The benchmark indices were trading higher for the second consecutive session on October 6 afternoon, as the Reserve Bank of India (RBI) kept interest rates steady for the fourth time in a row.

The RBI held the repo rate, the rate at which it lends money to banks, at 6.5 percent, while the Deposit Facility and Marginal Standing Facility, too, were left unchanged at 6.25 percent and 6.75 percent.

The status quo saw all sectoral indices trading in the green at noon.

"The RBI continues to exercise caution, with its policy narrative primarily focused on managing inflation uncertainty and liquidity, rather than reacting to the unpredictable global economic landscape, as markets adjust to a 'higher-for-longer' scenario,” Madhavi Arora, Lead Economist at Emkay Global Financial Services, said.

Higher-for-longer is a reference to interest rates remaining high for a while with no immediate cuts expected.

“While global financial conditions may impact India with some delay, we should brace for potential volatility ahead," she said.

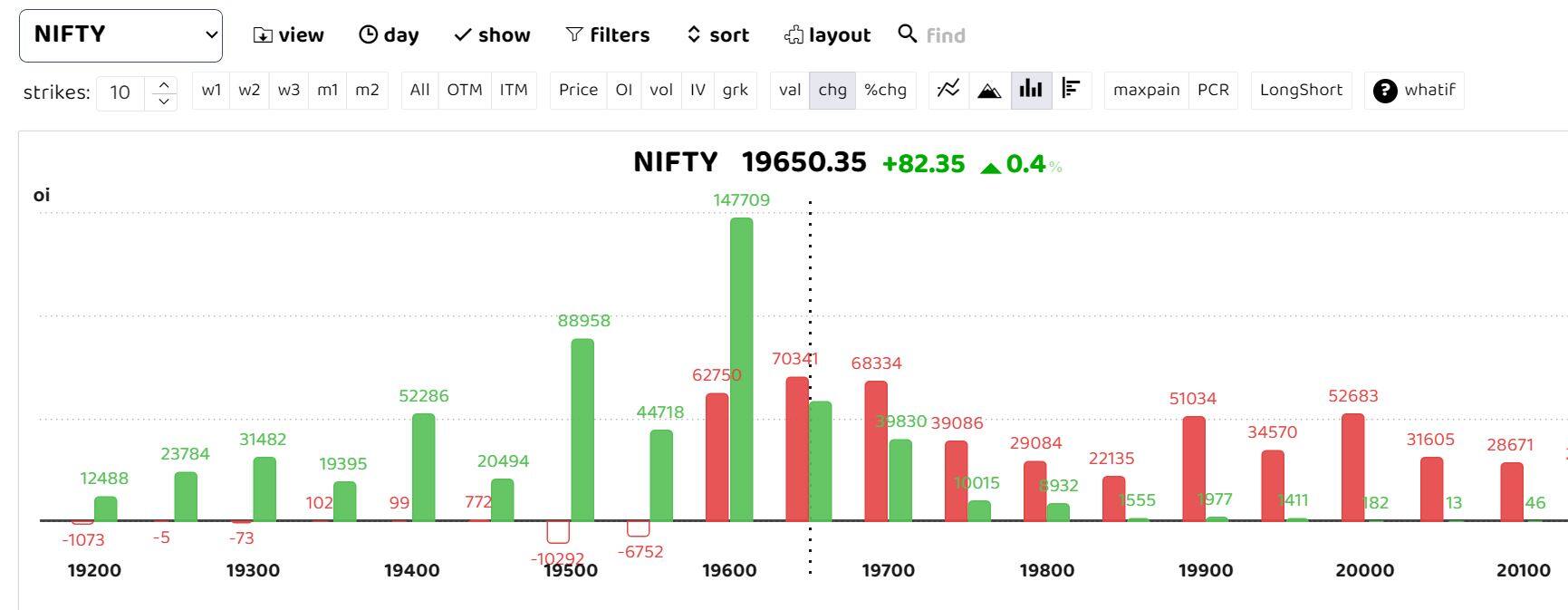

The options data reveals significant put writing at the 19,500 strike, forming a crucial support for the day.

According to Rupak De, Senior Technical Analyst at LKP Securities, "The market has responded positively to the RBI's decision to maintain the status quo. The Nifty index appears to be on a bullish trajectory, as long as it remains above the 19,430 level.”

On the higher side, the Nifty may move towards 19,750-19,800 and if it surpasses the 19,800 mark, further gains become increasingly possible, De said.

Follow our live blog for all market action

Among individual stocks, MCX, BajajFinsv and IndiGo saw a bullish buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.