A choppy market on July 25 kept traders guessing, while indices traded largely flat on mixed corporate earnings. The Nifty 50 index traded at 19,680.75, up about 8 points or 0.07 percent.

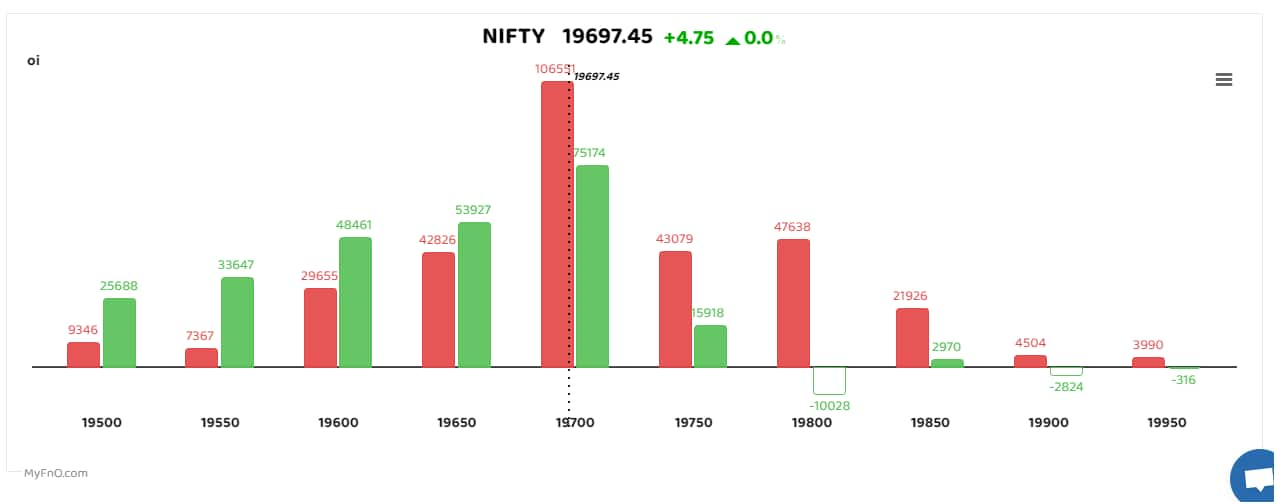

The option data showed that the 19,650-19,700 range was the battle zone for the index. Call writers were relatively more active as they tried to push the index lower.

Analysts believe the market is going through a consolidation phase but the overall bullishness remains intact. The rally may resume after a few things align for the indices.

“In the previous session, the Nifty saw a significant call writing at the 19,700 and 19,800 levels for this week's expiry,” said Rahul Ghose, Founder and CEO of Hedged. “The current OI distribution looks like the expiry is going to be below the 19,800 level unless we see Bank Nifty cross the 46,300 mark.”

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

“Bank Nifty continued to see put writing at the 46,000 level for the August 3 expiry and for the current week expiry, traders have converted their short put positions into short straddles. This basically means that traders are expecting the expiry to be in and around the 46,000 level,” Ghose said.

Among the key individual stocks that put up some action, TVS Motor that came out with a strong set of Q1 numbers saw long buildup. Bullish setup was also seen in Hindustan Copper, Tata Steel, GMR Infra and ACC.

Can Fin Homes was among the worst performing F&O stock of the day, while L&T Financial Holdings and ITC also saw bearish onslaught.

“The past two days have seen profit-booking, particularly in heavyweight stocks that were driving the market higher, such as Reliance and IT space, and yesterday, ITC. The broader market remains bullish, but caution is advised as profit-booking in these stocks can be severe, especially for late entrants,” said Sameet Chavan, Head Research, Technical and Derivatives, Angel One.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.