Dear Reader,

To quote Winston Churchill (who incidentally spent most of his extravagant life on the brink of financial ruin): It is a riddle, wrapped in a mystery, inside an enigma.

We are referring to the Employees' Provident Fund Organisation’s (EPFO) decision to give a return of 8.5 percent for 2020-21 when interest rates are low. Indeed, they have plumbed such depths that the central bank’s policy rate is the lowest since at least 1999-2000.

How is the EPFO then able to offer an 8.5 percent return? The best bank fixed deposit rate currently available is 6.3 percent, provided you are a senior citizen and willing to lock in money for a long period. None of the other small savings schemes offer a return as high as the EPFO. Their return is of course, linked to the market.

What about EPFO?

The law says that EPFO must invest about half of its incremental inflows in government and related securities. Another 20-45 percent has to put in debt. The more safe an instrument is, typically the lower its return.

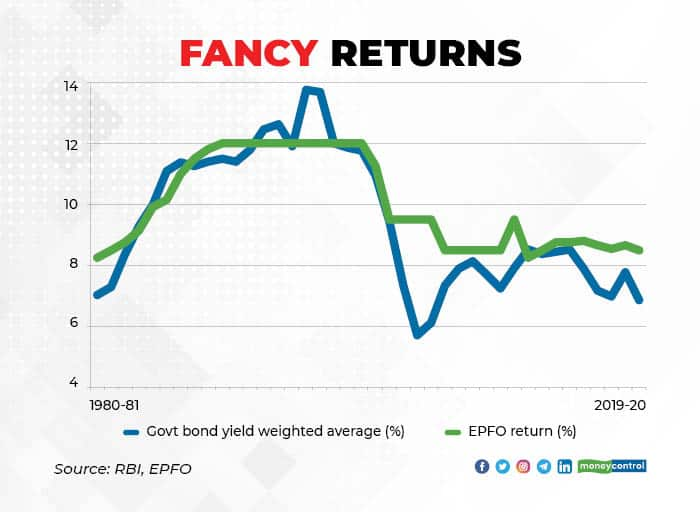

Yet, as the chart shows, EPFO has been consistently paying high returns irrespective of the interest rate cycle. In the last forty years, only in 10 instances was the EPFO interest rate higher than the weighted average of the yield on government securities.

While political compulsions dictate the need to offer as high as return as possible, how has EPFO managed to pull this trick? Even its investment in the equity markets has been limited and slow. Usually, only ponzi schemes offer a rate of return which is higher than their rate of investments.

Of course, there is no danger of the EPFO scheme folding up. As the economy progresses, and more businesses mushroom, inflows will continue. Moreover, this is a government of India scheme. Essentially, there is a sovereign guarantee on this and even if a day comes, when the organisation is hard-pressed to fund withdrawals, the taxpayer’s pocket will be picked to save the day.

Our contributor Prosenjit Datta takes a crack at decoding this puzzle. You can read the story here.

Here are today’s investment insights from our research team:

It is still no country for small firms

Is there any steam left in speeding tyre stocks?

Heranba, a short-term pop or long-term compounder?

What else are we reading today?

JSW’s Bhushan Power & Steel deal closure coincides with healthy steel margins

It is still no country for small firms

Shift petrol and diesel to GST

Is the PLI scheme enough to make Indian manufacturing self-reliant?

The Big Read | The race to scale up green hydrogen (republished from the FT)

Technical picks: Hindustan Copper, Kotak Bank, Emami and REC Ltd (These are published every trading day before the markets open and can be read on the app)

Cheers,

Ravi Krishnan

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.