The Bombay Stock Exchange (BSE) introduced a new surveillance measure--an add-on price band framework--to curb excessive price movement in securities on Monday. The measure is expected to cap the rise in the share price of stocks listed exclusively on BSE.

The circular had specified weekly, monthly, and quarterly limits for stocks subject to pre-specified gains over the last six months, one year, two years, and three years.

Following the release of the circular, trading in 521 mid and small-cap stocks was frozen after there were only sellers in these stocks.

The circular

Exchanges have been introducing several surveillance measures to maintain market integrity and curb excessive measures. Accordingly, it released the Add-on price band framework Monday.

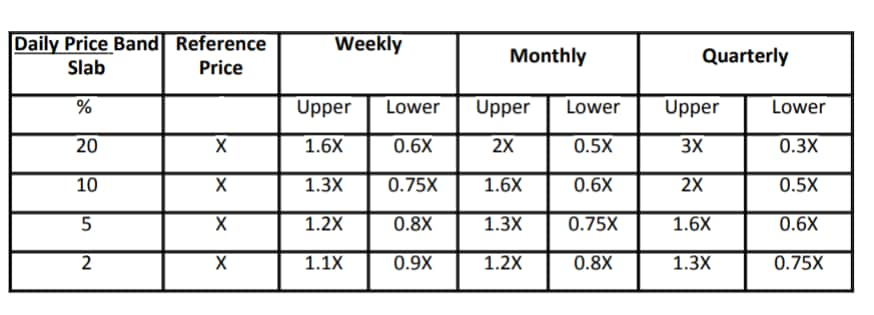

"Under the aforesaid framework, the shortlisted securities shall be subjected to additional periodic price limits viz. weekly, monthly, and quarterly price limits," BSE said in a circular.

Accordingly, the securities that have surged over 6 times their reference price in the last six months, 12 times within a year, over 20 times in two years and over 30 times in three years come within the criteria.

These add-on prices are in addition to the daily price bands of securities.

Further, it said the additional price should be expressed "in terms of a ratio of close price of the security and depending upon the daily price band slab applicable for the security," it added.

New measures

According to the new circular, the new measures will be applicable besides the existing filters.

If a stock is already in the 20 percent slab, then it can rise over 1.6 times its closing price (of the preceding date) in the next week. Further, the stock price cannot rise over 2 times the closing price in a month and only three times the price in a quarter.

For example, a stock with a closing price of Rs 100, in the 20 percent slab, cannot rise over Rs 160 in a week. And, it cannot rise over Rs 200 in a month and Rs 300 in a month.

Similarly, if a stock is in the 10 percent price slab, it cannot rise over Rs 130 in a week, over Rs 160 in a month, and over Rs 200 in a quarter.

The exchange has placed filters on the price fall as well.

In the 20 percent slab, a Rs 100 stock cannot fall below Rs 60 in a week, below Rs 50 in a month, and below Rs 30 in a quarter.

In the 10 percent slab, a Rs 100 stock cannot fall below Rs 75 in a week, below Rs 60 in a month, and below Rs 50 in a quarter.

The add-on price bands for different price band slabs:

Impact on mid-caps and small-caps

Impact on mid-caps and small-caps

Mid-caps and small-caps have witnessed heavy selling lately. And they extended their five-day losing run on Tuesday as well. Price curbs on securities curbs speculation, prompting traders to reduce exposure to those stocks, which is what happened Tuesday and Wednesday morning.

On Tuesday, the BSE Midcap and Smallcap indices declined nearly 1 and 2 percent, respectively. Whereas, the benchmark indices soared to all-time highs, with Sensex rallying 150 points to close at 54,554.

The clarification

BSE was quick to issue a clarification circular on Wednesday. It said the circular of Monday was only applicable to securities listed exclusively on BSE and falling under the groups X, XT, Z, ZP, ZY, Y.

Securities with a price of Rs 10 and more, with a market capitalisation of less than Rs 1,000 crore fall under the groups mentioned above.

The exchange has identified 31 stocks that come fall under this criteria. The securities are listed below:

| ScripCode | ISIN No. | Scrip Name |

| 511153 | INE096I01013 | Anjani Foods Ltd |

| 519174 | INE709D01012 | Ashiana Agro Industries Ltd |

| 542911 | INE165G01010 | Assam Entrade Ltd |

| 531310 | INE325G01010 | Available Finance Ltd |

| 539288 | INE897N01014 | AVI Polymers Ltd |

| 523186 | INE00FM01013 | B&A Packaging India Ltd |

| 523100 | INE124B01018 | Cosmo Ferrites Ltd |

| 504380 | INE952M01019 | Flomic Global Logistics Ltd |

| 514400 | INE340D01016 | Garware Synthetics Ltd |

| 539013 | INE776O01018 | Gita Renewable Energy Ltd |

| 526717 | INE136C01044 | Gopala Polyplast Ltd |

| 539854 | INE115S01010 | Halder Venture Ltd |

| 532467 | INE550F01031 | Hazoor Multi Projects Ltd |

| 524614 | INE056E01016 | IEL Ltd |

| 500306 | INE903A01025 | Jaykay Enterprises Ltd |

| 531402 | INE281M01013 | LWS Knitwear Ltd |

| 511768 | INE677D01029 | Master Trust Ltd |

| 514330 | INE670O01013 | One Global Service Provider Ltd |

| 523862 | INE926B01016 | Pacheli Industrial Finance Ltd |

| 517397 | INE648E01010 | Pan Electronics India Ltd |

| 532011 | INE147C01017 | Pooja Entertainment and Films Ltd |

| 514197 | INE110Q01015 | S & T Corporation Ltd |

| 534618 | INE299N01013 | Sangam Renewables Ltd |

| 512020 | INE967G01019 | Saraswati Commercial India Ltd |

| 531930 | INE074H01012 | Sarthak Industries Ltd |

| 526081 | INE895E01017 | SC Agrotech Ltd |

| 541358 | INE926R01012 | Shree Worstex Ltd |

| 526981 | INE402H01015 | Shri Bajrang Alliance Ltd |

| 532217 | INE027F01014 | Siel Financial Services Ltd |

| 539911 | INE730R01034 | Svarnim Trade Udyog Ltd |

| 526638 | INE594V01028 | Texel Industries Ltd |

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.