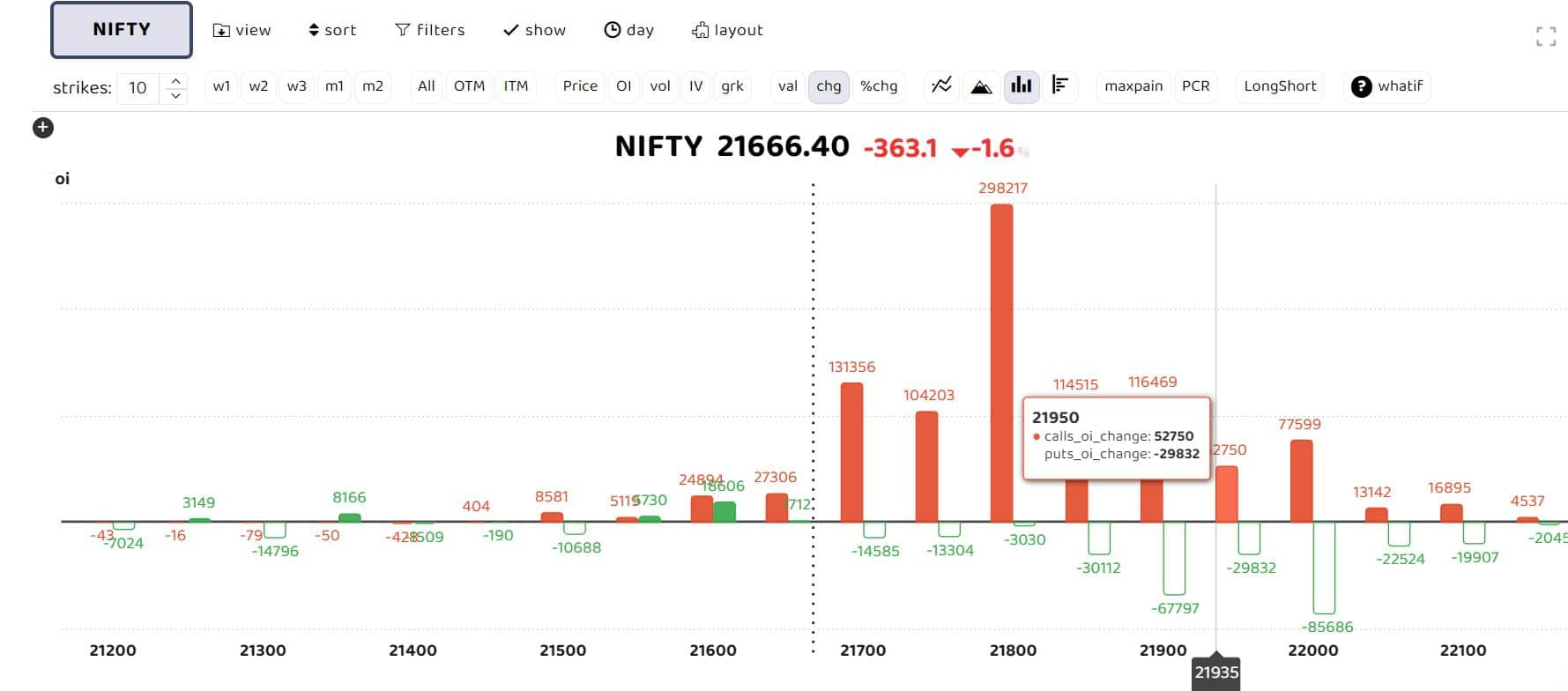

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data indicates a dominance of Call writers for the day. "With the fall, the Nifty is currently trading below its 10-day EMA positioned at 21,780 and is heading towards its 20-day EMA in the 21,550-21,600 zone, which could serve as a crucial support level. Positionally, if 21,550 is breached, the index may revisit the lower support zone around 21,430-21,350. Looking at it from a reversal perspective, the gap area of 21,900-21,930 will now play a pivotal role as a key resistance, posing a hurdle on the upside," Sudeep Shah, head of derivative research at SBI Securities, said.

On the Option Chain front, Shah highlights aggressive Call writing observed in the 21,800-21,900-22,000 strikes, while Put writing is evident in 21,800 and 21,700. This suggests that the 21,550-21,600 zone could function as a significant support zone, whereas the 21,850-21,930 zone will act as a resistance. Additionally, the PCROI has weakened to 0.8 levels.

"The broader outlook for the benchmark Nifty 50 remains highly upbeat over the key support of 21,500. As long as this support mark is protected, the index may attempt to cross the resistance range of 22,000 – 22,200. A breakout over this zone could pave the way for the next leg of upside towards 22,500 -22,700. A violation of 21,500 could see the index testing the accumulation range of 21,000 – 21,900.

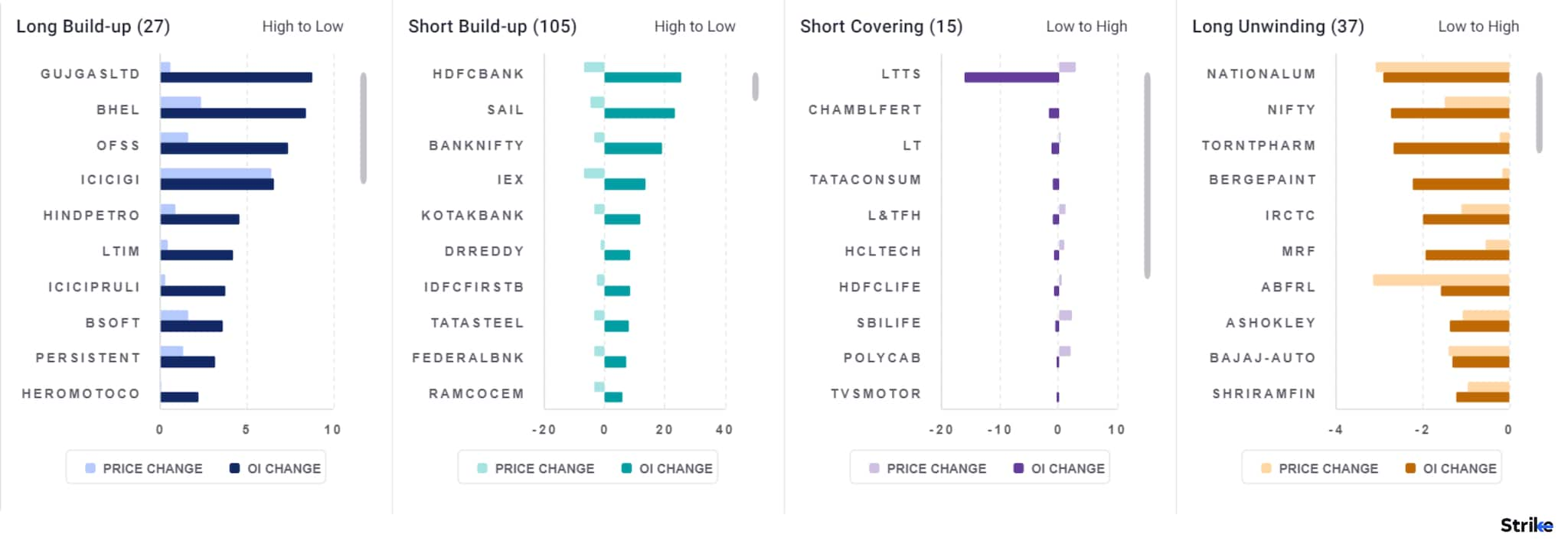

Among individual stocks long build up is observed in GujaratGas, BHEL, OFSS and ICICIGI. While short build up is seen in HDFCBank, SAIL and IEX.

Among individual stocks long build up is observed in GujaratGas, BHEL, OFSS and ICICIGI. While short build up is seen in HDFCBank, SAIL and IEX.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.