The Economic Survey 2023, tabled in Parliament on January 31, has shone the spotlight on the enthusiastic participation of retail investors in the capital markets but also said that the enthusiasm was beginning to ebb.

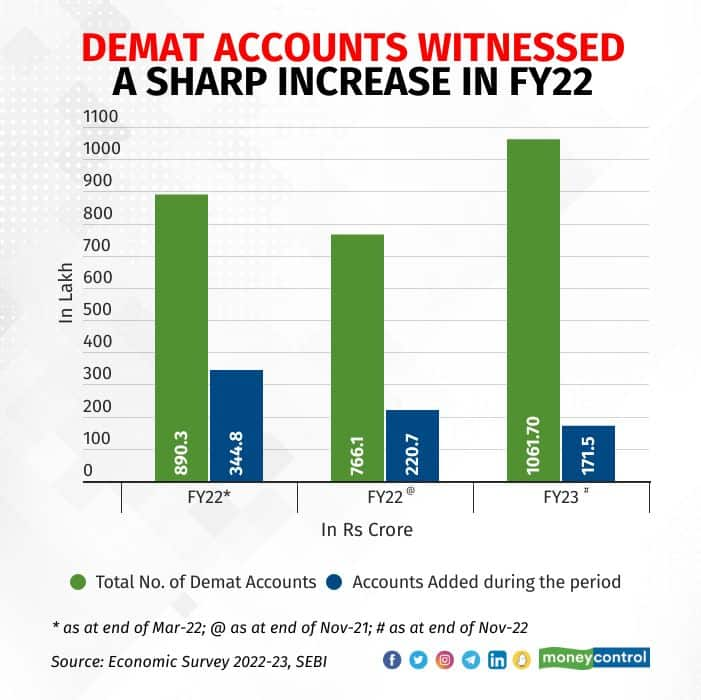

The Economic Survey said the number of demat accounts rose 39 percent by the end of November 2022 on a YoY basis. “The incremental additions of demat accounts have been on a declining trend during FY23 relative to FY22, probably because of the increased volatility in the secondary market and subdued primary market performance, amid prevailing global headwinds during the current financial year," the survey, which is released a day ahead of the budget and gives an overview of the state of the country's economy, said.

Total new demat accounts added in the April-November period of 2021 stood at 2.20 crore, while the figure had slumped to 1.71 crore during the same period in 2022.

The total number of demat accounts as of the end of November 2022 stood at 10.61 crore compared to the year-ago figure of 7.66 crore.

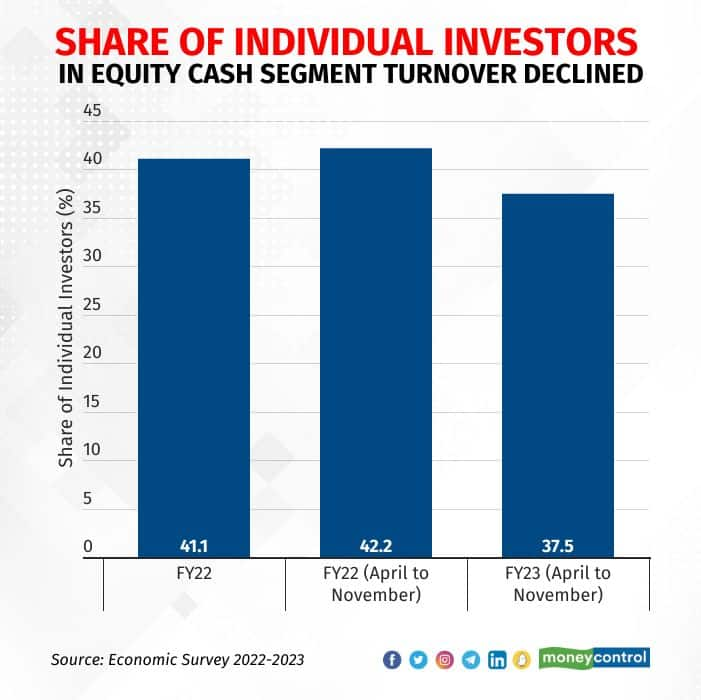

During the April-November period of FY22, individual investors accounted for 42.2 percent of the turnover in the equity cash segment. However, during the same period in FY23, the share had slumped down to 37.5 percent.

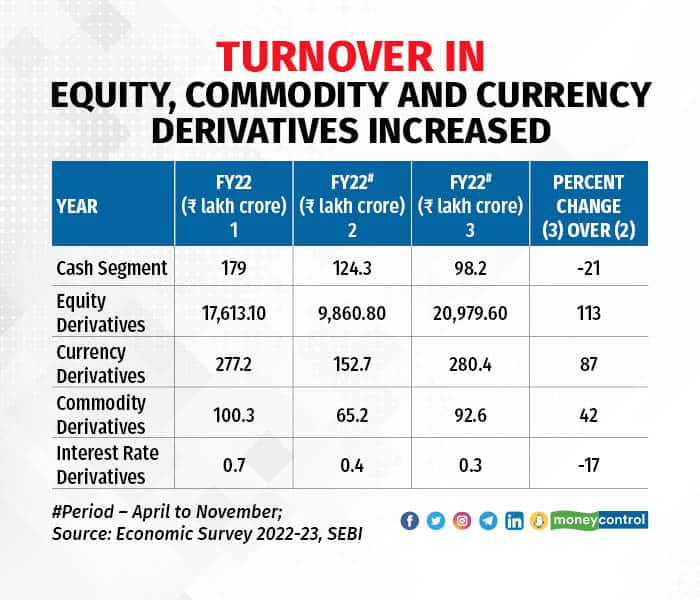

An interesting trend to emerge in the new paradigm dominated by new-age traders and investors is the increased interest in the equity derivatives segment and a gradual departure from the equity cash segment.

Consider, for instance, that during the April-November period of FY22, the total turnover in the equity cash segment chalked up to Rs 124.3 lakh crore, whereas it was only Rs 98.2 lakh crore in FY23, a sizable fall of 21 percent.

Compare this to the redoubtable rise of a whopping 113 percent in the equity derivatives turnover, which rose from Rs 9,860 lakh crore in the April-November period of 2021 to Rs 20,979.6 lakh crore during the same period in 2022.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.